Ethereum price charts reflect weakness, but inflow to LSDFi could prevent an ETH sell-off

ETH price still struggles to conquer the $2,000 level, but growth in LSDFi could prevent a sharper sell-off.

Ethereum (ETH) has been on a downward trend with the $2,000 level forming a crucial resistance level in recent months.

While Bitcoin (BTC) recorded 11.94% gains moving past $30,000 in June after BlackRock filed an ETF application with the U.S. Securities and Exchange Commission, the upside in ETH stayed around 3.16%.

In the first week of July, buyers attempted to move the price past crucial resistance at around $1,900, however, a failed breakout exposed the price to further correction.

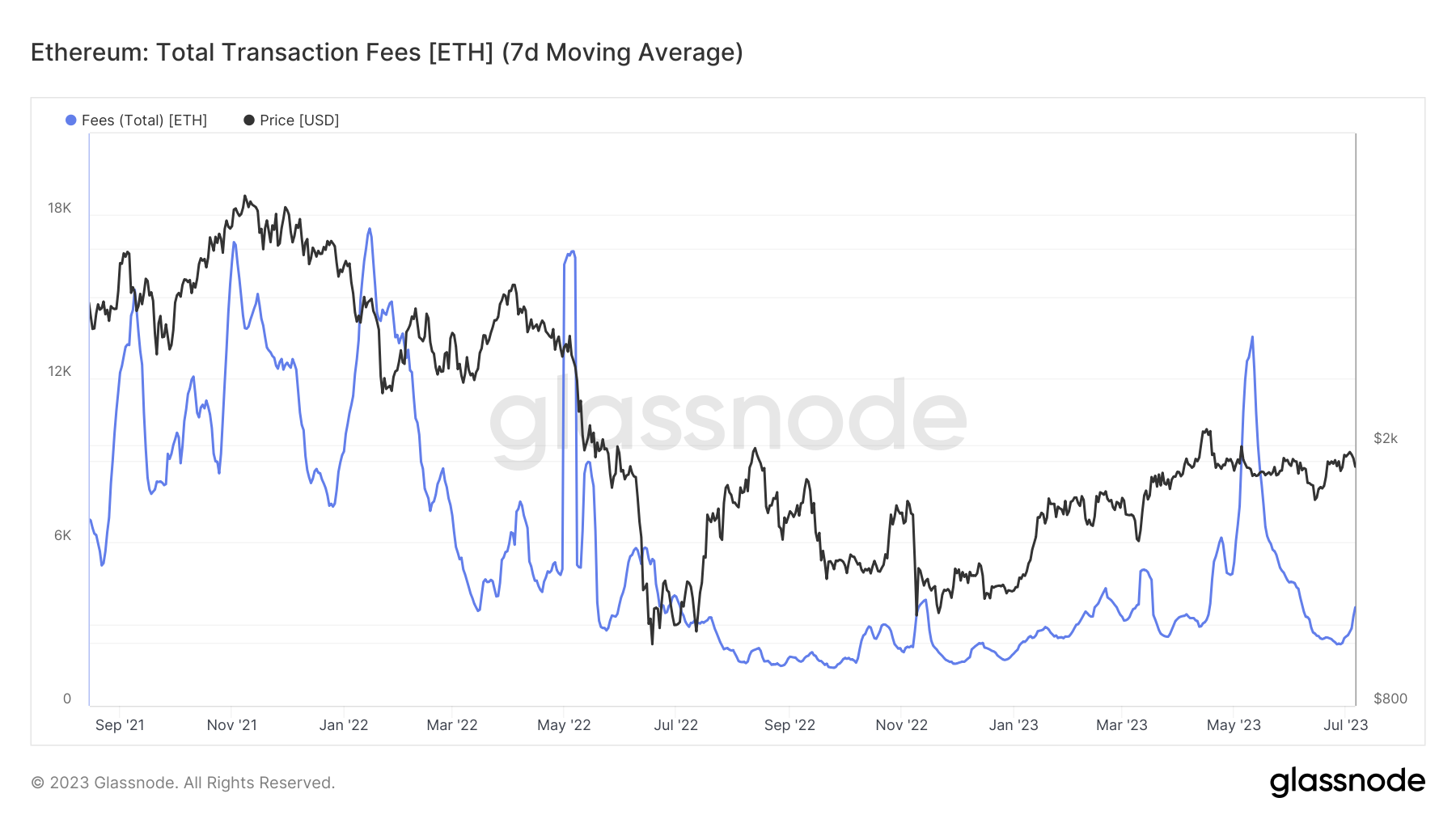

The Ethereum network also witnessed a decline in activity, evident in the one-year low levels in total transaction fees. The price of leading NFT collections on Ethereum plummeted, while DeFi activity stalled due to low yields.

However, the downside may be restricted as the demand for liquid staking derivatives (LSD) like Lido’s stETH continue to grow, rising faster than investors are moving to sell.

LSD activity is on the rise

While the primary use cases on Ethereum in NFT trading and DeFi activity suffered a downturn in June, the LSD narrative continued to grow.

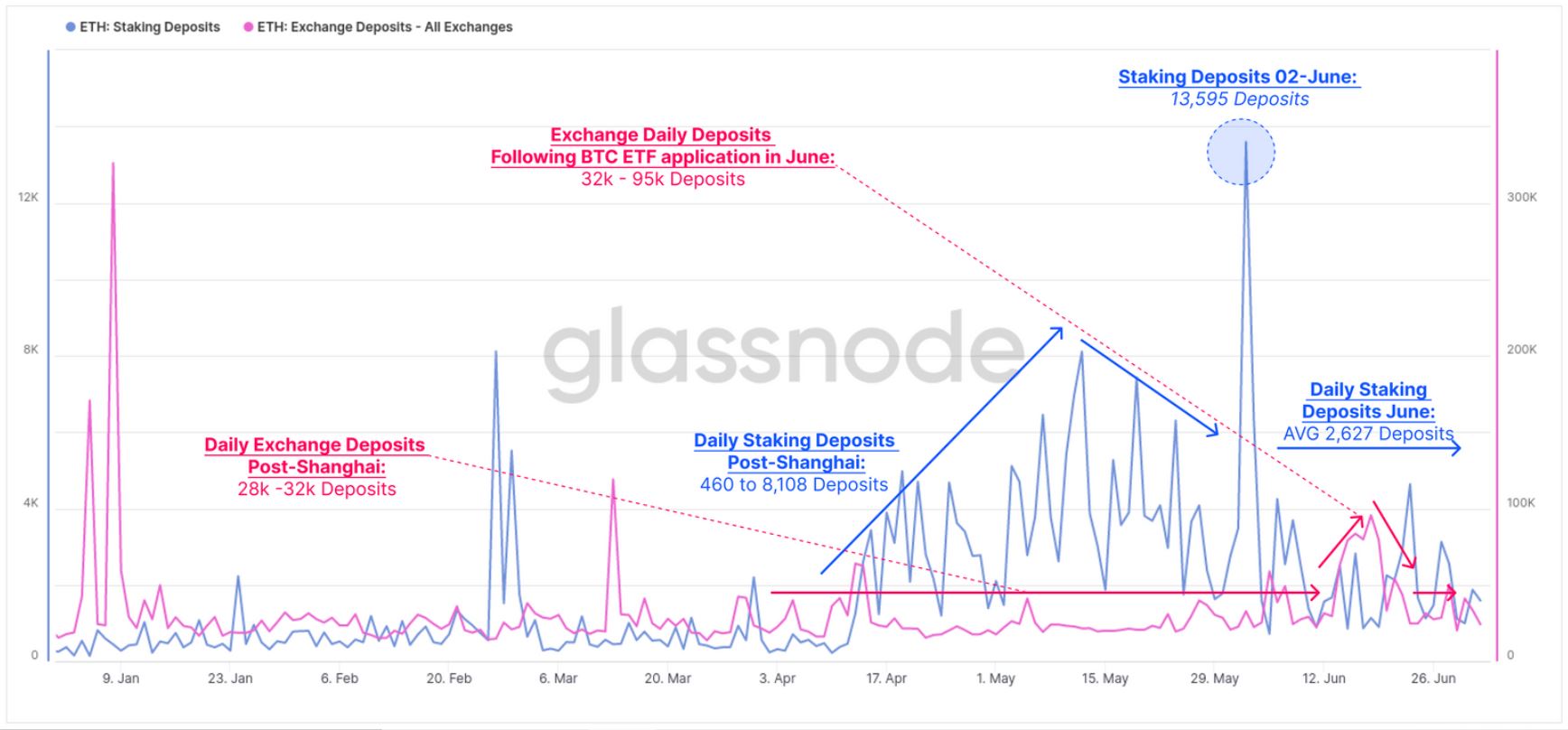

On-chain analytics firm Glassnode wrote in its latest report that deposits to the staking contract have “been higher, or equal in scale to exchange inflows since Shanghai went live,” suggesting that more ETH is being moved toward staking than selling on exchanges.

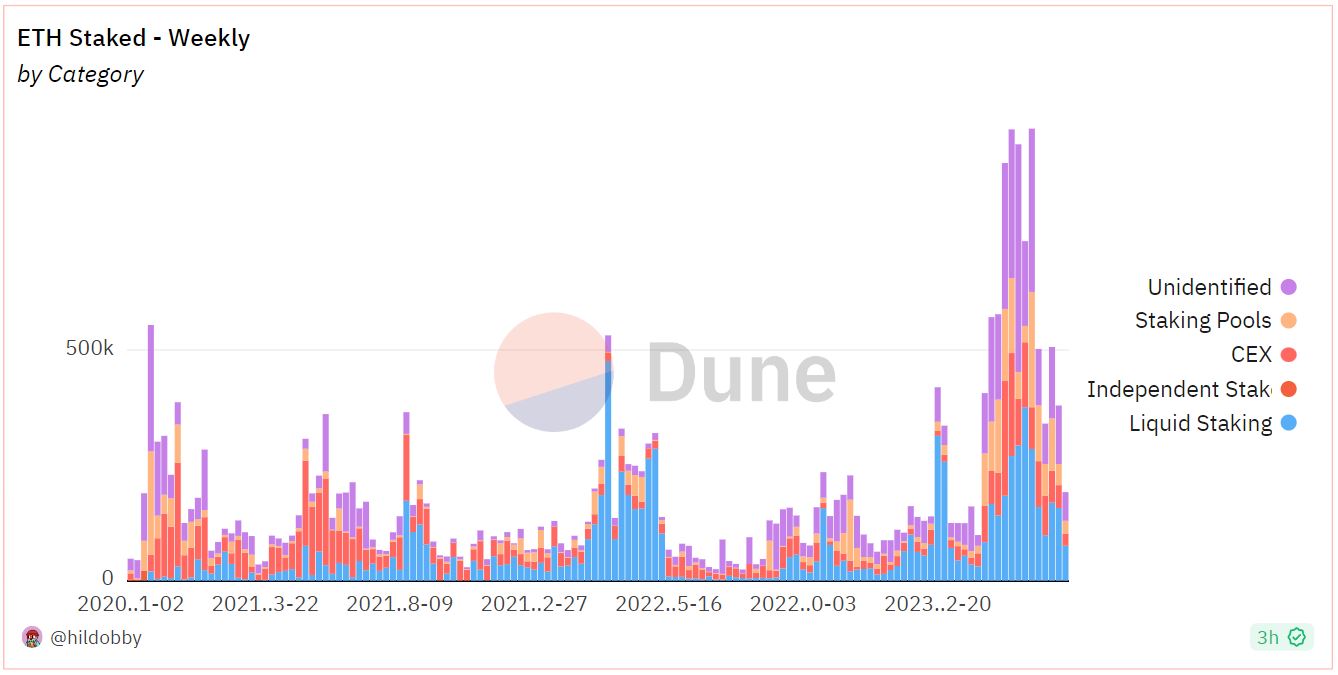

The total ETH deposited on staking contracts is 19.7% compared to the centralized exchange balance of around 12.8%. LSD platforms captured most of the inflow, followed by independent validators and staking-as-a-service clients.

Ether staking deposits increased significantly after the Shanghai upgrade in April as confidence increased with active redemptions. Among LSD platforms, Lido led the sector, followed by Rocket Pool and Frax.

Glassnode’s report also suggested that that the network has “yet to see an appreciable influx of new holders” as the new addresses holding Lido’s stETH has been “more or less unchanged YTD.”

Currently, 20% of Ether’s total supply is staked with validators compared to over 40% for most other proof-of-stake consensus based blockchains like Solana (SOL), Cosmos (ATOM) and Avalanche (AVAX), indicating room for growth.

With annual DeFi yields hovering around 1-3% for ETH on Aave and Yearn Finance and between 3-5% for stablecoins, LSD derivatives offer a base rate of 4% with an opportunity to earn additional yields by using their liquidity in DeFi applications.

Glassnode’s report read that LSD derivatives “have seen increased activity within different DeFi protocols, with Lido’s stETH being the most significant.”

Additionally, LSD token holders are also exhibiting a shift from providing liquidity on DEXes like Curve and Balancer to chasing higher yields on lending protocols like Compound and Aave. Glassnode’s analysts wrote, “this leveraged staking position is estimated to amplify yield by 3x.”

The LSD sector appears to be the current hotspot for DeFi players looking to maximize their yield.

Related: Rapid growth in DeFi-focused Ethereum liquid staking derivatives platforms raises eyebrows

Ether price analysis

ETH recorded a positive breakout from a bullish ascending channel pattern with a target of $3,000 earlier this week. However, the trend reversed quickly as Bitcoin (BTC) dropped to $30,000 after expectations of a rate hike by the U.S. Federal Reserve rose and sellers gained an upper hand.

Technically, the price can take two paths here, find support at the base of the ascending triangle around $1,790 before making a break for the $1,900 resistance level again. The other possible path is a continued drop toward long-term resistance and support level of $1,700.

A breakdown below $1,700 would give sellers a change to target the 200-day weekly moving average at around $1,575.

The ETH/BTC pair also shows that Ether has room for more downside toward the 200-day moving average at 0.0574 BTC and the long-term resistance and support level at 0.0538 BTC.

Ether had a failed positive breakout in early July, exposing the price to further downside to around $1,700. However, a surge in LSD narrative with higher yields than the DeFi sector is providing a cushion for any future downside, suggesting that the price will likely establish bullish support.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Go to Source

Author: Nivesh Rustgi