In 2023, meme coins have maintained their popularity, and the recent surge of PEPE demonstrates that investors remain enthusiastic about meme-centered tokens. A fresh study from Coingecko reveals that a significant portion of meme coin fascination originates from the United States, India, and the U.K., encompassing over half of the top ten countries’ interest driving […]

In 2023, meme coins have maintained their popularity, and the recent surge of PEPE demonstrates that investors remain enthusiastic about meme-centered tokens. A fresh study from Coingecko reveals that a significant portion of meme coin fascination originates from the United States, India, and the U.K., encompassing over half of the top ten countries’ interest driving […]

Dogecoin (DOGE) challenger Shiba Inu (SHIB) is still the most popular memecoin in the US despite seeing new competition. According to a new study by CoinGecko examining the total number of page views on the top 15 memecoins by market cap, Shiba Inu was by far the top meme token in the US during 2023 […]

The post Dogecoin (DOGE) Rival Shiba Inu (SHIB) Still Top Memecoin in US Despite New Competition: CoinGecko appeared first on The Daily Hodl.

According to the latest Coingecko crypto industry report, during the first quarter of 2023, bitcoin became the best-performing asset after it saw its U.S. dollar value go up from just under $17,000 observed on Dec. 31, 2022, to just over $28,000 by March 31, 2023. The report attributes the crypto asset’s resurgence to “increased volatility […]

According to the latest Coingecko crypto industry report, during the first quarter of 2023, bitcoin became the best-performing asset after it saw its U.S. dollar value go up from just under $17,000 observed on Dec. 31, 2022, to just over $28,000 by March 31, 2023. The report attributes the crypto asset’s resurgence to “increased volatility […]

People purchase NFTs for various reasons, but according to a new survey from CoinGecko, the majority buy them for utility and long-term profits.

Utility and long-term profits have been ranked as the top reasons for buying non-fungible tokens (NFTs), according to a survey conducted by CoinGecko and Blockchain Research Lab.

An April 10 CoinGecko report found most considered how much utility an NFT collection offers and the benefits of holding the token before buying with over 77% of respondents saying using an NFT for its “intended function” had some level of importance out of the 11 listed reasons for buying an NFT.

However, 15.7% responded they were "neutral" about utility and 6.7% felt it was "not important" in the decision-making process before buying an NFT.

The potential for long-term profits came in as the second most crucial factor with just over 76% of respondents giving a level of importance for hoping to sell their NFTs at a higher price later on.

Some NFTs have sold for millions in the past, but the market has experienced a severe downturn in step with the broader crypto market, although the NFT market is expected to hit $230 billion in value by 2030.

The third most important reason people bought NFTs was to participate as a stakeholder in a decentralized autonomous organization (DAO) with 72.9% motivated by the opportunity to gain a stake in such a project.

Related: Community-centric NFT collection for the hustlers goes live to the public

Other high-ranking reasons included enthusiasm for technology, community involvement and enthusiasm for an NFT collection’s business or artwork.

The reason that ranked as the least important on the list was “disrupting established structures or industries,” which was listed as a top reason for buying by 59.5% of respondents.

Overall, all of the 11 listed reasons were more heavily rated as having some level of importance rather than being rated neutral or not important.

The results were taken from 343 responses examined by CoinGecko and the Blockchain Research Lab which were received during a survey conducted from December 2022 to January 2023.

Magazine: 4 out of 10 NFT sales are fake: Learn to spot the signs of wash trading

After Paxos announced that it would no longer mint the stablecoin BUSD, 4.98 billion BUSD stablecoins have been removed from circulation to date. The Paxos-managed stablecoin has also fallen out of the top ten crypto assets by market capitalization, slipping below dogecoin’s valuation with a market cap of around $11.12 billion, compared to the meme […]

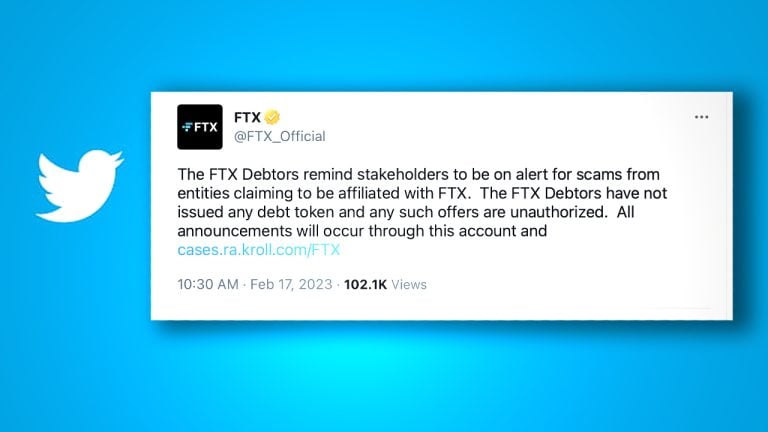

After Paxos announced that it would no longer mint the stablecoin BUSD, 4.98 billion BUSD stablecoins have been removed from circulation to date. The Paxos-managed stablecoin has also fallen out of the top ten crypto assets by market capitalization, slipping below dogecoin’s valuation with a market cap of around $11.12 billion, compared to the meme […] On Friday, debtors who control the official FTX Twitter account warned the community to “be on alert for scams from entities claiming to be affiliated with FTX.” They also noted that neither FTX debtors nor any entity related to the company has issued any IOU crypto assets or “debt tokens.” The alert comes as a […]

On Friday, debtors who control the official FTX Twitter account warned the community to “be on alert for scams from entities claiming to be affiliated with FTX.” They also noted that neither FTX debtors nor any entity related to the company has issued any IOU crypto assets or “debt tokens.” The alert comes as a […]

The new crypto classification effort aims to help investors and regulators spot potential crypto failures like those seen in 2022.

Major cryptocurrency data aggregator CoinGecko and crypto investment firm 21Shares have joined forces to launch a global standard for classifying various crypto asset.

On Feb. 8, CoinGecko and 21Shares released The Global Crypto Classification Standard report, proposing a uniform method to categorize crypto assets. The effort aims to help investors and regulators better understand the specifics of each asset class in crypto, including potential failures like those seen by the industry in 2022.

“Since Bitcoin’s inception around 13 years ago, thousands of unique crypto assets and protocols have emerged, each with unique characteristics and different value propositions,” Carlos Gonzalez, research analyst at 21Shares’ parent firm 21.co, told Cointelegraph, adding:

“Unlike traditional financial assets, crypto assets can vary dramatically in nature, both as it relates to the asset itself and the protocol behind it.”

At the time of writing, there are more than 12,000 diverse crypto assets listed on CoinGecko’s website, with each coin having its unique characteristics and features. CoinGecko and 21Shares’ classification standard is based on three categorization levels, differentiating these thousands of assets by stack, market sectors, industries and taxonomy.

The first level, dubbed “crypto stack,” breaks down crypto assets into classes like cryptocurrencies, smart contract platforms, centralized applications, decentralized applications, interoperable blockchains and others. The methodology only refers to networks or protocols in the first two levels, not the underlying token.

The second level, called “market mapping by sectors and industries,” further divides cryptocurrencies by segments like infrastructure, metaverse and decentralized finance (DeFi), as well as groups like payment platform, lending, developer tooling and others. As some protocols might fit into multiple industries, the methodology attempts to place the assets in the most relevant category in such cases.

The third level, “taxonomy of crypto assets,” classified crypto assets according to related asset “superclass” based on the cryptocurrency taxonomy system proposed by crypto analyst Chris Burniske in 2019. Burniske’s system follows Robert Greer’s 1997 paper, “What is an Asset Class Anyway?” categorizing crypto assets across their superclasses like capital assets, consumable or transformable assets and store of value assets.

Some of the examples in the store of value asset category include Bitcoin (BTC), Monero (XMR), Zcash (ZEC) and Dogecoin (DOGE). This type of crypto asset “cannot be consumed; nor can it generate income. Nevertheless, it has value; it is a store of value asset,” the proposed classification standard reads.

Related: The world must take a ‘collective action’ approach to regulations — India’s finance minister

CoinGecko and 21Shares’ effort to bring a global crypto classification standard is one of many global efforts to categorize cryptocurrencies. On Feb. 3, the Department of the Treasury in Australia released a consultation paper on “token mapping,” aiming to have its own taxonomy of crypto assets. Previously, Belgium’s Financial Services and Markets Authority was also seeking feedback on its classification of crypto assets as securities, investment instruments or financial instruments in July 2022.

“While the classification of digital assets is quite commonplace, many classification efforts are one-dimensional and confuse traditional investors by mixing crypto assets — the investable tokens — directly with the protocols behind them,” Gonzalez said.

The exec also expressed confidence that 21Shares’ collaboration with CoinGecko — a major independent crypto data website — will allow the newly proposed standard to appeal to both retail and institutional investors, as well as policymakers across the world.

A company spokesman says the second-biggest publicly listed holder of BTC wants to have a “war chest” of liquidity composed of both cash and Bitcoin.

The second largest publicly-listed holder of Bitcoin, crypto mining firm Marathon Digital Holdings has offloaded some of its Bitcoin (BTC) for the first time in two years.

A spokesman told Cointelegraph this was not a result of financial distress.

According to an update posted on Feb. 2, the company disclosed that during January it sold 1,500 BTC, worth $35.3 million at current prices.

While some crypto miners have been forced to sell Bitcoin due to distress, Marathon vice president of corporate communications Charlie Schumacher said this was not the case for Marathon.

Schumacher said that Marathon had been diamond-handing its Bitcoin until now, as the firm didn’t want to sell while production was down, and has been bullish on the long-term prospects of the leading cryptocurrency.

But coming into the new year, Marathon wants to have a “war-chest” of liquidity composed of both cash and Bitcoin and is looking to continue paying down debt and increase its cash positions.

Schumacher also noted that Bitcoin’s recent uptick in price contributed to the decision to sell some of its holdings.

January saw Bitcoin rise above the $24,000 price level for the first time since August.

Even after the sale, Marathon managed to increase its unrestricted Bitcoin holdings in the month to 8,090 BTC ($189.8 million).

Marathon said it also had significantly ramped up Bitcoin production throughout January, producing 687 BTC, which represents an increase of 45% compared to the month prior. In the update, Marathon chairman and CEO Fred Thiel noted:

“The improvement in our bitcoin production was primarily a result of our team’s ability to work in tandem with the new hosting provider in McCamey, Texas, to address the maintenance and technical issues at the King Mountain data center that had suppressed our bitcoin production in the fourth quarter of 2022."

Last year, Marathon noted in a May 4 update that the last time it had sold any Bitcoin was on Oct. 21, 2020, and has been hodling since then.

When asked how it had managed to avoid selling the main product of its business operations, Schumacher pointed to the firm’s low headcount, consisting of “32 people as of today,” and suggested it was a result of sound long-term financial strategies.

Related: Bitcoin price is up, but BTC mining stocks could remain vulnerable throughout 2023

Marathon is the second-biggest publicly listed holder of Bitcoin according to CoinGecko, beaten only by software analytics company MicroStrategy. It has recorded a significant boost in its share price in recent days, with MARA stock rising 135% so far this year to $8, according to MarketWatch.

Bitcoin's huge price surge in January has meant that 64% of Bitcoin investors are in profit, according to data from IntoTheBlock.

Bitcoin (BTC) has just clocked its 11th consecutive day outside the “Fear” zone in the Crypto Fear and Greed Index, cementing its longest streak out of fear since last March.

Bitcoin Fear and Greed Index is 61 - Greed

— Bitcoin Fear and Greed Index (@BitcoinFear) January 30, 2023

Current price: $23,780 pic.twitter.com/U5gxN3AwnT

This comes as Bitcoin hit $23,955 at 8:10 pm UTC time on Jan. 29, its highest level of the year. It has since come back down slightly, to $23,687 at the time of writing.

Meanwhile, Bitcoin sentiment is currently sitting firmly in the “Greed” zone with a score of 61, its highest level since the height of the bull run around Nov. 16, 2021, when its price was about $65,000.

However, despite Bitcoin’s strong resurgence in recent weeks, market participants continue to debate whether the recent price surge is part of a bull trap or whether there is a real chance for a bull run.

Regardless, the current rally has pushed a lot more BTC holders back into the green.

According to data from blockchain intelligence platform IntoTheBlock, 64% of Bitcoin investors are now in profit.

Those who first bought BTC back in 2019 are now — on average — back in profit too, according to on-chain analytics platform Glassnode.

We can calculate the average acquisition price for #Bitcoin by tracking exchange withdrawals.

— glassnode (@glassnode) January 29, 2023

The chart below shows the average withdrawal price for investors for each year.

The average class of 2019+ $BTC is now back in profit (at $21.8k)

Live Chart: https://t.co/yuhvydV70c pic.twitter.com/skjrM6w5lH

The average first-time buy price for BTC investors in 2019 was $21,800, which means those investors are on average up about 9% at the Jan. 29 price of $23,687.

Related: Bitcoin eyes $25K as BTC price nears best weekly close in 5 months

Meanwhile, a Jan. 29 poll from crypto market platform CoinGecko has revealed that 57.7% of 3,725 voters believe BTC will exceed $25,000 this week, while only 21.2% of voters believe BTC is primed for a pullback below $22,000.

The founder and CEO of Vailshire Capital, Dr. Jeff Ross, also provided a technical analysis of his own on Jan. 29, suggesting that a price surge toward $25,000 in the short term may be on the cards:

The strength of #bitcoin on the 4-hour charts continues to be impressive.

— Dr. Jeff Ross (@VailshireCap) January 29, 2023

While price action has trended sideways for over a week, short term indicators (MACD, RSI) have once again reset... and are now ramping higher.

A price surge to ~$25k is probable.

(Not investment advice) pic.twitter.com/QaPbNrxtxZ

Other analysts have called for excited investors to taper some of their expectations, however.

Head analyst Joe Burnett of Bitcoin mining company Blockware told his 43,900 Twitter followers on Jan. 29 that BTC won’t reach and surpass its all-time high of $69,000 until after the next Bitcoin halving event, which is expected to take place in March 2024:

I do not think Bitcoin will make a new all time high until after the 2024 halving.

— Joe Burnett ()³ (@IIICapital) January 29, 2023

Dovish macro conditions and decreased miner sell pressure will lead to the next parabolic bull run.

Using Energy Gravity as a potential top indicator, I expect the next peak to be $150k - $350k. pic.twitter.com/OfCER7s8Zq

Macroeconomist and investment adviser Lyn Alden also recently told Cointelegraph that there may be “considerable danger ahead” with potentially risky liquidity conditions expected to shake the market in the second half of 2023.

On Jan. 21, 2023, the price of bitcoin reached a 24-hour high of $23,333 per unit at 5 a.m. Eastern Time on Saturday. The entire crypto-economy is now valued at $1.05 trillion after rising 7.2% against the U.S. dollar. Bitcoin’s price rise has led to the crypto asset’s dominance level surpassing the 40% region among […]

On Jan. 21, 2023, the price of bitcoin reached a 24-hour high of $23,333 per unit at 5 a.m. Eastern Time on Saturday. The entire crypto-economy is now valued at $1.05 trillion after rising 7.2% against the U.S. dollar. Bitcoin’s price rise has led to the crypto asset’s dominance level surpassing the 40% region among […]