ezETH depeg puts ETH restaking volatility into the limelight

Share this article

Renzo’s liquid restaking token (LRT) ezETH experienced a dramatic drop this week, losing over 7% of its peg with Ether (ETH) within hours, with some 50% depeg in some decentralized applications. This decline was further intensified by the liquidation of leveraged yield farmers utilizing ezETH as collateral for high-risk loans and inserts the volatility of the liquid restaking market volatility into the limelight, according to IntoTheBlock’s “On-chain Insights” latest edition.

On April 24, ezETH saw a record trading volume of $1.5 billion as market participants reacted to the liquidations and the ensuing panic and uncertainty. While some in the crypto community view depeg scenarios with trepidation, Renzo has confirmed that ezETH remains fully backed by ETH.

Moreover, IntoTheBlock highlights that the Renzo team has announced plans for three audits and is preparing the protocol for ezETH redemptions for the underlying ETH by May. Additionally, they have increased the initial airdrop supply from 5% to 7% in an effort to stabilize community sentiment.

Although the restaking market has been shaken, the underlying protocol is expected to recover from this significant disruption. Meanwhile, EigenLayer, a protocol that enables the creation of applications secured by Ethereum, has surpassed $15 billion in total value locked (TVL) in less than a year. EigenLayer continues to attract deposits, with anticipation building for its upcoming token launch.

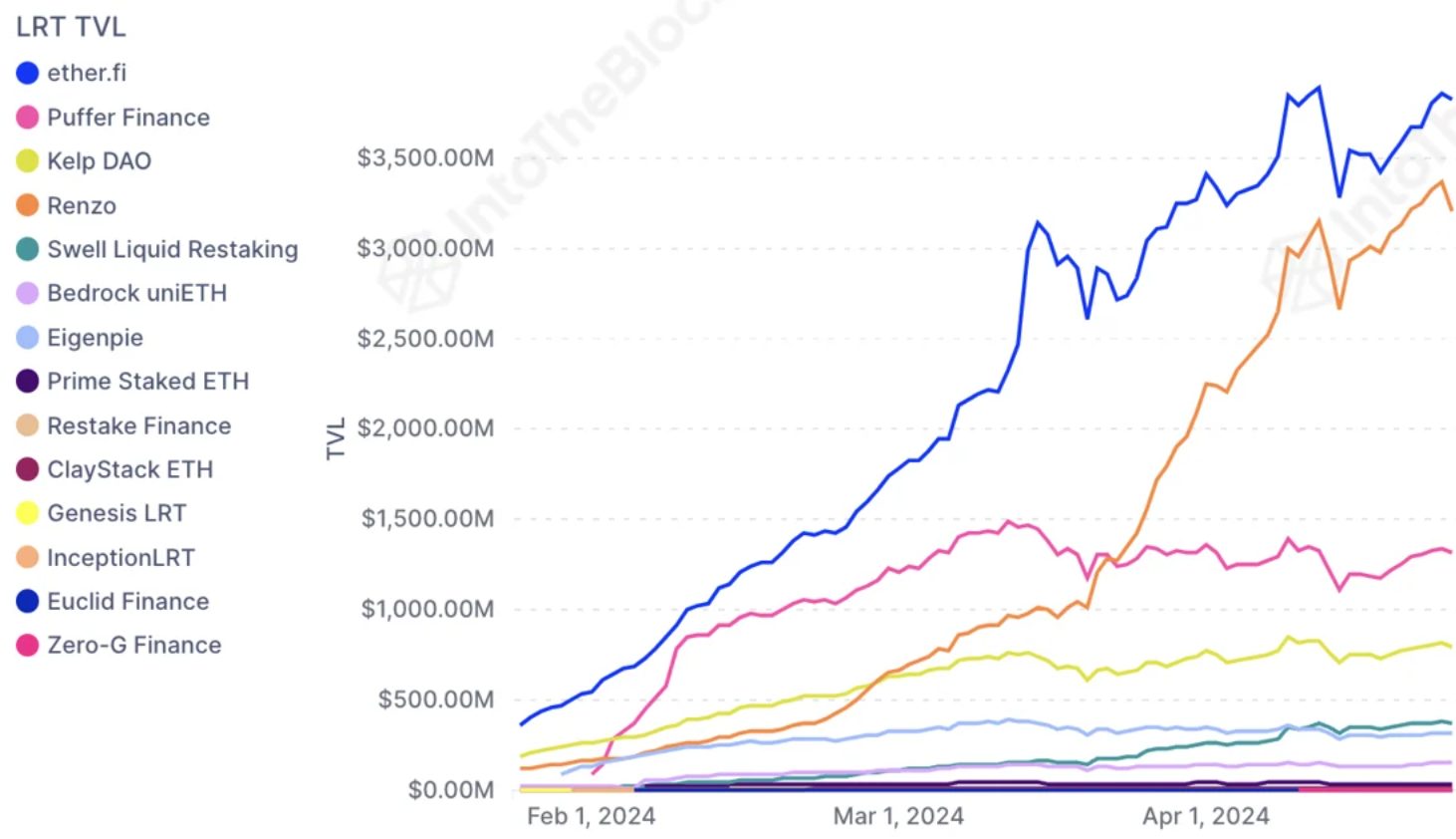

Nearly 4% of all ETH and 40% of LRT supply is currently being restaked into EigenLayer. Users have the option to deposit directly or through an LRT, which manages the assets on their behalf. The LRT landscape is competitive, with over $10 billion, or two-thirds of EigenLayer deposits, coming through these tokens.

EtherFi has maintained a lead in deposits, while Renzo has quickly risen to second place by expanding its decentralized finance presence, especially in layer-2 blockchains.

However, the recent announcement of Renzo’s governance token REZ has led to unexpected price fluctuations in ezETH. A controversial pie chart detailing token distribution sparked criticism and confusion on social media, contributing to the selling pressure on ezETH and its subsequent discount relative to ETH holdings.

Share this article

Go to Source

Author: Gino Matos