Malaysia’s communications ministry has proposed legalizing non-fungible tokens (NFTs) to increase the participation of young people in the cryptocurrency space. The crypto sector is under the purview of the central bank, Bank Negara Malaysia, and the Securities Commission. Malaysian Ministry Wants NFTs Legalized Malaysia’s Ministry of Communications and Multimedia has proposed legalizing non-fungible tokens (NFTs) […]

Malaysia’s communications ministry has proposed legalizing non-fungible tokens (NFTs) to increase the participation of young people in the cryptocurrency space. The crypto sector is under the purview of the central bank, Bank Negara Malaysia, and the Securities Commission. Malaysian Ministry Wants NFTs Legalized Malaysia’s Ministry of Communications and Multimedia has proposed legalizing non-fungible tokens (NFTs) […]

Malaysia’s finance minister previously warned that crypto payments were illegal as they did not meet the universal characteristics of money.

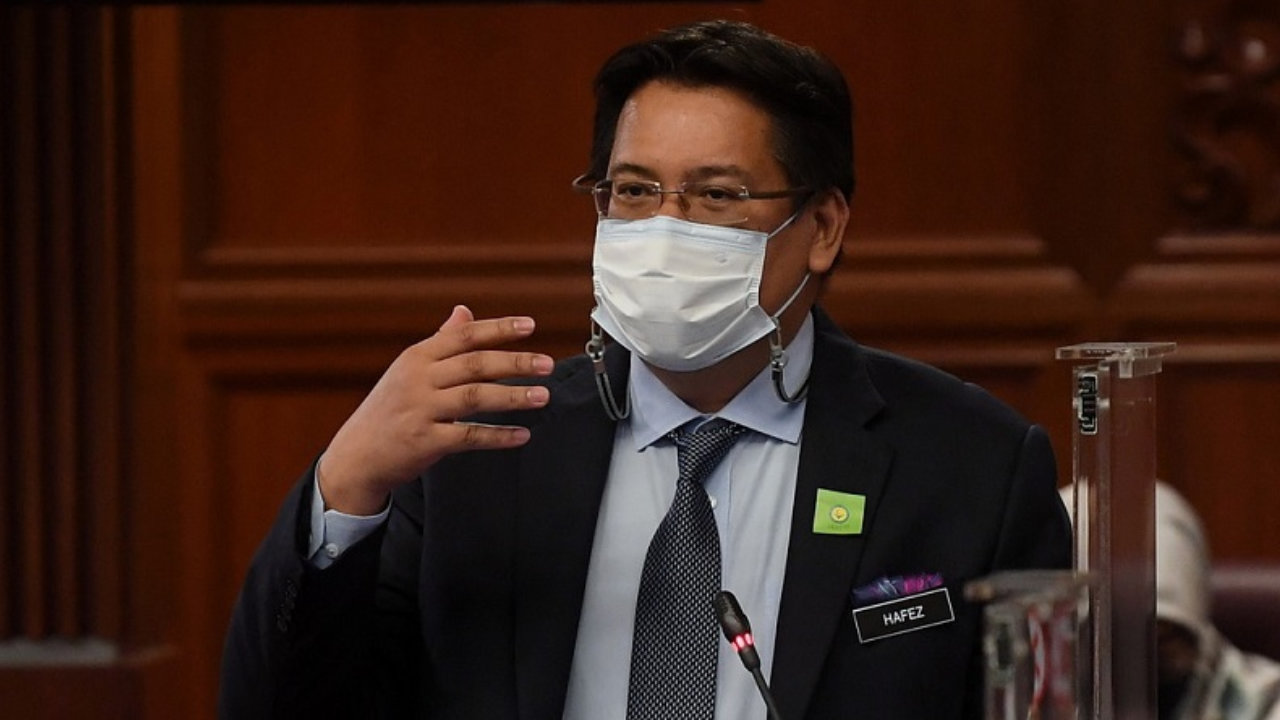

The Malaysian Ministry of Communications and Multimedia (KKMM) is reportedly backing the adoption of cryptocurrencies, with the deputy minister calling the government to legalize crypto.

Deputy communications and multimedia minister Datuk Zahidi Zainul Abidin has urged Malaysia’s regulators to legalize certain use cases of cryptocurrencies and nonfungible tokens (NFT), local news agency Harian Metro reported on Monday.

Zahidi pointed out that such measures would significantly support young people as the cryptocurrency industry has been growing increasingly popular among the younger generation. He also said that the KKMM is exploring ways to increase the participation of young people in the industry.

The deputy minister noted that the decision on crypto regulation is up to Malaysia’s financial regulators, including the central bank and the Securities Commission Malaysia.

However, the ministry is willing to bring this issue up because the crypto industry is the “business and financial program of the future, especially for young people now,” Zahidi said, adding:

“We hope the government can try to legalize this matter so that we can expand the participation of young people in cryptocurrencies and help them in terms of energy consumption and so on.”

According to some sources, Zahidi proposed not just legalizing certain cryptocurrency transactions in Malaysia but rather adopting cryptocurrency as legal tender.

The KKMM officials did not immediately respond to Cointelegraph’s request for comment. This article will be updated pending new information.

Comms Ministry in Malaysia proposes adopting cryptocurrency as legal tender "to help the younger generation who are active users of the currency, especially on non-fungible token (NFT) trading platforms"https://t.co/m4vXcsfMRr

— Zhu Su (@zhusu) March 21, 2022

In early March, Malaysia’s finance minister Tengku Datuk Seri Zafrul Tengku Abdul Aziz reiterated that payments in cryptocurrencies like Bitcoin (BTC) and Ether (ETH) were illegal in the country as cryptocurrencies did not meet the universal characteristics of money.

Related: Binance back in Malaysia via a strategic stake in regulated digital exchange

“In general, digital assets are not a good store of value and a medium of exchange. This is due to the fact that digital assets are vulnerable to volatile price fluctuations due to speculative investments, the risk of theft due to cyber threats and lack of scalability,” he said.

The minister added that Bank Negara Malaysia was working on potentially introducing a central bank digital currency and blockchain-related developments to respond to the growing trend in the digital asset industry.

Malaysia’s deputy finance minister says that cryptocurrencies, such as bitcoin and ethereum, are not suitable as a means of payment or a store of value. While digital assets are not recognized as legal tender in Malaysia, the finance ministry official said that they are an asset class that can be invested in. Deputy Finance Minister […]

Malaysia’s deputy finance minister says that cryptocurrencies, such as bitcoin and ethereum, are not suitable as a means of payment or a store of value. While digital assets are not recognized as legal tender in Malaysia, the finance ministry official said that they are an asset class that can be invested in. Deputy Finance Minister […]

Binance has forged an array of new partnerships with regulated firms, especially in countries where it has found it difficult to get regulatory approval.

Binance, the world’s leading crypto exchange by trading volume is returning to the Malaysian markets with a strategic stake in the country’s regulated digital asset trading platfrom MX Global.

Binance and Cuscapi Berhad acquired a key stake in MX Global, one of the four Recognized Market Operators - Digital Asset Exchange licensed by the Securities Commission (SC) in Malaysia.

Hello Malaysia. https://t.co/vsHzHlm7KI

— CZ Binance (@cz_binance) March 1, 2022

The leading crypto exchange has a significant presence in the Asian region and with its new partnership in Malaysia, the exchange aims to expand the sustainable growth of the crypto market in the Southeast Asia region. MX Global, on the other hand, aims to bank on the recent partnership and new flow of capital to expand its market and become a leading liquidity hub in the region.

Binance’s recent slew of partnerships also reflects a pattern of sorts, especially in regions where the exchange has found it difficult to mitigate regulatory compliance requirements independently. The crypto exchange has restricted its services in Malaysia back in July 2021 after an order from the SC over non-compliance with the regulatory laws.

Related: Binance exec to lead crypto expert center by Russian bank association

In Singapore, the crypto exchange withdrew its crypto license application just a week after announcing an 18% stake in the private stock exchange. The crypto exchange also managed to access the United Kingdom’s sterling payment network through its partnership with PaySafe, after getting barred by the country’s regulator in 2021.

The crypto exchange undertook a similar strategy in Thailand as well, where the exchange had to shut its operation in July 2021, but made a re-entry in the Thai market with its partnership with the country’s Gulf Energy Development PCL in January 2022.

In 2021, Binance faced regulatory warnings and service restrictions from over a dozen countries. However, the exchange managed to mend its regulatory relationship in several of these nations through third-party partnerships.

Police in Malaysia have shut down a bitcoin mining operation and seized 1,720 bitcoin mining machines in a major electricity theft crackdown following public complaints. “Police inspected 75 premises around the district and 30 of them were found to be carrying out illegal bitcoin mining activities and stealing electricity.” Malaysian Authorities Shut Down Bitcoin Mining […]

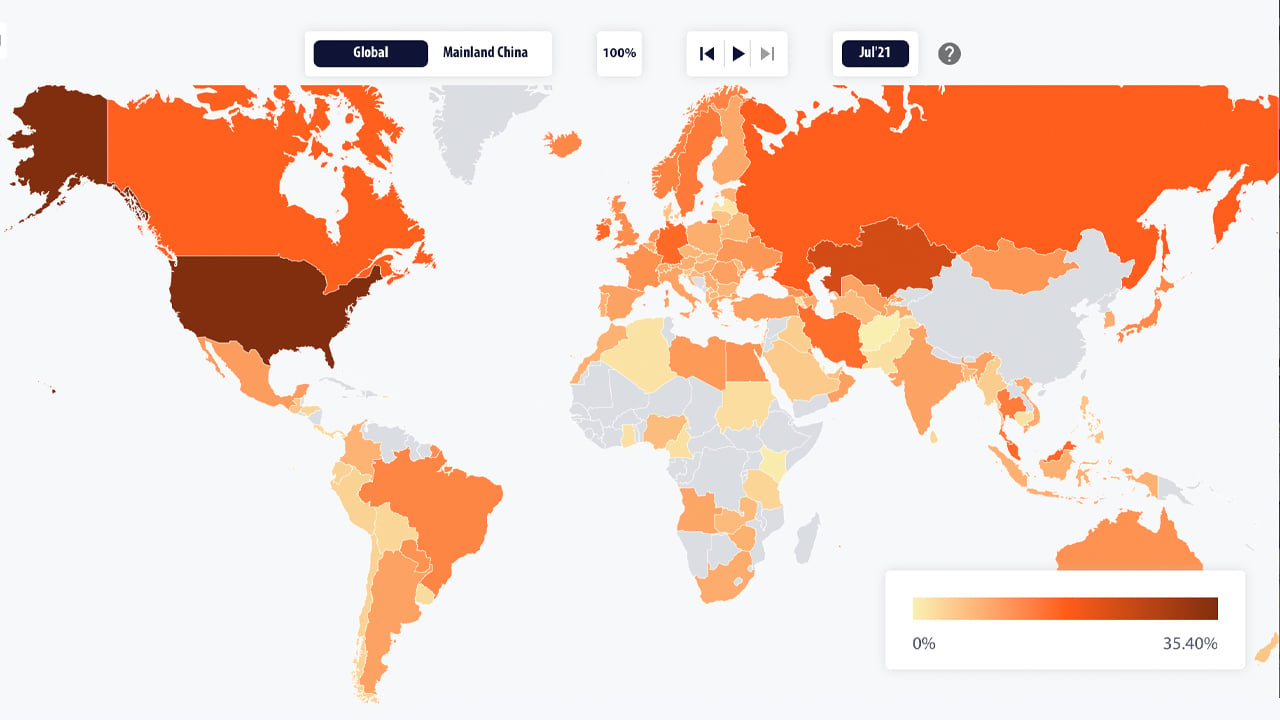

Police in Malaysia have shut down a bitcoin mining operation and seized 1,720 bitcoin mining machines in a major electricity theft crackdown following public complaints. “Police inspected 75 premises around the district and 30 of them were found to be carrying out illegal bitcoin mining activities and stealing electricity.” Malaysian Authorities Shut Down Bitcoin Mining […] After China has reigned for a number of consecutive years as the dominant bitcoin mining epicenter of the world, the United States has “taken the leading position in bitcoin mining,” according to new data from Cambridge University. Data Shows US, Kazakhstan, Russian Federation Rule the Bitcoin Mining Roost In mid-July, researchers from the Cambridge Bitcoin […]

After China has reigned for a number of consecutive years as the dominant bitcoin mining epicenter of the world, the United States has “taken the leading position in bitcoin mining,” according to new data from Cambridge University. Data Shows US, Kazakhstan, Russian Federation Rule the Bitcoin Mining Roost In mid-July, researchers from the Cambridge Bitcoin […] The central banks of Australia, Singapore, Malaysia, and the Republic of South Africa have set out to test the use of state-issued digital currencies in cross-border payments. The trial, led by the Bank for International Settlements, aims to establish whether they can simplify transactions and make them cheaper. Reserve Bank of Australia Teams Up With […]

The central banks of Australia, Singapore, Malaysia, and the Republic of South Africa have set out to test the use of state-issued digital currencies in cross-border payments. The trial, led by the Bank for International Settlements, aims to establish whether they can simplify transactions and make them cheaper. Reserve Bank of Australia Teams Up With […]

The joint initiative will prototype shared DLT platforms enabling institutions to settle cross-border transactions using central bank-issued digital currencies.

The central banks of Australia, Singapore, Malaysia and South Africa have announced a joint initiative to trial international settlements using central bank digital currencies (CBDCs).

The initiative, dubbed Project Dunbar, will prototype shared platforms enabling direct transfers between institutions using digital currencies issued by multiple central banks. The pilot’s findings will be used to inform the “development of global and regional platforms” in addition to supporting the G20’s roadmap for improving cross-border payments.

Project Dunbar will be carried out in partnership with the Bank for International Settlements (BIS) Innovation Hub from its Singapore Center. The project will engage multiple partners to develop different DLT platforms and explore different designs that would enable central banks to share CBDC infrastructure.

A joint announcement emphasizes the efficiency savings associated with distributed ledger technology (DLT)-based payments, stating:

“These multi-CBDC platforms will allow financial institutions to transact directly with each other in the digital currencies issued by participating central banks, eliminating the need for intermediaries and cutting the time and cost of transactions.”

Assistant Governor of the Reserve Bank of Australia (RBA) Michele Bullock highlighted that “enhancing cross-border payments has become a priority for the international regulatory community,” adding that the RBA is “very focused” on the matter in its domestic policy work.

“Project Dunbar brings together central banks with years of experience and unique perspectives in CBDC projects and ecosystem partners at advanced stages of technical development on digital currencies,” said Andre McCormack, the head of the BIS Innovation Hub Singapore Centre. He added:

“With this group of capable and passionate partners, we are confident that our work on multi-CBDCs for international settlements will break new ground in this next stage of CBDC experimentation and lay the foundation for global payments connectivity.”

The RBA has consistently downplayed the need for a domestic CBDC however, citing the success of the New Payments Platform, which allows instant digital transfers 24-hours a day.

Related: India CBDC pilot may commence in December, says RBI governor

Project Dunbar is expected to demonstrate technical prototypes of shared DLT platforms at the Singapore FinTech Festival in November of this year. The initiative expects to publish its complete findings in early 2022.