Is Bitcoin’s record-low volatility and decline in short-term holders a bull market signal?

Traders believe that Bitcoin’s low volatility is a bull market signal, but their bias could be preventing them from acknowledging potentially negative macro outcomes.

The latest report from Glassnode Insights, titled “The Week On-Chain,” emphasized that Bitcoin (BTC) has reached historically low levels of volatility. This has led to a mere 2.9% separation between the asset’s Bollinger Bands, indicating an exceptionally narrow trading range.

This situation has only been observed twice in Bitcoin’s history: in September 2016, when BTC traded near $604, and in January 2023, when the asset maintained a steady value of $16,800.

As outlined in the report, periods of reduced volatility, combined with investor fatigue, prompt the movement of coins based on their cost close to the current price. This implies that traders are likely making marginal profits or losses with their exits. The report concludes that establishing a new price range is necessary to stimulate fresh spending, potentially contributing to an anticipated increase in volatility.

Is Bitcoin’s low volatility a reflection of broader markets?

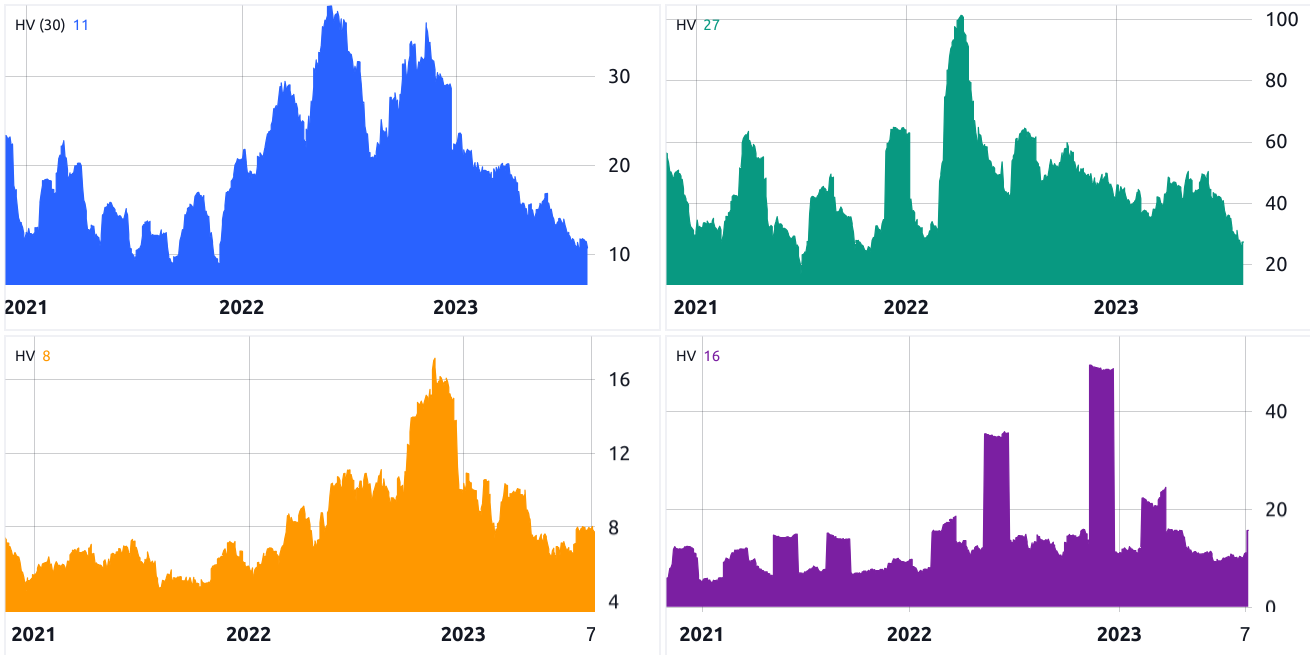

The constrained range within which Bitcoin has traded – specifically, $29,050 to $29,775 over the past three weeks – is atypical and it does not require advanced mathematical analysis to understand. This has resulted in an exceptionally low annualized 30-day volatility of 17%. The key question is whether this trend is isolated to cryptocurrencies, or if it’s a phenomenon also observed in the traditional markets, including stocks, oil, bonds and currencies.

Notice how the S&P 500 and oil price (WTI) 30-day volatility are currently at their lowest levels since November 2021. Interestingly, the DXY index didn’t follow this trend, as the metric rose to 8% from 6% in May 2023. Additionally, the 10-year Treasury yield recently rose from its 18-month low of around 10% to the current 16%. These trends could have potentially influenced the decrease in Bitcoin’s volatility.

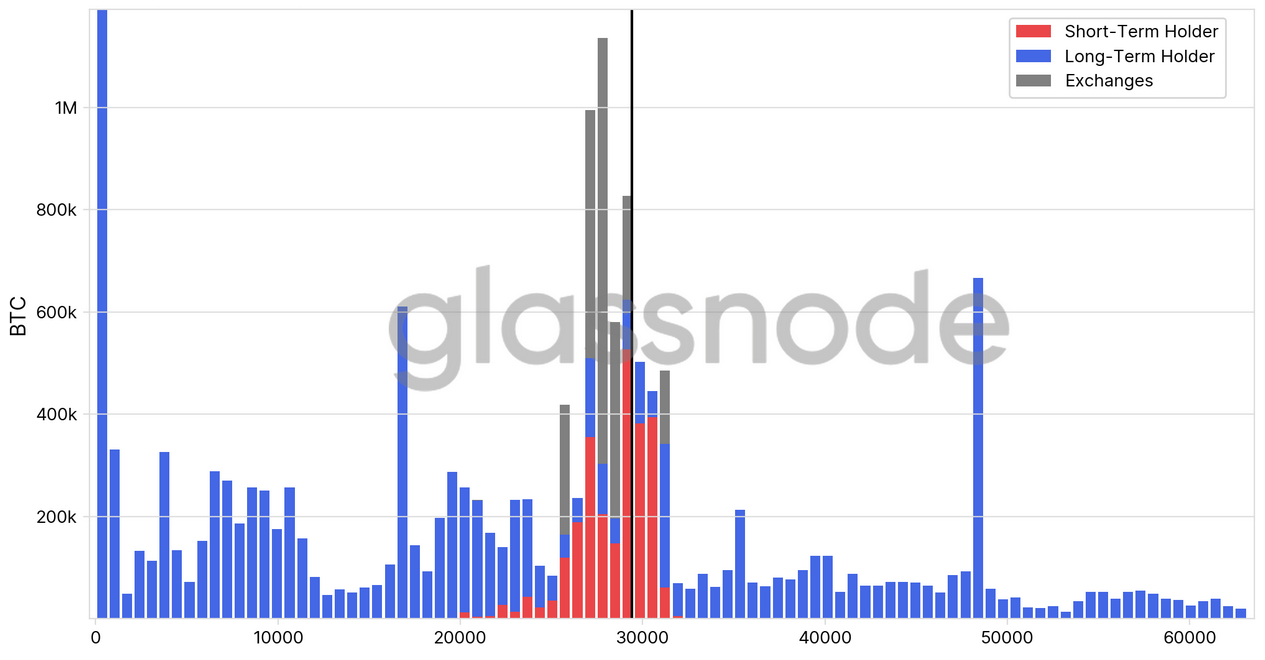

According to Glassnode, there’s a significant concentration of short-term holders’ price distribution between $25,000 and $31,000. This pattern is reminiscent of similar periods during past bear market recoveries. However, the data shows that many of these investors are still holding positions with losses, creating short-term selling pressure.

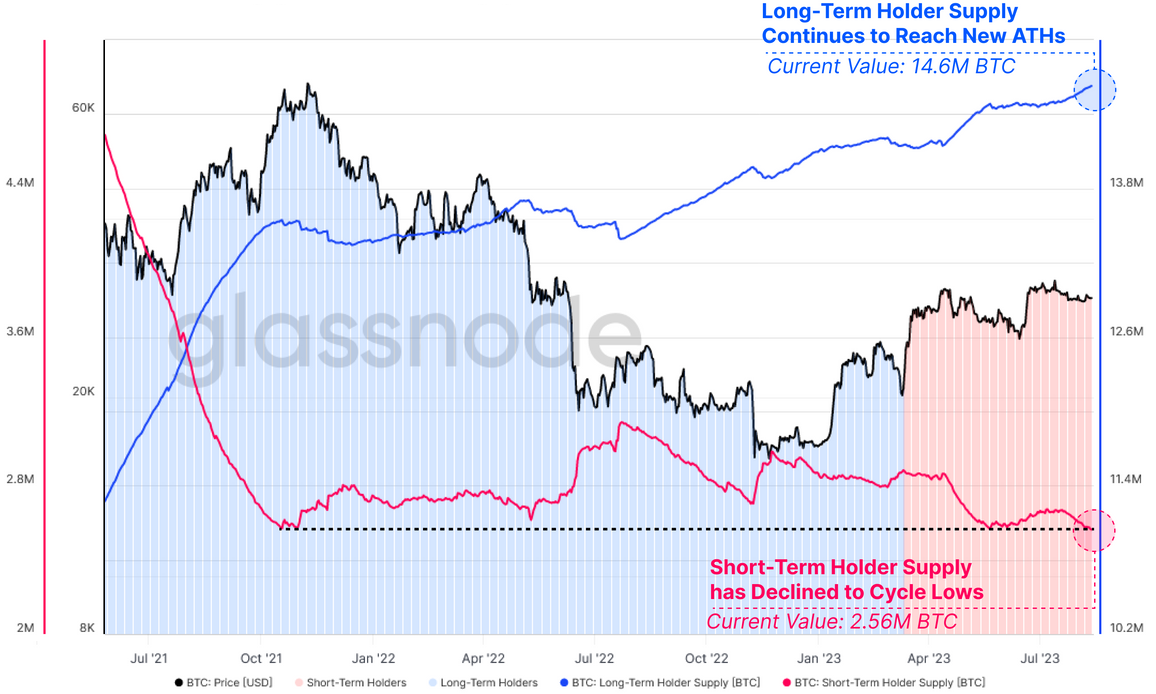

Moreover, the analytics firm highlights a noteworthy drop in short-term holder supply to a multi-year low of 2.56 million BTC. On the flip side, the supply held by long-term holders has reached an all-time high of 14.6 million BTC, as mentioned in the report.

Assuming a relatively optimistic scenario where only 10% of the 1.77 million BTC held by long-term investors at $47,000 or higher change their positions before Bitcoin surpasses $40,000, this amounts to about 6 and a half months of the current mining output. This illustrates the importance of not disregarding the potential impact of a global economic recession on Bitcoin’s price, beyond the fact that short-term holders are becoming scarce.

This hypothesis doesn’t invalidate Glassnode’s idea of increased positions by “long-term conviction holders.” Nevertheless, no historical data can account for the U.S. 10-year Treasury yields nearing their highest level in 16 years or the 30-year fixed average mortgage rate in the U.S. flirting with the 7% mark.

Despite the current trend, long-term holders still could flip their sentiment and actions in the advent of adverse economic conditions.

Higher yields in equities could attract investors, leading to possible volatility, while rising government and corporate borrowing costs might strain budgets and profitability. Concurrently, real estate markets might slow due to the impact on mortgage affordability. Such circumstances would likely compel central banks to implement fiscal policies to support economic activity, often resulting in upward inflation pressure.

Bitcoin’s ascension as a $50 billion asset class occurred merely 6 years ago, making it uncertain how holders will react to the stress faced by some traditional markets. This contradicts the historically low volatility in the S&P 500, oil and Bitcoin markets.

This raises the question: could this tranquility be preceding a period of turmoil and will Bitcoin serve as a hedge against escalating inflation? Only time will provide the answers.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Go to Source

Author: Marcel Pechman