PayPal’s crypto holdings increased by 56% in Q1 2023 to nearly $1B

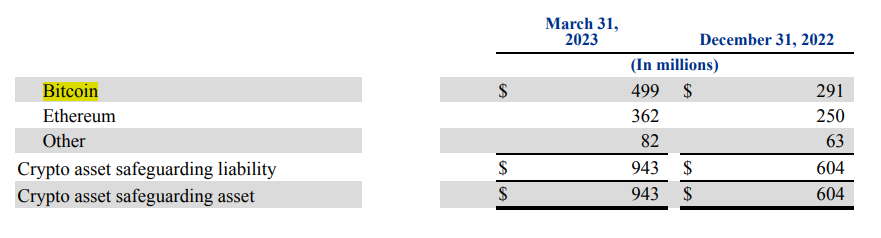

The lion’s share of the fintech’s held cryptocurrency assets lie in BTC and ETH with $499 and $362 million respectively — up more than 56% since Q4 2022.

Financial technology company PayPal recently disclosed its cryptocurrency holdings in a quarterly report filing to the Securities and Exchange Commision (SEC).

Claiming a combined total of $943 million in cryptocurrency assets as of March 31, 2023, the filing shows a 56% increase over the company’s previous quarter where PayPal disclosed $604 million.

PayPal’s reported total financial liabilities for this quarter were $1.2 billion, with crypto assets making up 77.9% — up more than 10% from 2022’s reported fourth quarter liabilities.

Related: PayPal crypto partner Paxos raises $300M

According to the report, PayPal considers its crypto assets a “safeguarding liability” due to the the “unique risks associated with cryptocurrencies.” The disclosure also indicates that the specific cryptocurrencies held by the company remain unchanged since last quarter:

“We allow our customers in certain markets to buy, hold, sell, receive, and send certain cryptocurrencies as well as use the proceeds from sales of cryptocurrencies to pay for purchases at checkout. These cryptocurrencies consist of Bitcoin, Ethereum, Bitcoin Cash, and Litecoin (collectively, “our customers’ crypto assets”).”

Custody of the assets PayPal holds on behalf of its customers remains limited to third-party holding companies. PayPal recognizes that this presents a liability for customers in the event that third parties are unable to process transactions — a statement carried over from last quarter’s filing — however, the filing also indicates that no such fault has yet occurred:

“As of March 31, 2023, the Company has not incurred any safeguarding loss events, and therefore, the crypto asset safeguarding liability and corresponding safeguarding asset were recorded at the same value.”

The Q1 2023 cryptocurrency asset breakdown for PayPal includes $499 million in Bitcoin (up from December’s $291 million), $362 million in Ether (up from $250 million), and $82 million composed of Bitcoin Cash and Litecoin (up from $63 million).

PayPal’s profitability also increased in the first quarter. On a GAAP basis, the company disclosed per-share earnings of $0.70, up from $0.43 in the first quarter of 2022. On a non-GAAP basis, PayPal’s per-share earnings were $1.17, up from $0.88 in the first quarter of 2022.

Go to Source

Author: Tristan Greene