Grayscale Ethereum ETF bleeds Thursday, outflows exceed $1 billion since debut

Key Takeaways

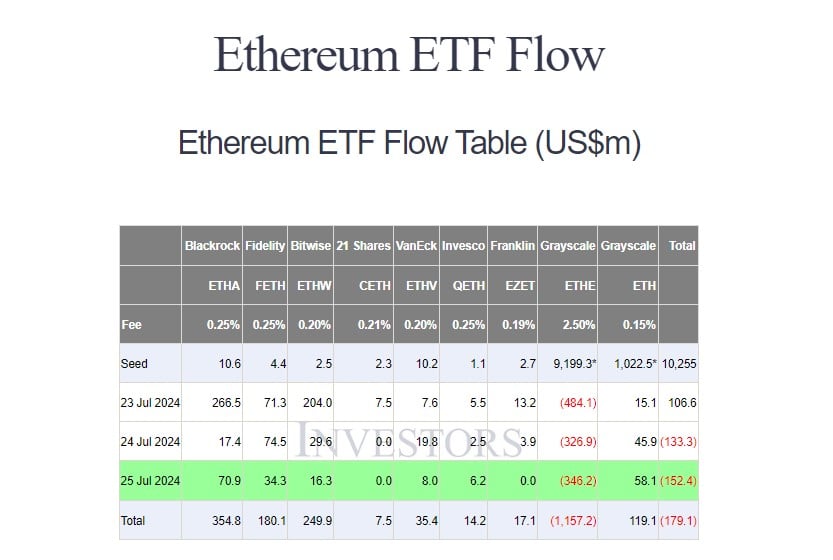

- Grayscale’s Ethereum ETF saw $346 million in net outflows on its third day of trading.

- BlackRock’s iShares Ethereum Trust led the pack with $71 million in inflows.

Share this article

URL Copied

Grayscale’s Ethereum ETF (ETHE) ended Thursday with $346 million in net outflows, extending its losses to $1.1 billion within three trading days since its conversion, data from Farside Investors reveals. After the third trading day, ETHE’s assets under management plummeted from over $9 billion to $7.4 billion, a remarkable decline since the launch of US spot Ethereum ETFs.

In contrast, BlackRock’s iShares Ethereum Trust (ETHA) led inflows on Wednesday, attracting approximately $71 million. Grayscale’s Ethereum Mini Trust (ETH), a spinoff of Grayscale’s ETHE, followed with over $58 million in net inflows. ETH has consistently attracted new capital since its conversion.

Other funds, including Fidelity’s Ethereum Fund (FETH), Bitwise’s Ethereum ETF (ETHW), VanEck’s Ethereum ETF (ETHV), and Invesco/Galaxy’s Ethereum ETF (QETH), also reported inflows. The remaining ETFs saw zero flows.

Despite inflows to eight Ethereum ETFs, the combined net outflow for all nine funds on Wednesday reached $152 million, the largest since their trading debut on July 23. This outflow was largely driven by Grayscale’s ETHE.

Share this article

URL Copied

Go to Source

Author: Vivian Nguyen