On Feb. 24, 2023, bitcoin’s price remained above the $23,000 threshold and then rose to a peak of $23,829 per unit on March 1. On March 2 at 8 p.m. Eastern Time, the price of bitcoin fell, dropping below the $23,000 mark. This decline resulted in a significant $237.97 million worth of long liquidations on […]

On Feb. 24, 2023, bitcoin’s price remained above the $23,000 threshold and then rose to a peak of $23,829 per unit on March 1. On March 2 at 8 p.m. Eastern Time, the price of bitcoin fell, dropping below the $23,000 mark. This decline resulted in a significant $237.97 million worth of long liquidations on […] Major crypto exchanges have failed to prevent sanctioned Russian banks and traders from transacting, according to a blockchain forensics report. At least two established coin trading platforms continue to allow Russians to use their bank cards in peer-to-peer deals, the analysis shows. It also highlights an increased Russian interest in tether. Russian Traders Still Using […]

Major crypto exchanges have failed to prevent sanctioned Russian banks and traders from transacting, according to a blockchain forensics report. At least two established coin trading platforms continue to allow Russians to use their bank cards in peer-to-peer deals, the analysis shows. It also highlights an increased Russian interest in tether. Russian Traders Still Using […]

The cryptocurrency exchange recently cut 20% of its staff, but now it will increase personnel in Hong Kong from 50 to 200.

Cryptocurrency exchange Huobi Global is seeking a license in Hong Kong, as the Chinese special administrative region considers new licensing and regulatory moves that would allow them to serve retail customers.

The new framework, which requires crypto exchanges to register with the Hong Kong Securities and Futures Commission (SFC), would allow the exchange to expand its services to the city. Huobi also plans to open a new exchange named Huobi Hong Kong that would concentrate on institutional and high-net-worth individuals, according to a tweet thread by Justin Sun.

The SFC has recently opened the new Hong Kong licensing proposals for public comment, with the new regime to go into effect in June. News of the expected changes led to financial services providers lining up to take part in the new, expanded system in December.

Exciting news! Huobi is stoked about Hong Kong's pro-crypto policies & we're working hard to secure our crypto license there. Our aim is to be one of the first fully compliant exchanges in HK & collaborate with our Asia-Pacific users to drive digital asset growth! #Huobi #Crypto pic.twitter.com/ktZw1WE2cs

— Huobi (@HuobiGlobal) February 20, 2023

Sun said in an interview with Nikkei Asia that Huobi may increase its staff in Hong Kong from 50 to 200 this year. Sun said Hong Kong’s friendlier stance on crypto and the possibility of retail sales motivated the expansion.

Related: Huobi delists 33 tokens in one day, citing trading risk, low volume

Huobi announced a layoff of 20% of its staff in January, characterizing it as part of the company’s restructuring after Sun’s takeover in October. The exchange announced in February that it was closing down its Huobi Cloud Wallet in May, due to “strategic and product adjustments.“

According to Nikkei Asia, Huobi is also considering moving its headquarters to Hong Kong from Singapore.

Huobi is expanding services in other regions as well. It announced in January that it is launching a Visa-backed crypto-to-fiat debit card that Huobi customers residing in the European Economic Area will be able to use worldwide. That card is expected to be available in the second quarter of this year.

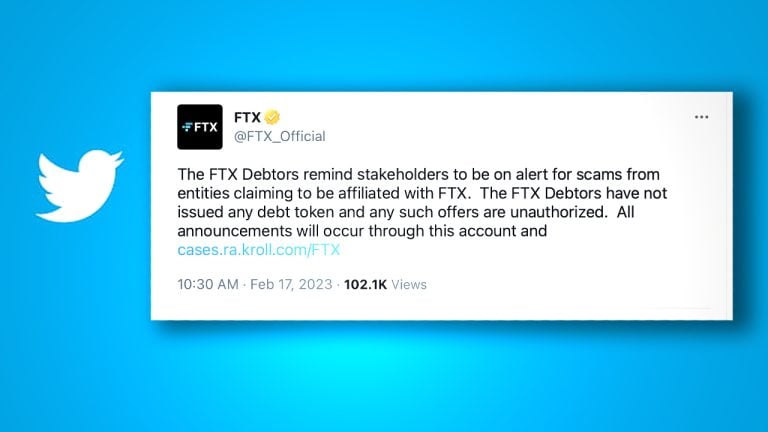

On Friday, debtors who control the official FTX Twitter account warned the community to “be on alert for scams from entities claiming to be affiliated with FTX.” They also noted that neither FTX debtors nor any entity related to the company has issued any IOU crypto assets or “debt tokens.” The alert comes as a […]

On Friday, debtors who control the official FTX Twitter account warned the community to “be on alert for scams from entities claiming to be affiliated with FTX.” They also noted that neither FTX debtors nor any entity related to the company has issued any IOU crypto assets or “debt tokens.” The alert comes as a […] Crypto exchanges Binance and Huobi have frozen cryptocurrencies worth approximately $1.4 million linked to North Korea, according to blockchain analytics firm Elliptic. The firm noted that the stolen funds, which were dormant until recently, originated from the June 2022 hack of Harmony’s Horizon Bridge. North Korea-Linked Crypto Frozen by Binance and Huobi Blockchain analytics firm […]

Crypto exchanges Binance and Huobi have frozen cryptocurrencies worth approximately $1.4 million linked to North Korea, according to blockchain analytics firm Elliptic. The firm noted that the stolen funds, which were dormant until recently, originated from the June 2022 hack of Harmony’s Horizon Bridge. North Korea-Linked Crypto Frozen by Binance and Huobi Blockchain analytics firm […]

Huobi has announced the impending closure of its Huobi Cloud Wallet service, citing strategic adjustments for the move.

Cryptocurrency exchange Huobi has announced that it will discontinue its Huobi Cloud Wallet platform in May 2023 citing ‘strategic and product adjustments’.

As per an announcement on Huobi’s support page, maintenance and upgrades of the multi-token wallet service will officially stop on Feb. 13. Users that are still using the Cloud Wallet are being encouraged to transfer cryptocurrency and nonfungible tokens (NFTs) to their main Huobi accounts or other wallet addresses.

Huobi Cloud Wallet’s withdrawal and transfer functions will work for the next three months, while users are cautioned not to transfer digital assets to their Cloud Wallet. Huobi Cloud Wallet’s official decommission date is May 13, 2023.

Related: Binance, Huobi team up to recover $2.5M from Harmony One hackers

Huobi Wallet was rebranded to iToken in May 2022 following a $200 million investment from Huobi Group. The Huobi Cloud Wallet was originally launched in October 2021 as a feature of Huobi Wallet, allowing users to manage digital assets without private keys.

The provision of a custodial wallet service was aimed to drive easier access to Decentralized Finance (DeFi) applications and services . Cloud Wallet allowed users to hold tokens without having to manage private keys, with a third-party management system keeping user private keys in escrow.

Huobi Global users were touted to enjoy seamless synchronization with the Cloud Wallet service, being able to transfer tokens between the platforms to access various DeFi projects.

Huobi also made headlines in Jan. 2023, delisting 33 different tokens that violated a number of prerequisites to maintain their listing on the exchange platform. The exchange confirmed plans at the beginning of the year to retrench 20% of its staff as part of its restructuring following Justin Sun’s takeover of the company.

Cointelegraph has reached out to Huobi to ascertain the main reasons for the discontinuation of the Huobi Cloud Wallet.

Major crypto exchanges have offered to help the people of Turkey to overcome the consequences of this week’s devastating earthquake. While the crypto industry pledged support, the country’s financial authorities allowed the raising of relief funds through cryptocurrency donations for a charity organization. Leading Exchanges Commit to Supporting the Victims of the Earthquake in Turkey […]

Major crypto exchanges have offered to help the people of Turkey to overcome the consequences of this week’s devastating earthquake. While the crypto industry pledged support, the country’s financial authorities allowed the raising of relief funds through cryptocurrency donations for a charity organization. Leading Exchanges Commit to Supporting the Victims of the Earthquake in Turkey […]

The first-ever case of crypto insider trading highlights the need for reforms from exchanges to keep track of their employee’s trade activities.

In January, the brother of a former Coinbase product manager was sentenced to 10 months in prison for wire fraud conspiracy in what prosecutors called the first case of insider trading involving cryptocurrencies. In September 2022, Nikhil Wahi entered a guilty plea for executing trades based on private data obtained from his brother, Ishan Wahi, a former product manager for Coinbase.

Most countries have laws against insider trading, which carry stiff penalties like jail time and heavy fines. The recent insider trading investigation against crypto exchanges by the United States Securities and Exchange Commission indicates that regulatory bodies are prepared to stop financial misconduct in crypto marketplaces.

Without clear regulation, many have questioned whether other exchanges and platforms have similar rogue employees participating in illegal trades.

Prosecutors raised a similar case against an OpenSea executive in a lawsuit filed in October 2022, with concerns growing in the wake of the FTX collapse and the alleged misconduct of its executives.

Binance listings-related token dumps became a hot topic weeks after the first insider trading conviction. Conor Grogan, a director of Coinbase, used Twitter to draw attention to the recent transaction activities of a few anonymous wallets. The unidentified wallets allegedly purchased several unlisted tokens minutes before Binance announced their listing and sold them as soon as the announcement was made public.

These wallets have made hundreds of thousands of dollars off price spikes in new tokens listed on Binance. The trade’s accuracy suggests that the wallet owners have access to intimate knowledge about these listings. According to Grogan, this could potentially be the work of a “rogue employee related to the listings team who would have information on fresh asset announcements or a trader who discovered some sort of API or staging/test trade exchange leak.”

Binance recently announced a 90-day token sale policy for employees and family members to fight insider trading. The policy prohibits the sale of any newly listed token on the exchange within the mentioned time frame. A spokesperson for the crypto exchange told Cointelegraph that it has a zero-tolerance policy for any employees using insider information for profit and adheres to a strict ethical code related to any behavior that could harm customers or the industry.

“At Binance, we have the industry’s leading cybersecurity and digital investigations team composed of more than 120 former law enforcement agents and security and intelligence experts who investigate both external and internal wrongful behavior. There is a long-standing process in place, including internal systems, that our security team follows to investigate and hold those accountable who have engaged in this type of behavior,” the spokesperson said.

The blockchain is a public, immutable database that stores all transaction histories for cryptocurrencies. While digital wallets conceal traders’ real identities, the blockchains’ openness and transparency enable researchers to access precise transaction data to examine crime and misbehavior.

Ruadhan O, the lead developer at token system Seasonal Tokens, told Cointelegraph that insider trading in crypto doesn’t happen in the same way it happens in the stock market. In the case of stocks, insiders are those with non-public knowledge of upcoming news about the company that will affect its performance.

Recent: Tax strategies allow crypto investors to offset losses

He added that these people are company employees, legislators and policymakers. In the case of cryptocurrencies, the people running the exchanges have the opportunity to front-run large trades and manipulate the market. In both cases, insider trading defrauds honest investors in a way that’s very difficult to detect. He explained how exchanges could work with existing policies to ensure fair price discovery:

“The United States could enforce strict regulations requiring incoming cryptocurrency orders to be processed by a public order-matching system, which would prevent front-running. This would help to create a safe system for cryptocurrency investors within the U.S., but it would also drive most cryptocurrency trading offshore. Fully stopping insider trading at the largest exchanges would require international coordination, and competing governments are unlikely to agree on measures that would harm their domestic economies.”

According to a study by Columbia Law School, a group of four linked wallets frequently bought cryptocurrency hours before formal listing announcements, which resulted in gains of $1.5 million. Before the formal listing announcement, the identified wallets bought the impacted tokens and stopped trading as soon as they sold their positions. The study found these digital wallets’ trade history to be precise, suggesting the owners had access to private information about cryptocurrencies scheduled for listing on exchanges.

The study found that 10–25% of the cryptocurrencies listed in the sample involved insider trading on listing announcements.

According to the study, cryptocurrency markets have a severe insider trading problem that is worse than traditional stock markets. Statistical data also demonstrates notable anomalous returns and run-up patterns before listing announcements. These trading patterns are comparable to those documented in insider trading cases in a stock market.

Jeremy Epstein, chief marketing officer at layer-1 protocol Radix, told Cointelegraph that a crypto exchange is no different than a traditional financial services company that deals in markets and should be regulated similarly. He explained:

“What this latest scandal highlights, again, is how superior a decentralized financial system, with transparency to all, will be for consumers and market participants who will need to worry far less about being fleeced by insiders. Insider trading won’t go away, but it will be easier and faster to spot, thus saving millions of dollars for the victims.”

Insider trading is a well-known phenomenon in traditional financial markets where someone carries out illegal trading to their advantage through access to confidential information. The insider trading frenzy in traditional markets is not often limited to former employees of a particular exchange. Many sitting politicians and policymakers have been found to be involved in such acts. According to a New York Times study, at least 97 current members of Congress made purchases or sales of stocks, bonds, or other financial assets related to their employment as lawmakers or disclosed similar activities taken by their spouses or dependent children.

Another prominent case was the 2020 congressional insider trading scandal, in which senators broke the STOCK Act by selling stocks at the start of the COVID-19 epidemic using information obtained from a private Senate meeting. On March 30, 2020, the Department of Justice opened an investigation into the stock transactions. All inquiries are now closed, and no one was ever charged.

This high-profile case of insider trading in traditional markets highlights that, despite all the measures and regulations in place, the same policymakers tasked with safeguarding investors’ interests were allegedly involved in the same activities.

Regulations alone cannot fix some of the inherent critical issues. Paolo Ardoino, the chief technical officer at Bitfinex, believes crypto shouldn’t be targeted for it.

Recent: Bitcoin’s big month: Did US institutions prevail over Asian retail traders?

Ardoino told Cointelegraph that there would be opportunities for abuse in a young industry such as crypto until there are clear rules and guidelines to protect against such abuse. He said that there must be safeguards against asymmetric information flow so that there is true price discovery. He explained:

“I believe that crypto exchanges and policymakers should work together to create a regulatory framework that will allow the industry to thrive while protecting all participants against market abuses. As a cryptocurrency exchange which is at the forefront of technological innovation in terms of digital token trading, Bitfinex’s primary aim has always been to provide an environment that is safe for traders and transparent. We will continue with that ethos.”

With calls for regulations growing after the FTX collapse, crypto exchanges are taking extra precautions to track and ensure fair trading and better protect their customers.

Prominent crypto exchange platform Huobi has listed a new altcoin project backed by the debt of FTX users, according to a new company announcement. Huobi says it is supporting the token FTX Users’ Debt (FUD) with the approval of Justin Sun, a high-ranking advisor to the exchange and the founder of Tron (TRX). Crypto exchange […]

The post Crypto Exchange Huobi Lists New ‘FUD’ Token Backed by FTX Users’ Debt With Approval From Justin Sun appeared first on The Daily Hodl.

Protocol Labs CEO Juan Benet published a blog post on Friday announcing that 21% of the company’s staff will be laid off. Protocol Labs is the creator of the blockchain network Filecoin. Benet emphasized in the blog post that it has been an “extremely challenging economic downturn, worldwide, and especially in the crypto industry.” Protocol […]

Protocol Labs CEO Juan Benet published a blog post on Friday announcing that 21% of the company’s staff will be laid off. Protocol Labs is the creator of the blockchain network Filecoin. Benet emphasized in the blog post that it has been an “extremely challenging economic downturn, worldwide, and especially in the crypto industry.” Protocol […]