Bitcoin's bull market is likely to start earlier than expected due to anticipation of the BTC halving and favorable macroeconomic conditions, according to Mark Yusko, founder and CEO of Morgan Creek Capital Management.

The next crypto bull market will start sooner than most people think, according to Mark Yusko, the founder and CEO of Morgan Creek Capital Management. Yusko thinks the next crypto bull run or, as he calls it, "the crypto summer," could kick off as soon as the second quarter of this year due to the combination of more dovish central bank policies and the anticipation of the Bitcoin (BTC) halving.

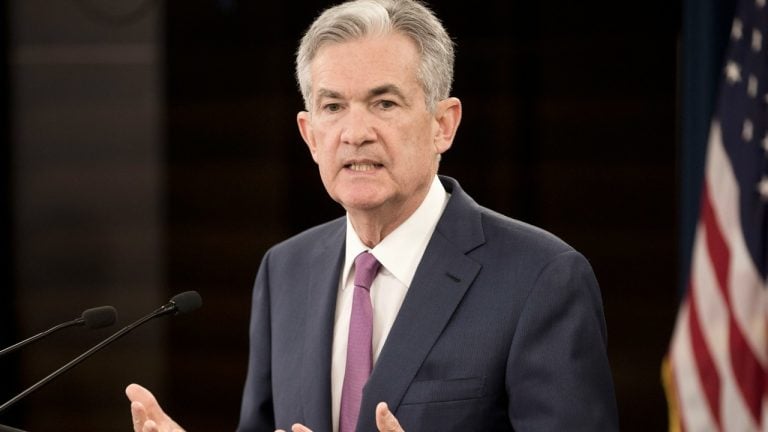

While the United States Federal Reserve is unlikely to cut interest rates anytime soon, according to Yusko, the markets tend to anticipate the Fed's decisions. That means even a slowing down or a pause in interest-rate hikes would be interpreted as the signal of an imminent pivot. That would spark a positive dynamic among all risk assets, including crypto.

“What I do think is very likely is the Fed signaling that: "Okay, we're good." But that will be interpreted as “we're going to cut” and then risk assets will explode again,” Yusko pointed out.

Besides the Fed's more dovish policies, the anticipation of the Bitcoin halving, which is due to take place in the second quarter of next year, will also drive bullish sentiment in the market.

“The market always anticipates the halving [...] Nine months before that is usually when the beginning of summer starts," Yusko said.

To learn when to expect the next crypto bull run and how best to prepare for it, watch the full interview on our YouTube channel, and don’t forget to subscribe!