The most recent Bank of America Fund Manager Survey shows that about three out of four professional investors think that bitcoin is a bubble. The fund managers also rated bitcoin second on the list of the most crowded trades. Recently, investment bank JPMorgan also warned that cryptocurrency as a sector is in a bubble. Bank […]

The most recent Bank of America Fund Manager Survey shows that about three out of four professional investors think that bitcoin is a bubble. The fund managers also rated bitcoin second on the list of the most crowded trades. Recently, investment bank JPMorgan also warned that cryptocurrency as a sector is in a bubble. Bank […]

Forbes’ “2021 Blockchain 50 Symposium: Crypto Goes Corporate” event sheds light on Bitcoin’s role as an investment tool, along with the future of stablecoins.

If 2021 has taught us anything about digital currencies, it’s that big banks and major payments providers are now feeling more comfortable with Bitcoin (BTC). While the CEO of PayPal and other large corporations are expressing excitement for crypto payments and salaries paid in Bitcoin, executives from Visa, JPMorgan and ING all agree that Bitcoin is still an investment vehicle rather than a currency.

This notion was revealed during a panel discussion entitled “Buying with Bitcoin,” which took place during Forbes’ “2021 Blockchain 50 Symposium: Crypto Goes Corporate” online event. Michael del Castillo, associate editor at Forbes, led the discussion and was joined by Umar Farooq, CEO of JPMorgan’s blockchain unit Onyx; Mariana Gomez de la Villa, program director for distributed ledger technology at ING; and Cuy Sheffield, vice president and head of crypto at Visa.

When panelists were asked whether or not anything has changed for Bitcoin payments since 2014, all three executives noted that the primary use case for Bitcoin is still as a store of value. Farooq pointed out that accessibility is the only major change Bitcoin payments have undergone since 2014:

“Square and PayPal, for instance, are enabling easier ways to utilize Bitcoin. Although, I think Bitcoin payments remain more as a marketing play for many large companies.”

While Farooq mentioned that consumers can certainly pay for items using Bitcoin, the volatility creates a major challenge. He further pointed out that tax implications create even more complications when it comes to crypto payments.

Sheffield noted that Visa is seeing growing demand from customers wanting to access Bitcoin, yet many still view the digital currency as more of a “savings account.” As such, Sheffield explained that Visa is currently focused on “stacking sats,” or allowing customers to acquire small units of Bitcoin overtime. “Companies like Fold are enabling customers to spend fiat and then earn Bitcoin back.This has been our primary motivation,” he remarked.

Echoing Farooq and Sheffield, Gomez de la Villa noted that Bitcoin remains an investment, primarily due to challenges such as ongoing high transaction fees. “I don’t think Bitcoin as a means of payment will be widely used right now,” she said.

Given the sentiment expressed by all three panelists regarding Bitcoin payments, it shouldn’t come as a surprise that Farooq mentioned that JPM Coin — JPMorgan’s digital currency offering that was announced in 2019 — is not a cryptocurrency.

Rather, Farooq explained that JPM Coin was created specifically to meet the needs of JPMorgan’s Fortune 500 and Fortune 1000 corporate clients. “Our clients want access to programmable money, conditional payments and future capabilities. But they don’t care as much about being on a fully decentralized, public network with autonomy,” he said.

Farooq noted that JPM Coin provides corporations with the future capabilities of payments but acts more like a digitalized M1, or the money supply typically issued by banks. He said:

“It’s our point of view that corporations can come and interact on the platform to perform decentralized transactions across the broader ecosystem, allowing them access to programmable money. JPM Coin is not a pure cryptocurrency because, in my mind, a pure cryptocurrency is something with independent value on a public blockchain, like Bitcoin or Ether.”

In addition to JPM Coin, Farooq discussed the reasons behind the recent $65-million investment round in ConsenSys, which was led by major financial institutions including JPMorgan. According to the software company ConsenSys, the new funding will help expand its enterprise blockchain infrastructure solutions to enable more decentralized finance and Web 3.0 applications on Ethereum. Given this announcement, del Castillo asked Farooq if JPM Coin is a competitor to Ether (ETH).

According to Farooq, JPM Coin is not competing with Ether, noting that JPM Coin specifically caters to JPMorgan’s clients and not to retail investors. Farooq also mentioned that although JPMorgan built the Quorum platform on Ethereum, which has now become ConsenSys Quorum, the idea has been for those two platforms to merge to allow for JPMorgan’s blockchain solution to be built on the network that ConsenSys runs on. “We have a great relationship with ConsenSys and will continue to collaborate on the core technology with them,” Farooq said.

When asked about the future of stablecoins, all three panelists agreed that stablecoins could be a useful tool for cross-border transactions, along with a solution that will enable fintechs and startups to build financial products upon.

Stablecoins have been of particular interest to Visa, as the major credit card provider recently announced a pilot program that will allow its partners to leverage the Ethereum blockchain to settle fiat transactions. According to an announcement from Visa, the company will be partnering with the crypto exchange and card issuer Crypto.com to provide a crypto settlement platform for fiat transactions later this year. This will enable Visa’s partners to exchange the stablecoin USD Coin (USDC) over Visa’s payment network to clear fiat transactions.

Sheffield noted that Visa has been following the stablecoin ecosystem closely over the past few years, with a special focus on USD Coin:

“We’ve been impressed and excited to see USD Coin and a developer ecosystem emerge around it. There is also an increasing number of fintech and crypto companies actually building their businesses on top of USDC.”

Sheffield mentioned that USD Coin is becoming a “crypto-native dollar-based treasury infrastructure,” noting that work is being done to ensure Visa acts as the bridge between USD Coin payments and innovative crypto companies.

In regards to cross-border transactions, Sheffield pointed out that stablecoins will enable new digital wallet products, followed by more efficient cross-border business-to-business payments leveraged by non-crypto companies. Echoing Sheffield, Farooq noted that stablecoins will help on the cross-border front but pointed out that regulations must first be in place:

“In the short term, stablecoins will act like money in your Apple Wallet — they will be used within closed ecosystems to create and generate value. But the long term depends on regulators becoming comfortable with cross-border payments at scale.”

ConsenSys is using the funds to expand its enterprise blockchain solutions centered around DeFi and Web 3.0.

ConsenSys, a prominent blockchain software company, has raised $65 million in strategic investments from major financial institutions including JPMorgan Chase, Mastercard and UBS, offering yet another sign that traditional finance is entering the crypto space.

The investment round will aid ConsenSys in expanding its enterprise blockchain infrastructure solutions to enable more decentralized finance and Web 3.0 applications on Ethereum, the company announced Tuesday. After a year of significant growth, ConsenSys is now focusing on accelerating mainstream adoption of Web 3.0, which is considered to be the next phase of the internet’s evolution.

In addition to the major finance players, blockchain-focused firms like Protocol Labs, Maker Foundation and Alameda Research also contributed to the raise.

Joseph Lubin, founder of ConsenSys and co-founder of Ethereum, said the funding round highlighted the growing number of “revolutionaries” getting behind blockchain technology. He continued:

“ConsenSys’ software stack represents access to a new automated objective trust foundation enabled by decentralized protocols like Ethereum.”

UBS’ Mike Dargan, who heads the firm’s group technology division, said adding ConsenSys to the portfolio “underscores our commitment to working with fintechs and the broader tech ecosystem to shape the future of banking for the benefits of our clients.”

Raj Dhamadharan, executive vice president of digital asset and blockchain products at Mastercard, called Enterprise Ethereum “a key infrastructure on which we and our partners our building payment and non-payment applications.” He also commented on Mastercard’s support of central banks as they explore the utility of central bank digital currencies, or CBDCs:

We are delivering on our multi-rail strategy focusing on digital currencies including our work supporting central banks as they explore CBDCs. Our investment and partnership with ConsenSys helps us bring secure and performant Enterprise Ethereum capabilities to our customers whom we believe will benefit from a robust, open source Ethereum community to create relevant and scalable solutions.”

ConsenSys has made numerous headlines of late due to its expanding suite of products and major partnerships. As Cointelegraph recently reported, ConsenSys is developing Palm, a new layer-two nonfungible token platform, to compete with Flow, a leading NFT blockchain.

The firm’s core software stack has also witnessed exponential demand, with its Ethereum wallet and MetaMask browser garnering over 3 million monthly active users. Roughly 4.5 million developers are using ConsenSys’ Truffle software suite, and more than 150,000 are building blockchain-based apps on Infura.

Following a month-long consolidation period, the buying pressure behind Bitcoin is finally being reflected on prices. The flagship cryptocurrency has broken through a crucial resistance level, threatening to rise toward $70,000.

According to Bloomberg, Tesla’s decision to allocate some of its wealth into BTC served as an “inflection point” that has encouraged many institutions to follow suit. The narrative around cryptos has shifted toward “the risks of missing out on the potential for Bitcoin becoming the global benchmark digital asset.”

Demand for Bitcoin has risen to an all-time high given these chances. From China to the U.S., institutions are rushing to get a piece of the pioneer cryptocurrency.

Over the past week alone, Chinese technology company Meitu scooped up roughly 175 BTC at an aggregate value of approximately $10 million, while business analytics firm MicroStrategy raked in roughly 253 BTC at an average price of $59,339.

Along the same lines, Grayscale bought another $1 billion worth of Bitcoin and other cryptocurrencies, bringing its total assets under management to $46.10 billion.

04/09/21 UPDATE: Net Assets Under Management, Holdings per Share, and Market Price per Share for our Investment Products.

Total AUM: $46.1 billion$BTC $BCH $ETH $ETC $ZEN $LTC $XLM $ZEC $BAT $LINK $MANA $FIL $LPT pic.twitter.com/8RMLseCeQQ

— Grayscale (@Grayscale) April 9, 2021

The growth and gradual maturation of Bitcoin’s spot market are generating heightened interest in the derivatives markets.

JP Morgan maintains that the “richness of [Bitcoin] futures” is quite “acute” as the CME BTC contract offers a 25% annualized slide relative to spot. On other unrelated exchanges, it can be as high as 40%.

“Bitcoin ‘yields’ implied by futures are substantially higher than all major currencies across developed and emerging markets, and the situation is even more pronounced on offshore exchanges… Compared to the explicitly deflationary monetary policy and cross-border transferability of Bitcoin, this hardly seems a plausible substitute,” said JP Morgan.

The American investment bank maintains that the rising demand for BTC and related derivates products makes it ideal to launch a Bitcoin ETF in the U.S., which “could reduce many barriers to entry, bringing new potential demand into the asset class.”

As the buying pressure behind Bitcoin surged substantially over the past week, its price sliced through a crucial resistance level in the past 24 hours.

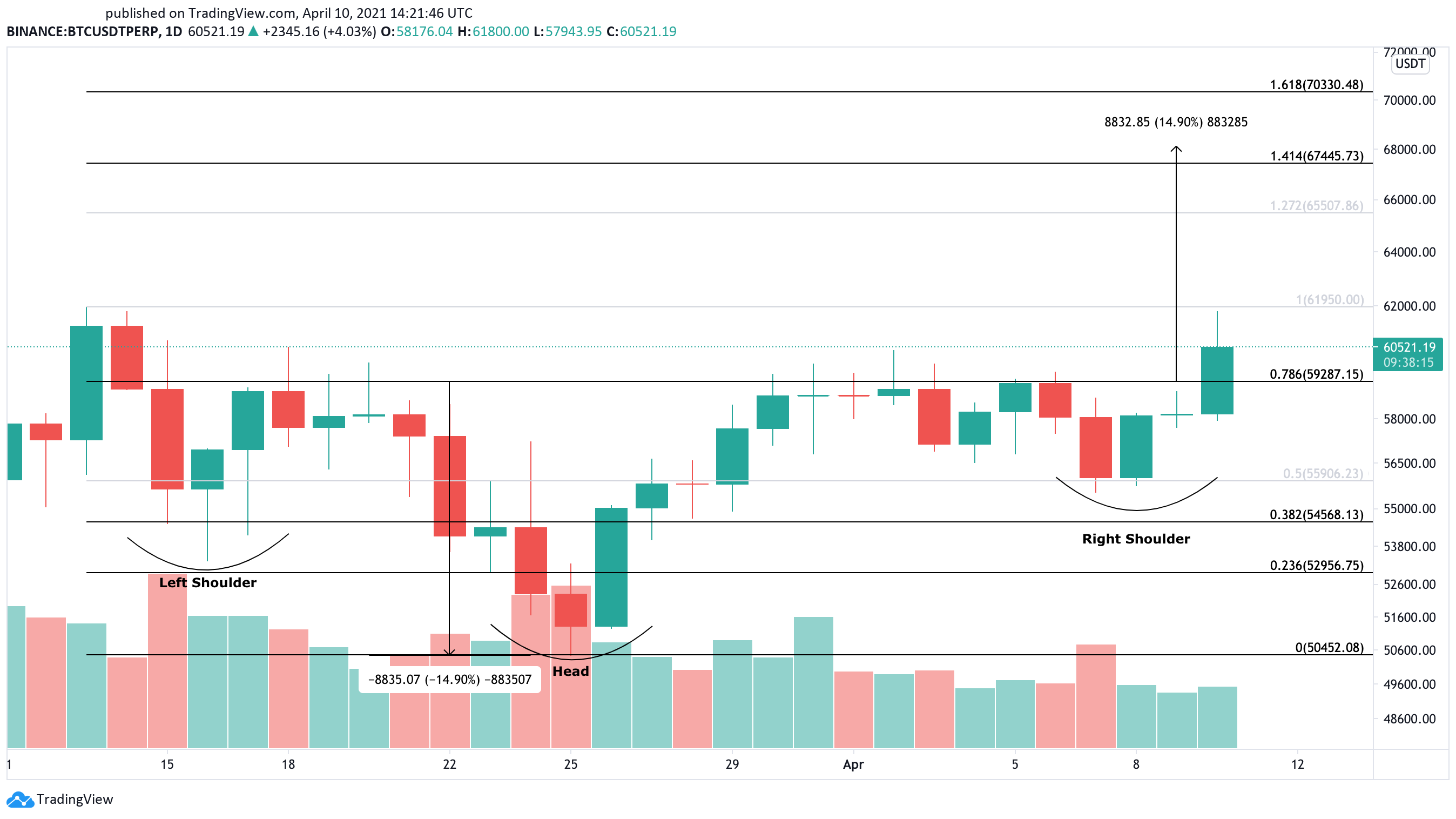

BTC has managed to break out of an inverse head-and-shoulders formation that developed over the past month on its 4-hour chart. The distance between the pattern’s neckline and head suggests that Bitcoin can rise by nearly 15% toward the 141.1% or 161.8% Fibonacci retracement level.

These critical areas of interest sit at $67,450 and $70,330, respectively.

For the optimistic outlook to be validated, Bitcoin must continue trading above the inverse head-and-shoulders’ neckline at $59,300. A sudden bearish impulse underneath this price hurdle could trigger panic among investors, causing prices to retreat to the 38.2% or 23.6% Fibonacci retracement level.

These support levels sit at $54,570 and $52,960, respectively.

Disclosure: At the time of writing, this author owned Bitcoin and Ethereum.

JPMorgan’s boss Jamie Dimon has a bone to pick with cryptocurrencies, shadow banking, and the financial technology (fintech) economy. In a letter to JPMorgan shareholders, Dimon explained that banks are “playing an increasingly smaller role in the financial system” and there’s a list of items like digital currencies he’s named that needs to be “dealt […]

JPMorgan’s boss Jamie Dimon has a bone to pick with cryptocurrencies, shadow banking, and the financial technology (fintech) economy. In a letter to JPMorgan shareholders, Dimon explained that banks are “playing an increasingly smaller role in the financial system” and there’s a list of items like digital currencies he’s named that needs to be “dealt […]

Top funds in the U.S. expect Bitcoin to hit anywhere between $130K to half a million dollars in the long term.

JPMorgan Chase expects Bitcoin (BTC) to reach $130,000, while Ark Invest anticipates the market valuation of BTC to surpass that of gold.

The optimistic macro prediction from both funds revolves around the scarcity of Bitcoin, which has buoyed its popularity as a safe-haven asset.

As Cointelegraph previously reported, the outlook of the U.S. dollar index is on the decline.

The fear of inflation and the increasing liquidity in the financial markets is causing reserve currencies, like the dollar, to depreciate.

Ark Invest, as an example, sees Bitcoin nearing $500,000 in the future, considering that the fund expects it to surpass gold by market capitalization. Currently, the market cap of Bitcoin is roughly 10% of gold.

BREAKING: Ark Invest believes #Bitcoin’s market capitalization will one day “comfortably eclipse” that of gold, and exceed $10 trillion

— Market Meditations (@MrktMeditations) April 5, 2021

The Winklevoss twins, who own over a billion dollars worth of cryptocurrencies like Bitcoin, outlined a similar thesis in the past.

In the new popular essay entitled "The Case for $500K Bitcoin," Tyler Winklevoss, co-founder of Gemini, said:

"Today, the market capitalization of above-ground gold is conservatively $9 trillion. If we are right about using a gold framework to value bitcoin, and bitcoin continues on this path, then the bull case scenario for bitcoin is that it is undervalued by a multiple of 45. Said differently, the price of bitcoin could appreciate 45x from where it is today, which means we could see a price of $500,000 U.S. dollars per bitcoin."

Meanwhile, JPMorgan has set a more conservative target at $130,000, which is more realistic as a shorter-term target for Bitcoin, as it would put BTC's valuation at around $2.73 trillion.

Holger Zschaepitz, market analyst at Welt, noted:

"JPMorgan sets $130k #Bitcoin target BUT the long-term risk-adjusted Bitcoin theoretical fair value of $130,000 would drop to between $24,000 and $30,000 based on current volatility ratios. Upside potential conditional on volatility of Bitcoin converging to that of gold. (via BBG)"

However, Zschaepitz noted that the long-term risk-adjusted price of Bitcoin could fall in the future, which is not accurately predictable because it is difficult to forecast the trend of volatility over time.

According to a pseudonymous trader known as Bitcoin Jack, the spent output profit ratio (SOPR) indicator forecasts some profit-taking could occur in the short term.

The SOPR indicator gauges how much BTC in the market is in profit and, thus, vulnerable to a sell-off. The trader said:

"Pretty much filled out all specific area of interest on the volume profile to be ready for trend confirmation Trend confirmation expected soon, otherwise I think we will reset to another corrective structure that will last >1-2 weeks aSOPR indicates little profit taking ahead."

Fellow cryptocurrency trader Scott Melker emphasized that Bitcoin has performed well against the S&P 500 and the U.S. stock market, which still makes it favorable as a store of value.

Melker wrote:

"$BTC Vs. $SPX. Most assets have 'risen' in value because the denominator is USD, which is depreciating. When you look at stocks vs. a deflationary asset, they look far less impressive."

As long as Bitcoin continues to outperform the U.S. stock market, from a risk standpoint, it would remain compelling for both retail traders and high-net-worth investors in the near to medium term.

JP Morgan says that bitcoin’s volatility has decreased in recent weeks, making the cryptocurrency more appealing to institutional investors. The investment bank has also revised its bitcoin price target to $130,000. Increased Institutional Adoption, New Price Prediction for Bitcoin JPMorgan said last week that bitcoin’s price volatility has been declining in recent weeks, noting that […]

JP Morgan says that bitcoin’s volatility has decreased in recent weeks, making the cryptocurrency more appealing to institutional investors. The investment bank has also revised its bitcoin price target to $130,000. Increased Institutional Adoption, New Price Prediction for Bitcoin JPMorgan said last week that bitcoin’s price volatility has been declining in recent weeks, noting that […]

Naver is reportedly looking to strengthen its position in the crypto industry with a potential equity stake in South Korea’s largest crypto exchange.

Major South Korean internet company Naver has reportedly begun negotiations to acquire a stake in the country’s largest cryptocurrency exchange, Bithumb.

Naver has discussed a potential equity stake acquisition with major Bithumb stakeholder Vidente, local publication the Maeil Business Newspaper reported Monday, citing several unnamed sources.

Naver is the provider of South Korea’s largest search engine and Line messenger, and is reportedly seeking to expand its platform’s presence in the country’s fintech market. The internet giant is reportedly planning to add Bitcoin (BTC) as a payment option on its payment services Naver Pay as well as Line Pay in Japan and the United States.

As reported, there are at least 10 firms seeking a stake in Bithumb including major U.S. investment banks like Morgan Stanley and JPMorgan, payment giant Visa, as well as the world’s largest crypto exchange, Binance. According to a report by The Korea Times, Deutsche Bank is also among potential investors.

Bithumb has been the subject of multiple reports and rumors regarding a potential acquisition deal over the past several years. The South Korean crypto giant has reportedly been negotiating the sale with foreign companies since at least 2019, following alleged difficulties with payments in Bithumb’s previous acquisition deals. Gaming conglomerate Nexon denied reports that it was acquiring a stake in the exchange.

Naver did not immediately respond to Cointelegraph’s request for comment.