DYdX to unlock 6.52M tokens worth $14M for community treasury, rewards

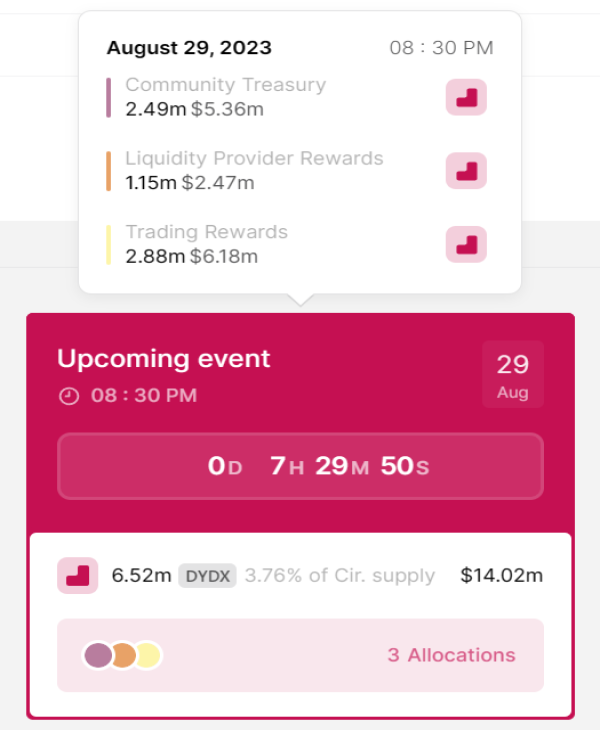

Out of the lot, 2.49 million DYDX tokens — worth $5.36 million — will be allocated to the community treasury, which funds contributor grants, community initiatives and liquidity mining, among other programs.

Decentralized exchange (DEX) platform dYdX will unlock $14.02 million worth of its native DYDK tokens to be allocated to its community treasury and rewards for traders and liquidity providers.

On Aug. 29, dYdX will release 6.52 million tokens, representing 3.76% of the DYDX circulating supply. Out of the lot, 2.49 million DYDX tokens — worth $5.36 million — will be allocated to the community treasury. The treasury funds contributor grants, community initiatives and liquidity mining, among other programs.

The remaining 4.03 million DYDX tokens will be split between liquidity provider rewards (1.15 million tokens worth $2.47 million) and trading rewards (2.88 million tokens worth $6.18 million).

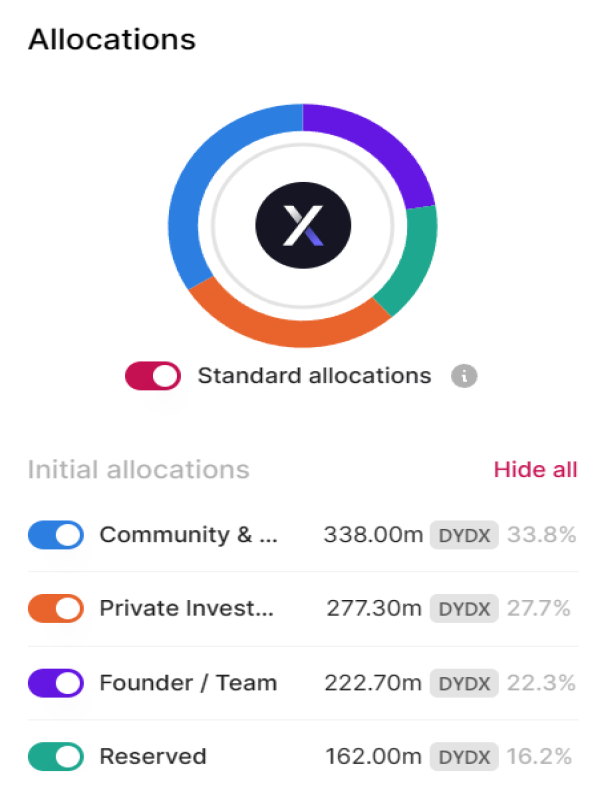

DYdX conducted an identical unlock event on Aug. 1 with the same allocation of funds. Data on dYdX’s full allocation from TokenUnlocks suggests that investors hold the highest allocation at 27.7%, followed by trading rewards and community treasury at 20.2% and 16.2%, respectively.

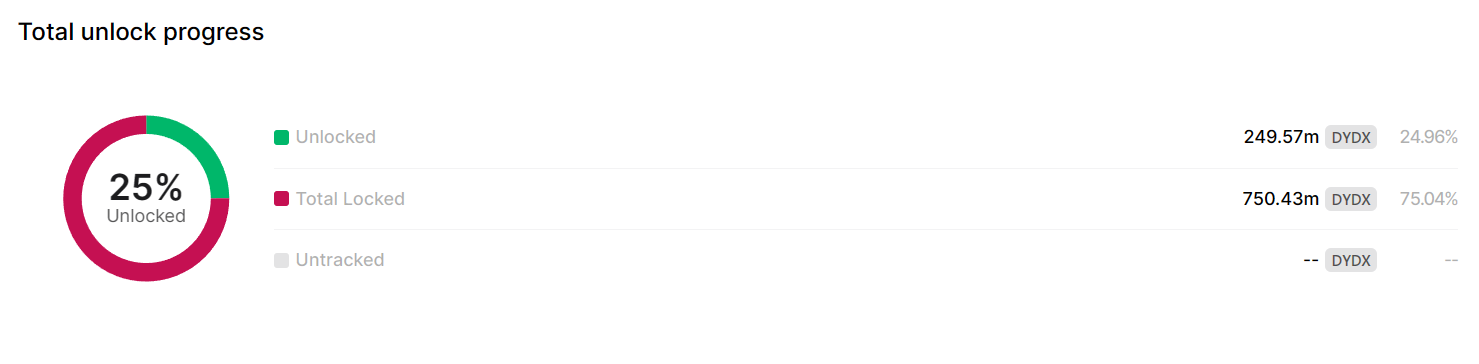

DYDX has a maximum supply of 1 billion tokens, and over 75% are locked, as shown above.

Related: dYdX exchange launches testnet for ‘fully decentralized’ version 4

DYdX founder Antonio Juliano recently recommended crypto entrepreneurs explore markets outside the United States.

Crypto is aligned with American values. What could be more American & capitalist than a financial system of the people, by the people, and for the people

That is literally what we’re building here. America will realize that eventually

— Antonio | dYdX (@AntonioMJuliano) August 25, 2023

Juliano emphasized that crypto startups could scale faster overseas in friendlier markets:

“Crypto builders should just give up serving US customers for now and try to re-enter in 5-10 years. It’s not really worth the hassle/compromises. Most of the market is overseas anyways. Innovate there, find PMF [product market fit], then come back with more leverage.”

As the U.S. government continues to drag its heels on establishing crypto regulation, Juliano suggested that the crypto sector needs to grow further to have more sway over U.S. policy.

Magazine: Recursive inscriptions: Bitcoin ‘supercomputer’ and BTC DeFi coming soon

Go to Source

Author: Arijit Sarkar