Here’s why CFTC suing Binance is a bigger deal than an SEC enforcement

Market observers pointed out that the CFTC goes after the bigger fish, and its regulatory action often proves fatal for the crypto companies.

The United States Commodity Futures Trading Commission (CFTC) sued crypto exchange Binance for trading and derivatives laws violations. The lawsuit, filed on March 27, alleged that the global crypto exchange offered its derivatives trading services to U.S. customers without applying for a derivatives license.

The lawsuit from the commodities watchdog in the U.S. took many by surprise, with market observers and reporters claiming it to be a political move. Eleanor Terrett, a Fox news reporter, tweeted that sources close to the CFTC suggest the commodities regulator decided to go for a lawsuit to show the Securities and Exchange Commission (SEC) that this is a commodities issue rather than a securities one.

than a securities one. They also say “Vegas odds” have the @SECGov rushing out a similar lawsuit against @binance as a counter.

— Eleanor Terrett (@EleanorTerrett) March 27, 2023

The lawsuit accuses Binance of prioritizing commercial success over regulatory compliance. It said that Binance disregarded applicable federal laws while boosting Binance’s U.S. customer base. The U.S. regulator has accused Binance and its CEO, Changpeng “CZ” Zhao, of seven violations of the commodities exchange and act (CEA), and controlled foreign company (CFC) rules.

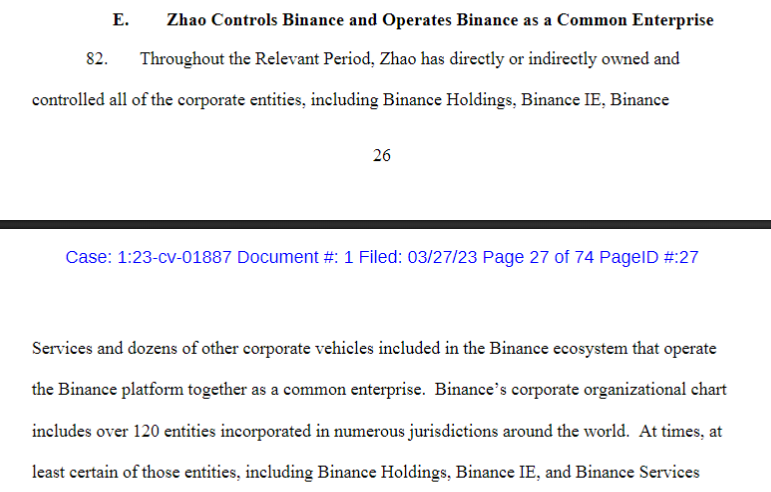

Apart from the regulatory violations, the suit also specifically targets Binance’s U.S. trading arms, Merit Peak and Binance.US. The CFTC alleged that Binance and its affiliated entities are a common enterprise with an ultimate beneficial owner (UBO) and under the direct control of CZ.

In the suit, the CFTC has demanded that Binance and CZ should be banned from engaging in any of the conduct described in this case, such as trading on registered entities, holding any commodity interest or directing any trading of digital assets. The CFTC also wants Binance to pay back the trading profits, revenues, salaries, commissions, loans and fees derived from U.S. persons, and pay civil penalties for the violations.

The CFTC lawsuit against Binance is a big deal for the crypto industry, given its general belief that the CFTC doesn’t pursue small crypto players without merit. This was evident in the Bitfinex case back in 2018, in which the crypto exchange settled with a hefty fine in 2021.

Related: 7 details in the CFTC lawsuit against Binance you may have missed

Adam Cochran, a crypto observer, reiterated a similar stance, saying the CFTC “doesn’t go after small frequent cases like the SEC,” adding that “It’s a different beast and its cases are often fatal.”

In his Twitter thread, Cochran commented that the early evidence gathered by the CFTC could prove fatal for Binance. He added that Binance could either fight the case in the U.S. or settle it outside the court, but in all likelihood, it would be forced to cease operations in the United States.

Magazine: Best and worst countries for crypto taxes — plus crypto tax tips

Go to Source

Author: Prashant Jha