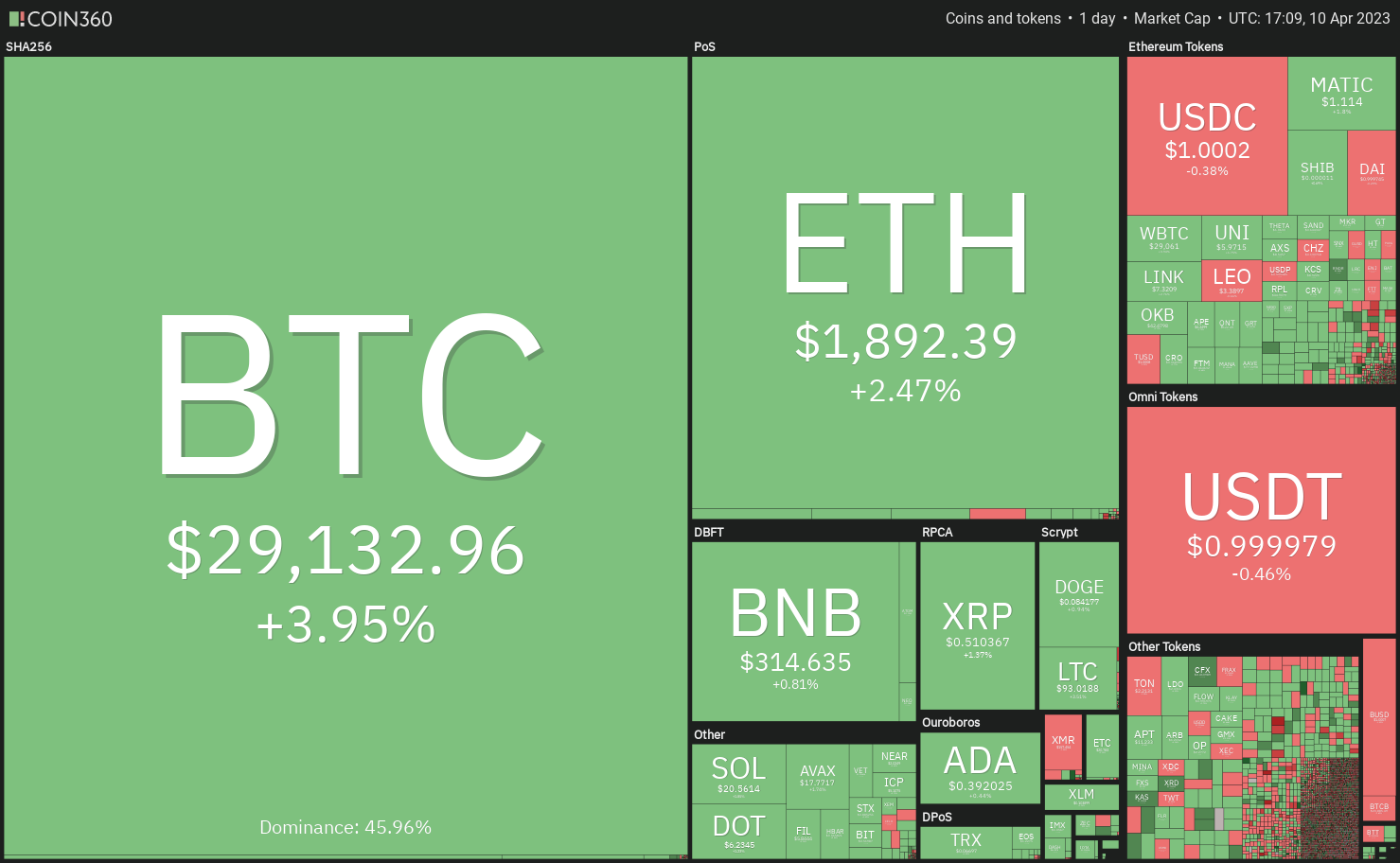

Price analysis 4/10: SPX, DXY, BTC, ETH, BNB, XRP, ADA, MATIC, DOGE, SOL

After days of consolidation near the local high, Bitcoin is trying to breakout and challenge the $30,000 level.

Bitcoin’s (BTC) tight consolidation near its local top suggests that traders are waiting for a catalyst to start the next trending move. The consumer price data on April 12 and the producer price index data on April 13 could give insight into the Federal Reserve’s future rate hikes and shake the traders out of their slumber.

The dull price action in Bitcoin has not reduced the interest in it. According to Ahrefs search volume data, Bitcoin remains the most Googled term in the United States followed by the keywords Donald Trump and Breaking news.

Another point worth noting is that Bitcoin’s circulating supply continues to dwindle. Citing Glassnode data, investor Anthony Pompliano pointed out that 53% of Bitcoin’s circulating supply has not moved in the past two years.

If demand increases, there could be a shortage of supply, which could boost prices higher. What are the critical resistance levels to watch for in Bitcoin and altcoins in the near term?

Let’s study the charts to find out.

S&P 500 index price analysis

The S&P 500 index (SPX) turned up after a two-day correction on April 6, indicating that the sentiment remains positive and traders are buying on minor dips.

The upsloping 20-day exponential moving average (4,035) and the relative strength index (RSI) in the positive territory increase the likelihood of a rally to 4,200. Although this level has behaved as a formidable barrier in the past, it is likely to be scaled during the third attempt. If that happens, the index may challenge the 4,300 resistance. This level may witness aggressive selling by the bears.

The first important support to watch on the downside is the 20-day EMA. If this support cracks, the index could retest the vital support at the 200-day simple moving average ($3,944).

U.S. dollar index price analysis

The U.S. dollar index continues to trade below the 20-day EMA (102.73), indicating that the short-term trend remains bearish. Sellers are likely to defend the 20-day EMA during the current relief rally.

If the price turns down from the 20-day EMA, the index may drop to the vital support of 100.82. The bulls are expected to guard this level with all their might because a break below it will complete a head and shoulders (H&S) pattern. The index may then start the next leg of the downtrend.

Another possibility is that the price rebounds off the 100.82 support and rises above the 20-day EMA. If that happens, it will suggest that the index may oscillate between 100.82 and the 200-day SMA (106.47) for some more time.

Bitcoin price analysis

Bitcoin bounced off the 20-day EMA ($27,692) on April 9, indicating buying at lower levels. The gradually upsloping 20-day EMA and the RSI in the positive territory indicate advantage to the buyers.

The $29,200 is the key level to watch for on the upside. If bulls pierce this resistance, the BTC/USDT pair may climb to $30,000. The bears will try to stall the rally at this level but the likelihood of a break above it is high. The pair may then soar to $32,200.

Contrarily, if the price once again turns down from $29,200, it will suggest that bears are active at higher levels. The sellers will then make one more attempt to sink the price below the 20-day EMA. If they succeed, the pair may slump to $25,250.

Ether price analysis

Buyers successfully defended the 20-day EMA ($1,813) on April 9, indicating that the trend remains positive in Ether (ETH).

The bulls will try to overcome the barrier at $1,943 and catapult the price to $2,200. Sellers are likely to fiercely defend the zone between $2,000 and $2,200. If the price turns down from this zone but does not break below the 20-day EMA, it will signal that the rally may extend further.

This positive view will invalidate in the near term if the price turns down and plummets below the 20-day EMA. The ETH/USDT pair could then descend to the strong support zone of $1,743 to $1,680.

BNB price analysis

BNB (BNB) has been trading below the 20-day EMA ($313) for the past few days but the bulls have not allowed the price to slide below the immediate support at $306. This suggests that the selling pressure dries up at lower levels.

The bulls will take advantage of the situation and try to drive the price above the overhead resistance of $318. If they do that, the BNB/USDT pair could pick up momentum and soar to $338 and later to $346.

On the contrary, if the price turns down from the current level, it will suggest that the bears are selling on every minor relief rally. If the $306 level gives way, the pair may slip to the 200-day SMA ($292).

XRP price analysis

XRP (XRP) has been trading above the 38.2% Fibonacci retracement level of $0.49 for the past few days, indicating that buyers are not waiting for a deeper correction to buy.

The bulls will try to strengthen their position by pushing the price to the overhead zone between $0.56 to $0.58. This remains the key zone to keep an eye on because a break above it could open the doors for a potential rally to $0.65 and thereafter to $0.80.

Instead, if the price turns down and breaks below the 20-day EMA ($0.48), it will suggest that short-term traders may be booking profits. That could tug the XRP/USDT pair to the important support at $0.43.

Cardano price analysis

Cardano (ADA) has been trading above the 20-day EMA ($0.37) for the past few days but the bulls are struggling to clear the neckline of the inverse H&S pattern. This suggests that the bears are defending the level with vigor.

Usually, a tight consolidation is followed by a sharp breakout. The rising 20-day EMA and the RSI in the positive area suggest that the breakout may happen to the upside. A close above the neckline will complete the reversal setup and signal the start of a new uptrend toward the target objective of $0.60.

This bullish view will be negated if the price turns down and breaks below the 20-day EMA. The ADA/USDT pair may then tumble to the 200-day SMA ($0.35). This level is likely to attract strong buying by the bulls.

Related: ‘Pop or drop?’ Bitcoin analysts decide if BTC price will beat $30K

Polygon price analysis

Sellers tried to sink Polygon (MATIC) below the support line on April 9 and 10 but the bulls held their ground. This suggests buying at lower levels.

The bulls will try to push the price above the 20-day EMA ($1.11). If they are successful, the MATIC/USDT pair could surge to the resistance line of the symmetrical triangle. A break and close above the triangle will suggest that the bulls have overpowered the bears. That will clear the path for a possible rally to $1.30.

Instead, if the price turns down from the 20-day EMA and plunges below the support line, it will indicate that bears are in control. The pair may then retest the vital support at the 200-day SMA ($0.99).

Dogecoin price analysis

Dogecoin (DOGE) successfully held the moving averages on April 8 but the shallow bounce on April 9 suggests that demand dries up at higher levels.

Both moving averages have flattened out and the RSI is just above the midpoint, indicating a balance between supply and demand. The bounce off the current level could face selling at the 38.2% Fibonacci retracement level of $0.09. If the price turns down from this level, the DOGE/USDT pair may oscillate between $0.09 and the moving averages for some time.

A break below the moving averages could sink the pair to the strong support of $0.07 while a rise above $0.09 will increase the likelihood of a rally to $0.11.

Solana price analysis

The trading range in Solana (SOL) has narrowed down further, indicating uncertainty among the bulls and the bears.

The flattish 20-day EMA ($20.64) and the RSI just below the midpoint do not give a clear advantage either to the bulls or the bears. Hence, it is better to wait for a breakout to happen before waging large bets.

If the price turns up and pierces the downtrend line, it may attract strong buying by the bulls. The SOL/USDT pair could then start a rally to $27 and subsequently to $39. On the other hand, the selling could intensify if the price collapses below $18.70. The pair may then nosedive to $15.28.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Go to Source

Author: Rakesh Upadhyay