Indian central bank-backed NPCI begins blockchain recruitment

Singapore, Malaysia, the UAE, France, Benelux countries, Nepal and the U.K. have adopted the NPCI’s UPI payments system to varying degrees.

The National Payments Corporation Of India (NPCI) — an initiative led by the Reserve Bank of India (RBI) and 247 Indian banking companies — is on the lookout for a seasoned blockchain technologist to head and investigate opportunities for blockchain in current-day payment systems.

NPCI owns and operates the Unified Payments Interface (UPI), India’s home-grown instant payment system that facilitates interbank peer-to-peer and person-to-merchant transactions. A recent LinkedIn job posting confirmed NPCI’s ongoing drive to hire a head of blockchain.

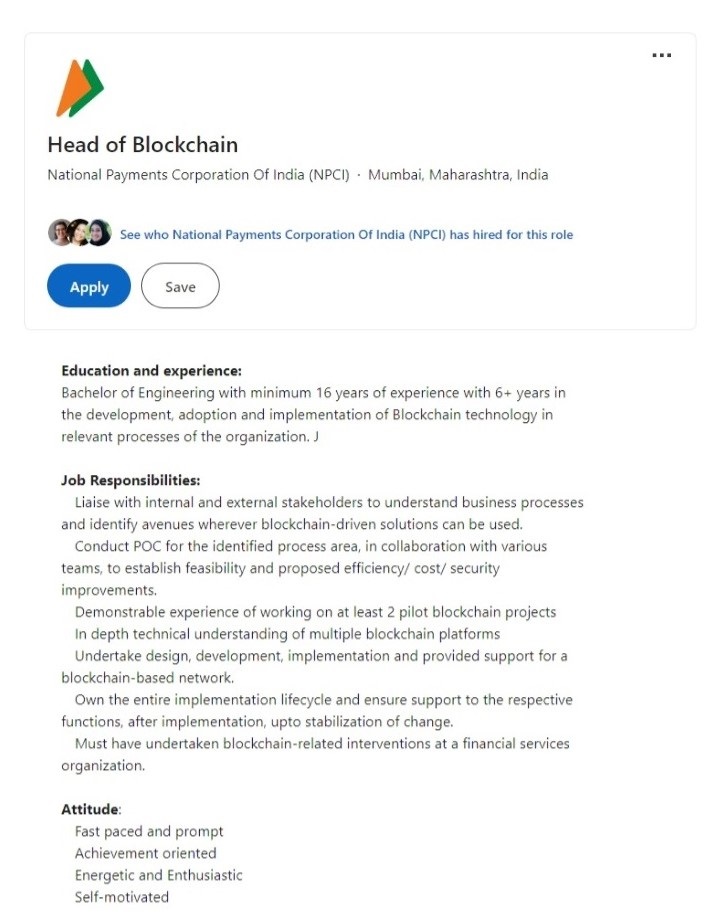

The ideal candidate will be a seasoned technologist with at least six years of experience in developing and implementing blockchain, who will be primarily tasked with identifying “avenues wherever blockchain-driven solutions can be used.”

The senior leadership position also demands an in-depth technical understanding of multiple blockchain platforms and previous experience working on at least two pilot blockchain projects. UPI’s success in fortifying the Indian payments landscape has garnered interest from other jurisdictions.

Singapore, Malaysia, the United Arab Emirates, France, Benelux countries, Nepal and the United Kingdom have adopted the UPI payments system to varying degrees. Infusing blockchain elements in the UPI can potentially expose the technology to millions of users in an instant, thus reaffirming the capability of the underlying tech that has continued to power Bitcoin (BTC) for nearly 14 years.

The NPCI job application had over 200 applicants at the time of writing. NPCI’s blockchain hiring drive is expected to increase in the near future once viable blockchain use cases are unearthed.

Related: Amid crypto winter, central banks rethink in-house digital currencies

In August, the United Kingdom’s National Crime Agency (NCA) set out to hire four senior investigators for its Complex Financial Crime Team to work on crypto-related crimes.

The investigators will be tasked with pursuing high-end crypto fraud, money laundering and other blockchain-based crimes carried out by organized crime groups.

The U.K. has been working to establish an investigative team focusing on illicit crypto activities. On Jan. 4, the NCA launched its digital assets team, signaling an increased focus on crypto assets.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: How to protect your crypto in a volatile market: Bitcoin OGs and experts weigh in

Go to Source

Author: Arijit Sarkar