Galaxy Digital Report Predicts Bitcoin NFT Market Could Reach $4.5 Billion by 2025

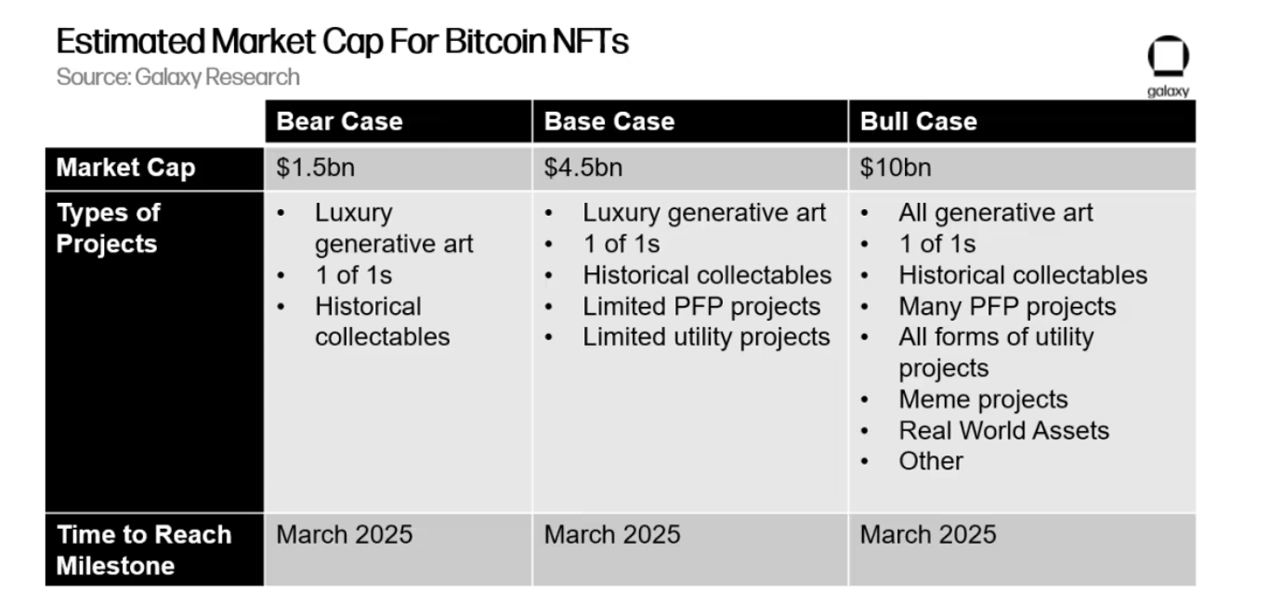

As the number of Bitcoin-based Ordinal inscriptions nears the 300,000 mark, Galaxy Digital’s research team published a report on the subject that says the market size of non-fungible tokens (NFTs) built on Bitcoin could reach $4.5 billion over the next two years. The researchers at Galaxy think that new use cases stemming from the inscription trend will “drive growing interest and adoption” for bitcoin.

Galaxy Researchers Explore the Potential Use Cases of Bitcoin-Based Ordinal Inscriptions and NFTs

At the time of writing, there are more than 288,000 Ordinal inscriptions hosted on the Bitcoin blockchain, as the trend has swelled greatly since the start of February 2023. Four days ago, the number of Ordinal inscriptions reached 200,000, and that same day, Yuga Labs, the creators of the Ethereum NFT collection Bored Ape Yacht Club (BAYC), revealed it had minted a collection of 300 inscriptions to auction the artwork. Six researchers and executives from Galaxy Digital published a report about the subject and assessed that it is possible that Bitcoin NFTs “built on inscriptions [and] Ordinals” could reach $4.5 billion by 2025.

“Inscriptions significantly expand the design space for Bitcoin,” Galaxy’s report says. “The addition of sizeable data storage with strong availability assurances opens up a variety of use-cases, many of which are only beginning to be explored, including things like new types of decentralized software or Bitcoin scaling techniques. Even the NFT use-case alone, though, has the potential to dramatically widen the scope of Bitcoin’s cultural impact.”

Galaxy researchers highlight that the ecosystem is still very young but note that “infrastructure is emerging quickly.” One of the key building blocks for the technology will be wallets, according to Galaxy’s paper on the inscription subject. Moreover, the study delves into the various collections minted in recent times, such as Taproot Wizards, Bitcoin Punks, and Ord Rocks. The paper mentions the marketplace Openordex, which leverages “partially-signed bitcoin transactions (PSBTs) to enable the trustless listing and purchasing of inscriptions.” Additionally, Galaxy researchers also discuss the controversy tied to the Ordinal inscriptions.

The researchers note that they believe technical arguments are already mostly avoided, and a social movement to stop Ordinal inscriptions probably won’t happen. “Ultimately, because witness data can be pruned and old data can be avoided in initial block download (IBD) by enabling assumevalid=1, we view the technical arguments against inscriptions to already be mostly mitigated,” the Galaxy researchers wrote. “On the narrative side, Ordinal inscription transactions are valid to all nodes on today’s Bitcoin network. A social movement to make changes to Bitcoin such that Ordinal inscriptions are no longer possible would need to emerge to change that, an outcome we view as unlikely.”

Galaxy’s study also notes that, unlike Ethereum, because of the lack of smart contract technology within Bitcoin, NFT royalties are also unlikely. The researchers think the criteria for blue-chip Ordinal inscriptions will be “dynamic,” and the market “could see significant secondary volume.” While the study mentioned a number of tools, Galaxy believes Ordinal inscription market infrastructure will be developed by the second quarter of this year. As a result of all these trends, layer two (L2) or other types of Bitcoin scaling solutions will be pushed to the forefront of development.

“The emergence of inscriptions, and the low-likelihood that the functionality is ever removed from the project, has the potential yet again evolve Bitcoin, driving new use cases, interest, and adoption,” Galaxy’s study concludes.

What do you think about the potential impact of Ordinal inscriptions on the future of Bitcoin and the wider adoption of NFTs? Share your thoughts in the comments section below.

Go to Source

Author: Jamie Redman