At block height 839,856, the Bitcoin blockchain stands a mere 144 blocks short of the forthcoming reward halving at block height 840,000. Historically, bitcoin’s price has seen substantial increases following prior halving events. However, there are speculations that this occurrence might not follow the previous pattern. This week, the creator of the stock-to-flow (S2F) price […]

At block height 839,856, the Bitcoin blockchain stands a mere 144 blocks short of the forthcoming reward halving at block height 840,000. Historically, bitcoin’s price has seen substantial increases following prior halving events. However, there are speculations that this occurrence might not follow the previous pattern. This week, the creator of the stock-to-flow (S2F) price […] As bitcoin hovers around the $67,000 mark on March 18, 2024, there’s still widespread speculation about the potential for its price to climb even higher. The analyst Plan B continues to shed light on his well-known stock-to-flow (S2F) model, which suggests that “exponential growth” is expected to “continue.” Plan B: ‘S2F = Exponential Growth’ The […]

As bitcoin hovers around the $67,000 mark on March 18, 2024, there’s still widespread speculation about the potential for its price to climb even higher. The analyst Plan B continues to shed light on his well-known stock-to-flow (S2F) model, which suggests that “exponential growth” is expected to “continue.” Plan B: ‘S2F = Exponential Growth’ The […] As bitcoin remains close to its peak price levels, a wave of positive sentiment and enthusiastic vigor is enveloping the crypto sphere. This week, onchain analyst Willy Woo, the same market strategist who asserted in November 2023 that bitcoin will probably not fall under $30,000 again, is of the opinion that the latest surge is […]

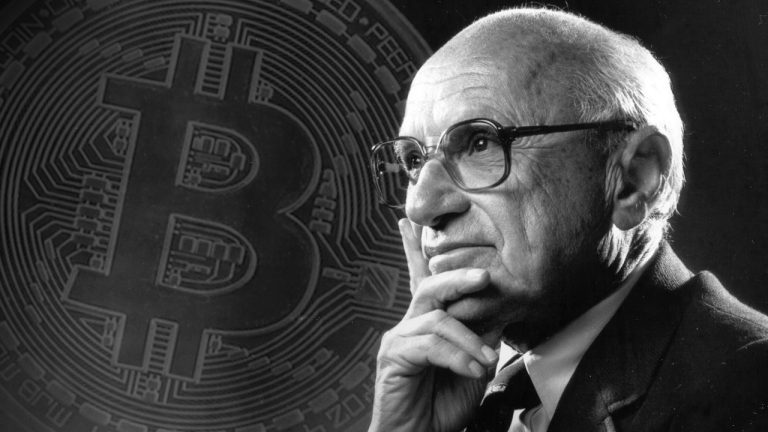

As bitcoin remains close to its peak price levels, a wave of positive sentiment and enthusiastic vigor is enveloping the crypto sphere. This week, onchain analyst Willy Woo, the same market strategist who asserted in November 2023 that bitcoin will probably not fall under $30,000 again, is of the opinion that the latest surge is […] Nearly two decades before the Bitcoin network revolutionized the digital world, Nobel Laureate Milton Friedman foresaw the emergence of digital currencies. His prediction of an electronic currency facilitating anonymous transactions has become a cornerstone in understanding the evolution of digital finance. Ahead of His Time: How Milton Friedman Envisioned Bitcoin Before the conceptualization of Satoshi […]

Nearly two decades before the Bitcoin network revolutionized the digital world, Nobel Laureate Milton Friedman foresaw the emergence of digital currencies. His prediction of an electronic currency facilitating anonymous transactions has become a cornerstone in understanding the evolution of digital finance. Ahead of His Time: How Milton Friedman Envisioned Bitcoin Before the conceptualization of Satoshi […] This week, bitcoin’s value ascended to the vicinity of $64,000, leading to a widespread belief among observers that the bullish trend has officially commenced. Speculation centers on the exact moment this upward trajectory began, given that bitcoin has appreciated by 46% since the start of the year and 139% over the previous six months in […]

This week, bitcoin’s value ascended to the vicinity of $64,000, leading to a widespread belief among observers that the bullish trend has officially commenced. Speculation centers on the exact moment this upward trajectory began, given that bitcoin has appreciated by 46% since the start of the year and 139% over the previous six months in […]

Bitcoin is likely to reach $1 million quickly due to a "torrent of money" coming from institutional investors in 2024, according to the JAN3 CEO.

Bitcoin (BTC) is likely to reach $1 million in the "days to weeks" following the approval of a spot BTC exchange-traded fund (ETF), according to JAN3 CEO Samson Mow.

“You're hitting a very limited supply of Bitcoin on the exchanges and available for purchase with a torrent of money,” Mow said, referring to the inflow of institutional capital that is expected following a potential spot ETF approval.

“This is why you can go really high all at one time,” he adds.

Next year will see Binance lose its leadership position, a U.S. recession, new stablecoin market cap highs and a new peak price for Bitcoin, according to asset manager VanEck.

Bitcoin (BTC) will hit a new all-time high in late 2024 on the backdrop of a long-feared United States recession and regulatory shifts after the next U.S. presidential election, asset manager VanEck predicts.

On Dec. 8, VanEck made 15 crypto predictions for 2024, including price forecasts, timings of a spot Bitcoin ETF launch, the impact of the Bitcoin halving, and emerging dominant crypto platforms.

Magazine: Asia Express: HTX hacked again for $30M, 100K Koreans test CBDC, Binance 2.0

The report also delves into a potential scenario where Solana becomes the first blockchain to accommodate applications with over 100 million users.

Layer-1 blockchain and Ethereum competitor Solana has seen its native SOL token surge above $32 this week, as asset management company VanEck anticipates further price gains and shares its price forecast.

In a report, VanEck outlined diverse valuation scenarios for Solana’s (SOL) price to range from a conservative $9.81 to an ambitious $3,211.28 by 2030 (in comparison, Ethereum’s target price is $11,800).

This would mark a 10,600% price surge for Solana in the coming years. The report also delves into a potential scenario where Solana becomes the first blockchain to accommodate applications with over 100 million users.

Furthermore, the report illustrates Solana’s potential to narrow the distance between itself and Ethereum in the future. VanEck has been engaged in the cryptocurrency arena for a while, having submitted Bitcoin exchange-traded fund applications to the United States Securities and Exchange Commission in recent years.

SOL has emerged as a top 10 cryptocurrency, with impressive growth exceeding 200% since the start of 2023. The total value locked in the Solana ecosystem is $378 million.

However, there might be potential for a partial pullback in the price of SOL. The daily directional movement index (DMI) indicates an increasing hold by bears on the daily chart, requiring strong action from the bulls to safeguard the gains amassed since the crypto market aligned with Bitcoin’s (BTC) rise to $35,000 in recent days.

If the bulls fail to gain the upper hand, it could lead to a drop below the $30 mark. Traders considering short positions for SOL may consider selling against the United States dollar, as suggested by the decreasing blue +DI line and the rising red -DI line.

Related: Solana Labs launches Web3 incubator offering dev and fundraising support

This pattern indicates a heightened bearish impact and the possibility of a market downturn, which could result in a 15% decrease in Solana’s price from its current valuation of $27. This aligns with a nearby support level bolstered by the 21-day Exponential Moving Average.

Magazine: 5,050 Bitcoin for $5 in 2009: Helsinki’s claim to crypto fame

After first setting its 2023-year-end BTC price target at $45,000 in early 2023, Matrixport has reiterated its bold Bitcoin prediction.

Matrixport, a cryptocurrency trading firm founded by Bitmain co-founder Wu Jihan, has doubled down on its prediction that Bitcoin (BTC) will hit $45,000 by the end of 2023.

After first setting its 2023-year-end BTC price target at $45,000 in early 2023, Matrixport reiterated its bold Bitcoin prediction in a blog post on Oct. 24.

Titled “Bitcoin Targets $45,000 — FOMO Is Hitting the Market,” the blog post provides a brief analysis of Matrixport’s previous market forecasts, noting that the firm successfully predicted several market events.

Matrixport specifically cited its “October Ignites a Bitcoin Boom: Institutions Fueling the Price Surge” report from September 2023, which has so far successfully predicted significant action on the Bitcoin market in October.

The firm predicted that October would be a strong month for Bitcoin due to excitement around potential approvals of a spot BTC exchange-traded fund (ETF). The firm also pointed out that October has historically been the strongest month for Bitcoin with average returns of 20%.

Related: Galaxy predicts 74% Bitcoin price increase first year after ETF launch

After starting October at around $27,000, Bitcoin briefly touched $35,000 on Oct. 24, hitting 17-month highs and triggering the fear of missing out among investors. At the time of writing, Bitcoin is trading at $34,396, up 27% from its price on Oct. 1, according to data from CoinGecko.

In the report, Matrixport also emphasized that Bitcoin’s breakout above July’s $31,500 shows that $45,000 is achievable by year-end, adding:

“While our prediction might have been bold, our analysis is based on a proven investment process that has been incredibly successful this year.”

Matrixport first mentioned the $45,000 Bitcoin prediction in its bullish 2023 report published in January 2023. “There is a high statistical probability that Bitcoin prices could double from here until year end. This could bring Bitcoin prices to $45,000 by Christmas 2023,” the firm wrote at the time.

Some analysts haven’t been too optimistic about Bitcoin’s price in 2023 though. In December 2022, Standard’s Chartered global research head and chief strategist predicted that Bitcoin would drop to as low as $5,000 in 2023. Bitcoin’s lowest value so far this year was about $16,600.

Magazine: Blockchain detectives — Mt. Gox collapse saw birth of Chainalysis

A Thai fortune teller once purpotedly predicted when the crypto market would recover last year, claiming they were told by the god of the dead.

Crypto and stock investors have always found interesting and sometimes bizarre ways to “predict” the market's ebbs and flows.

Some have suggested that our unconscious minds can predict the stock market through “precognitive dreaming,” while others have recently been turning to the advice of artificial intelligence chatbots.

However, in Thailand, there appears to be a growing group of investors turning to divine powers and astrology to predict market movements, including crypto — as recently highlighted in a r/cryptocurrency thread on Reddit.

One astrologist, who goes by “Pimfah,” has a 160,000-strong Facebook group where members ask for and send tarot card readings — some ask for help on what their readings mean for the crypto market.

Another self-proclaimed fortune teller, Ajarn Ton, has a YouTube channel with nearly 26,000 subscribers where he’s uploaded hundreds of videos attempting to predict the price of various cryptocurrencies using astrology.

Ton’s most recent focus is predicting that Terraform Labs’ collapsed crypto Terra Luna Classic (LUNC) will see a surge of nearly 50,000% — saying it could hit $0.029.

So far, however, it’s trading at less than $0.000055.

Occasionally, these predictions turn out to be somewhat accurate.

High-profile fortune teller, Mor Plai, made local headlines earlier this year for her August 2022 prediction of a crypto market recovery starting that November — which turned out to be somewhat accurate, ignoring the crypto retrench around FTX’s collapse.

Commenters on the Reddit post were largely doubtful about the so-called method of prediction.

“Put out enough vague predictions, and you gotta be right eventually,” one Redditor commented.

“If a hamster can perform better than most adults I don’t see why we shouldn’t try astrology,” another joked.

However, while spiritual beliefs would likely attract skeptics in the West, it is not considered out of the ordinary in Buddhist-majority Thailand.

A September Pew Research report said just over 80% of surveyed Thais believe in God, deities or spirits and nearly half believed spells, curses or other magic influenced people’s lives.

Related: Binance collaborates with Royal Thai Police to seize $277M from scammers

Even in parts of the Western world, self-described astrologers have also been using signals from the stars to divine price movements in crypto.

During the 2021 crypto bull market, the United States-born TikTok astrologer Maren Altman gained a following of millions for her astrology-backed Bitcoin price predictions.

Altman told Magazine in January she was “familiar with financial astrology, so it just made sense to apply it to cryptocurrency.”

Didi Taihuttu, a Dutch-born Bitcoiner and “Bitcoin family” patriarch — who sold all their assets in 2017 and lived off Bitcoin since — has a homebrew market indicator that considers moon cycles alongside directional trading data to flag buy and sell opportunities for Bitcoin.

I received many questions about the Bam Bam #bitcoin Indicator and why also moon cycles are part of it. It’s another confirmation that gives you help with deciding when to sell and buy. This research article is a good explanation. https://t.co/hQfhzeXSoG

— ₿ Didi Taihuttu ₿ ALLIN (@Diditaihuttu) July 13, 2023

One Redditor postulated that there could be an indirect relation between astrology and prices, as belief in it could cause traders to "act accordingly" — and thus cause a shift in prices in itself through a self-fulfilling prophecy.

As for what lies in store for Bitcoin in the near future, the pseudonymous crypto-focused astrologer “Crypto Damus” claimed in an Oct. 18 X (Twitter) post:

“Mars is lining up to make a favorable sextile to [Bitcoin] natal Mars over the next several days, (with Mercury cazimi),” which is assumedly positive as they claim it shows strength and will “pump the market.”

However, the “transit of Mars in Scorpio generally hasn’t been that good for BTC” they said — whatever that means.

Magazine: How to protect your crypto in a volatile market — Bitcoin OGs and experts weigh in