Republicans Seek to Repeal Biden’s Inflation Reduction Act in Exchange for Raising US Debt Limit

There has been a lot of commentary concerning the U.S. raising its debt limit, as Treasury secretary Janet Yellen said last month that a U.S. default would be “devastating,” and European Central Bank president Christine Lagarde warned it would be a “major disaster” if the U.S. defaulted on its obligations. It now appears that Republican politicians are willing to raise the country’s debt limit, but only if fellow lawmakers repeal the mandates on green energy and climate change in the Inflation Reduction Act.

Debate Over Inflation Reduction Act Heats Up as Debt Ceiling Deadline Approaches

This weekend, there is a great deal of discussion regarding repealing several measures installed in the Biden administration’s Inflation Reduction Act. Republicans, led by House speaker Kevin McCarthy (R-CA), are looking to gut the Inflation Reduction Act, and in return, they would be willing to raise the debt ceiling. On Wednesday, McCarthy said that the repeals would “end the green giveaways for companies that distort the market and waste taxpayers’ money.”

McCarthy is not the only lawmaker proposing to repeal the Inflation Reduction Act. Congressman Andy Ogles (R-TN) introduced legislation in February aimed at “repealing the Democrats’ record spending.” “President Biden and his House Democrat colleagues shoved through countless spending measures to further their woke ‘green agenda,’” Ogles said at the time. There were complaints against the Inflation Reduction Act before it was passed, with 230 economists sending a letter to the country’s House and Senate leaders explaining that the act would fuel inflation.

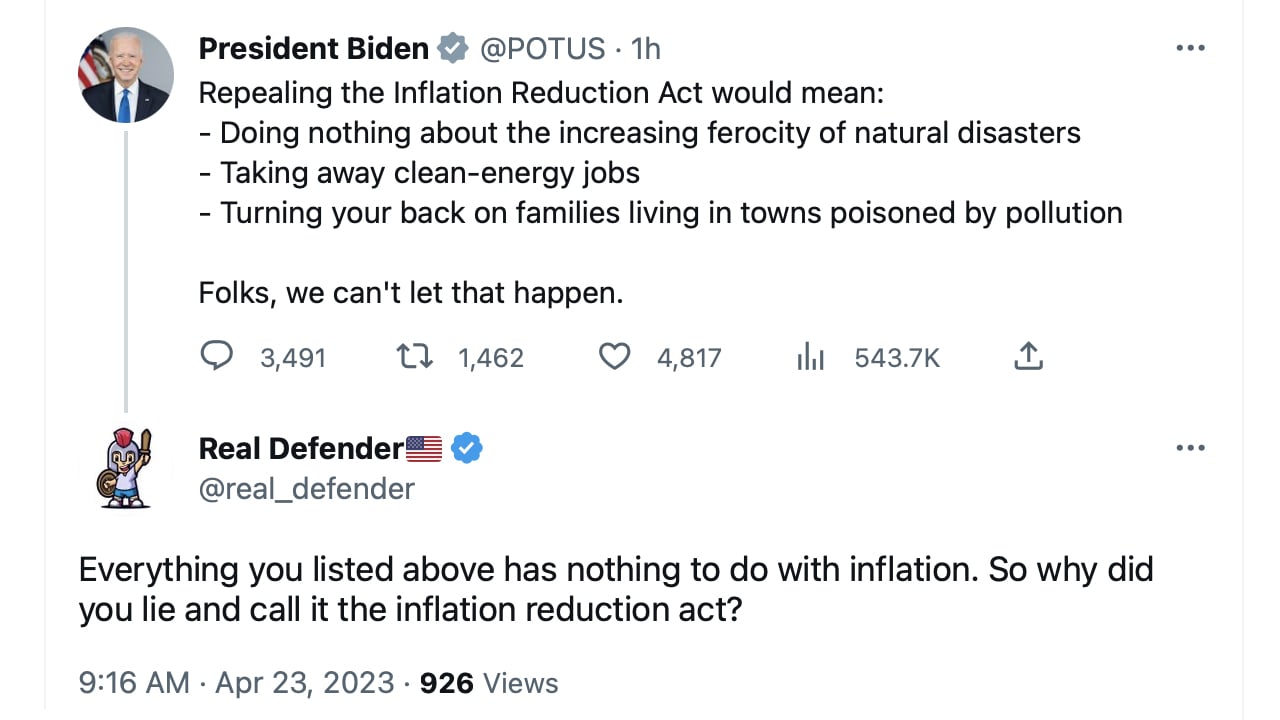

After McCarthy and the House Republicans’ plan was made public, White House deputy press secretary Andrew Bates said in a memo that Republicans want to “kill over 100,000 manufacturing jobs.” Biden took to Twitter on Sunday to complain about the repeal discussion. “Repealing the Inflation Reduction Act would mean doing nothing about the increasing ferocity of natural disasters, taking away clean-energy jobs, and turning your back on families living in towns poisoned by pollution,” Biden tweeted. “Folks, we can’t let that happen.”

Biden’s tweet was met with a lot of opposition. One individual replied to the U.S. president by saying the Inflation Reduction Act “had nothing to do with inflation and everything to do with increasing climate alarmism and feeding cash into the climate industry.” Another person wrote, “In other words, you lied to Americans about what the ‘Inflation Reduction Act’ does. Now, you’re lying about what it can do. Why say anything? It’s all lies.” Another individual criticized the U.S. president for not visiting East Palestine, Ohio after the major train derailment disaster.

The U.S. is expected to default on its obligations with private investors, foreign businesses, and other nation-states by the end of the summer if the debt limit is not raised. ECB President Christine Lagarde said last week she was confident the U.S. would not let this happen as it would be a “major disaster.” The United States has accumulated more than $31 trillion in debt. Last month, after the collapse of three major banks in the U.S., Treasury Secretary Janet Yellen insisted that a debt limit breach would be “devastating” for American banks.

What do you think should be done to address the United States’ mounting debt and prevent a default on its obligations? Share your thoughts in the comments section below.

Go to Source

Author: Jamie Redman