Ethereum ETF launch propels crypto fund inflows to record $20.5 billion

Key Takeaways

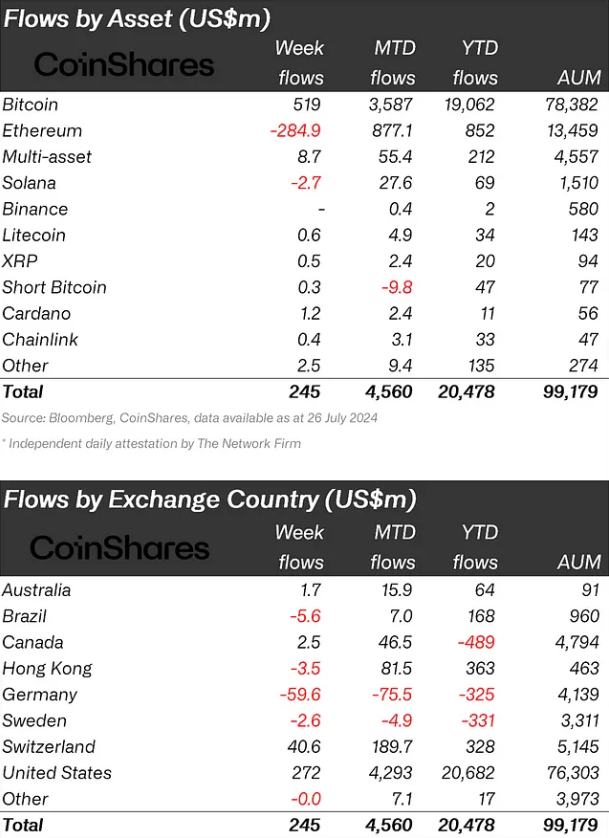

- New Ethereum ETFs attracted $2.2bn in inflows, while Grayscale’s trust saw $1.5bn in outflows.

- Digital asset investment products reached $99.1bn in total assets under management.

Share this article

Spot Ethereum exchange-traded funds (ETFs) started trading in the US market last week, attracting $2.2 billion in inflows, but faced selling pressure from incumbent products. As reported by asset management firm CoinShares, the newly issued ETFs saw some of the largest inflows since December 2020, while trading volumes in ETH ETP rose by 542%.

However, Grayscale’s incumbent trust experienced $1.5 billion in outflows as some investors cashed out, resulting in a net outflow of $285 million for Ethereum products last week. This situation mirrors the Bitcoin trust outflows during the January 2024 ETF launches.

Overall, digital asset investment products saw $245 million in inflows, with trading volumes reaching $14.8 billion, the highest since May. Total assets under management rose to $99.1 billion, while year-to-date inflows hit a record $20.5 billion.

Notably, Bitcoin continued to attract investor interest, with $519 million in inflows last week, bringing its month-to-date inflows to $3.6 billion and year-to-date inflows to a record $19 billion.

The renewed investor confidence in Bitcoin is attributed to US election comments about its potential as a strategic reserve asset and increased chances for a rate cut by the Federal Reserve in September 2024.

Regionally, the US took the lead with $272 million in inflows last week, followed by Switzerland’s $40.6 million, Canada’s $2.5 million, and Australia’s $1.7 million. Meanwhile, Germany and Brazil saw outflows of $59.6 million and $5.6 million, respectively.

Share this article

Go to Source

Author: Gino Matos