Ethereum set for bull run, but short-term struggles expected: Kaiko

Share this article

Last week marked a significant shift in the market sentiment for Ethereum (ETH) following the SEC’s unexpected approval of spot ETH exchange-traded funds (ETFs), and market data suggests that ETH is headed for a bull run soon, according to a report from on-chain analysis firm Kaiko.

The SEC’s decision came through the approval of 19b-4 filings from major exchanges including NYSE, Cboe, and Nasdaq. This pivotal step precedes the review of S-1 forms from issuers such as BlackRock, Fidelity, and VanEck, with the commencement of trading in ETH ETFs pending these approvals.

“With these approvals, the SEC implicitly stated that ETH (without staking) is a commodity rather than a security,” stated Will Cai, Head of Indices at Kaiko. “This isn’t just about access to ETH, but has significant and likely positive ramifications on how all similar tokens will be regulated in the US with respect to trading, custody, transfer, etc.”

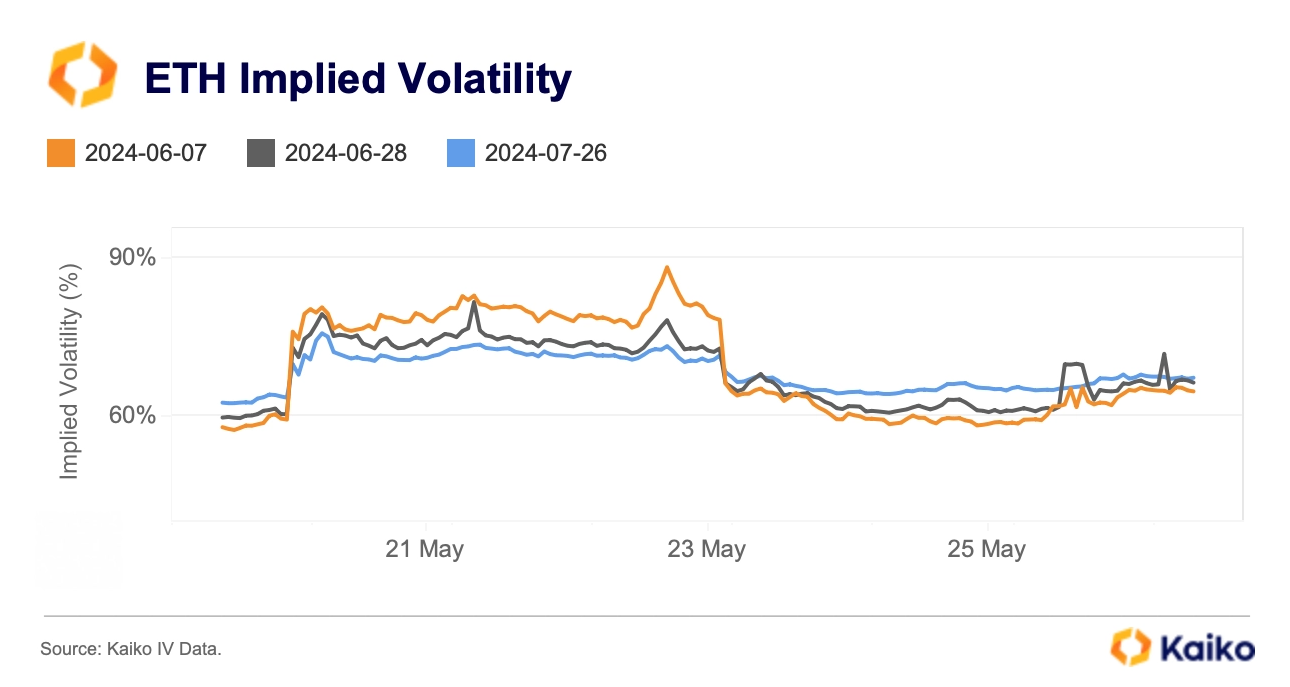

The anticipation of approval was hinted at earlier in the week when several exchanges amended their filings to exclude staking, and Bloomberg increased its approval odds from 25% to 75%. The market’s reaction was swift, with ETH’s implied volatility for the nearest expiry jumping from under 60% to nearly 90% within two days, before settling down by week’s end.

The derivatives market echoed this sentiment shift, with ETH perpetual futures funding rates soaring from a year’s low to a multi-month high within three days. Open interest also reached a record $11 billion, indicating robust capital inflows. Despite this, the ETH to BTC ratio showed a surge from 0.044 to 0.055, remaining below February’s highs.

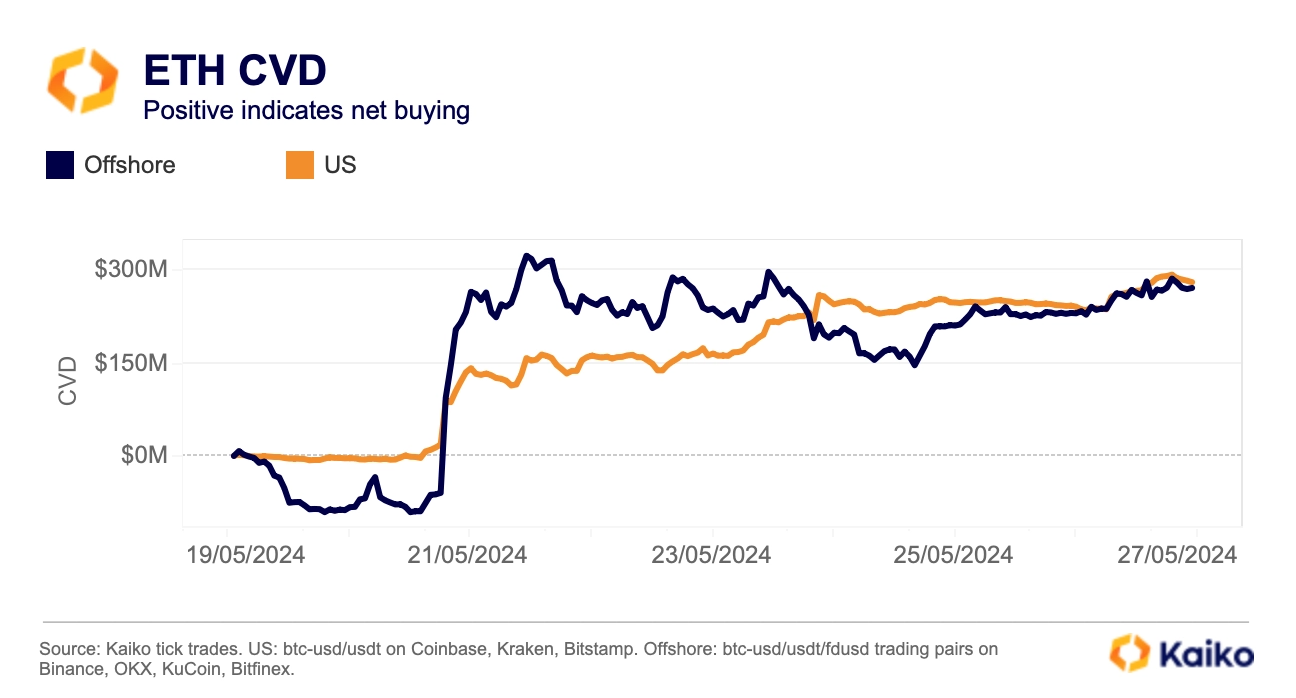

Moreover, the ETH Cumulative Volume Delta (CVD) revealed a broad-based rally, with strong net buying in both US and offshore spot markets starting May 21. This marked a change from the net selling previously recorded on offshore exchanges.

However, the upcoming launch of ETH ETFs may exert selling pressure on ETH due to potential outflows from Grayscale’s ETHE, which has been trading at a discount. ETHE, the largest ETH investment vehicle with over $11 billion in assets under management, could see significant outflows, impacting ETH’s average daily volume on Coinbase.

Despite potential short-term inflows disappointment, the SEC’s approval is a milestone for Ethereum, alleviating some of the regulatory uncertainty that has affected its performance over the past year.

Share this article

Go to Source

Author: Gino Matos