Bitcoin, Ethereum Technical Analysis: BTC Falls Below $24,000 Ahead of FOMC Minutes

Bitcoin extended recent declines on Feb. 22, as markets prepared for the release of the latest Federal Open Market Committee (FOMC) minutes. Following a recent move to a multi-month high, prices have slipped, with traders instead protecting profits. Ethereum has also declined, however remains above the $1,600 mark.

Bitcoin

Bitcoin (BTC) extended recent declines on Wednesday, as markets began to anticipate the upcoming FOMC minutes report.

Today’s report will shed light on the Federal Reserve’s current view of the U.S. economy, in light of last month’s 25-basis-point hike.

As a result, BTC/USD fell to an intraday low of $23,902.54 on hump-day, less than 24 hours after hitting a high of $24,824.10.

The decline comes following two breakouts, first the 14-day relative strength index (RSI) moving below a support point at 61.00, plus prices falling under $24,200.

Currently, the index is tracking at a reading of 59.24, which is its weakest point since February 14.

A floor at 58.00 awaits remaining bulls, which could potentially help ease the current bleeding in prices.

Ethereum

In addition to BTC, ethereum (ETH) was in the red for a second consecutive session, breaking out of a key support point in the process.

Following a high of $1,682.78 on Tuesday, ETH/USD slipped to a bottom of $1,628.69 earlier in the day.

Today’s drop came as ethereum moved further below a long-term support zone at the $1,675 mark, with $1,625 acting as an interim floor.

Since hitting this low, bulls have somewhat reentered the market, with ethereum now trading at $1,643.32.

Price strength has also plunged, with a floor of 57.00 giving way earlier in the session, with the RSI now tracking at 53.76.

Overall, ethereum is still trading nearly 6% higher from the same time last week.

Register your email here to get weekly price analysis updates sent to your inbox:

Do you believe ethereum could fall below $1,600 in the coming days? Leave your thoughts in the comments below.

Go to Source

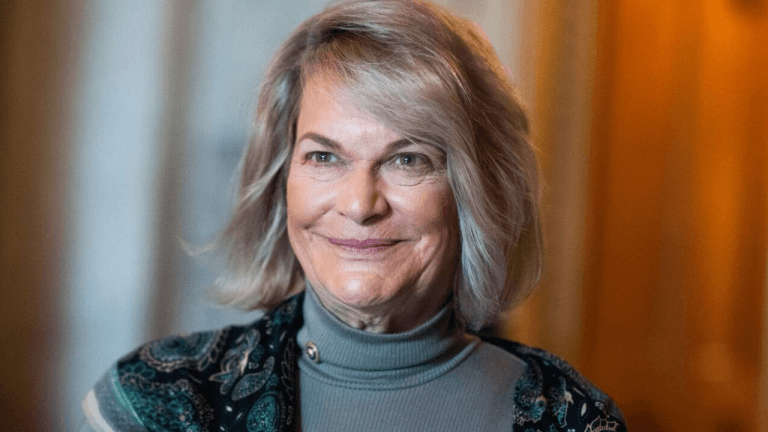

Author: Eliman Dambell