European DeFi startups saw a 120% increase in VC funding in 2022: Finance Redefined

The top 100 DeFi tokens had a mixed week, with little changes and a majority of the tokens trading in green.

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week.

The ongoing downturn in the crypto market hasn’t stopped European venture capital (VC) firms from investing in DeFi projects. A new report revealed that European DeFi startups saw a 120% increase in VC funding last year.

The Euler Finance saga continued to dominate headlines, with the exploiter returning a significant chunk of the $190 million in stolen funds. The exploiter has returned over 58,000 stolen Ether (ETH) in one installment, and another $37 million worth of ETH and Dai (DAI) in the second one.

Traditional banking giant, Citibank, forecasts tokenization will take over traditional finance and predicts that by 2030 trillions in assets could be tokenized.

MakerDAO passed a new constitution to create multiple offices tasked with fulfilling various jobs for the protocol, each with its powers and responsibilities.

The top 100 DeFi tokens had a mixed week and didn’t see many changes from the previous week, with a majority of the tokens trading in green.

European DeFi startups saw 120% increase in VC investment in 2022: Data

2022 was a turbulent year for the crypto space, from an ongoing bear market and high-profile collapses of some of the industry’s most prominent players, like Terra and FTX. Despite the setbacks, venture capital investors continued supporting crypto startups.

According to a new study released by European investment firm RockawayX, VC investment in crypto startups based in Europe reached its all-time high in 2022, with $5.7 billion invested. European decentralized finance startups hit $1.2 billion in 2022 — a 120% increase from the previous year’s investments of $534 million.

Euler Finance exploiter returns over 58,000 stolen Ether

The hacker behind the $196 million exploit on lending protocol Euler Finance has returned most of the stolen assets, according to on-chain data.

In a transaction on March 25, the exploiter returned 51,000 ETH, worth around $88 million at the time of writing. A second transfer of 7,737 ETH was made on the same day, worth over $13 million. Previously, on March 18, the hacker sent 3,000 ETH to the protocol, worth nearly $5.4 million at the time. The exploiter still controls some of the stolen assets. By April 27, the attacker returned another $37.1 million worth of ETH and DAI.

‘Killer use case’: Citi says trillions in assets could be tokenized by 2030

Citibank is betting on the blockchain-based tokenization of real-world assets to become the next “killer use case” in crypto. The firm forecasts the market to reach between $4 trillion and $5 trillion by 2030.

That would mark an 80-fold increase from the current value of real-world assets locked on blockchains, Citibank explained in its “Money, Tokens and Games” March report.

MakerDAO passes new ‘constitution’ to formalize governance process

MakerDAO, the decentralized autonomous organization that governs the DAI stablecoin, has passed a new proposed “constitution” intended to formalize governance processes and help prevent hostile actors from taking over the protocol, according to the official forum page for the proposal.

According to the proposal’s text, a constitution is needed because the Maker protocol “relies on governance decisions by humans and institutions holding MKR tokens,” which can “expose weaknesses and vulnerabilities that can fail the Maker protocol or the loss of user funds.”

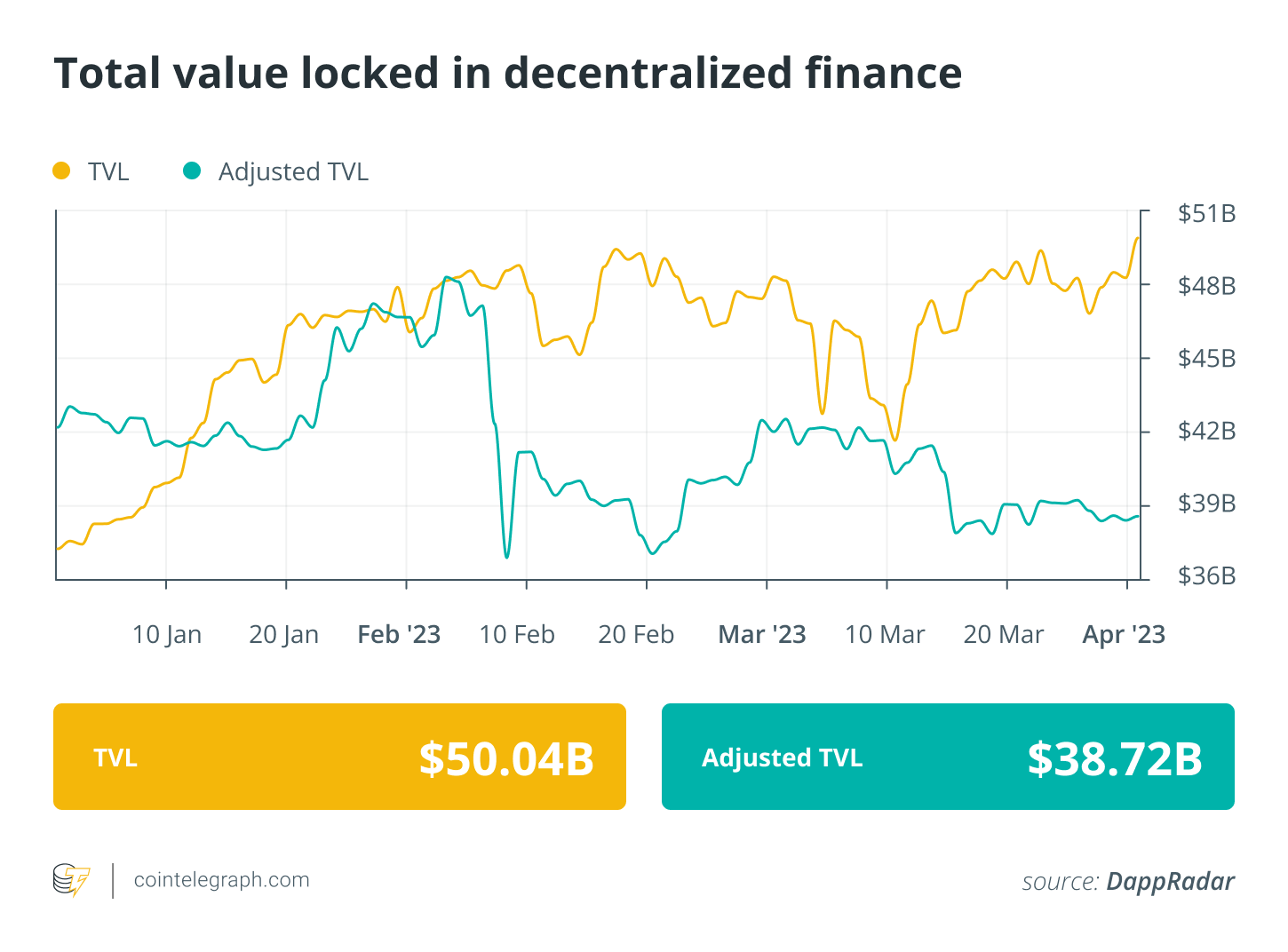

DeFi market overview

Analytical data reveals that DeFi’s total market value rose above $50 billion this past week. Data from Cointelegraph Markets Pro and TradingView shows that DeFi’s top 100 tokens by market capitalization had a bullish week, with most of the tokens trading in green, barring a few.

Thanks for reading our summary of this week’s most impactful DeFi developments. Join us next Friday for more stories, insights and education in this dynamically advancing space.

Go to Source

Author: Prashant Jha