‘Take a Cautious Approach’ – Santiment Issues Warning on Solana, NEAR Protocol and One Bitcoin Ecosystem Altcoin

Crypto analytics firm Santiment is warning about Solana (SOL) and two other altcoins based on one key metric.

The firm says that the discussions of Solana on social media platforms are soaring, which often signals a market top.

Social media discussions are also rising quickly for Stacks (STX), a project that aims to enable smart contracts and decentralized finance (DeFi) applications on Bitcoin (BTC), as well as for Ethereum (ETH) competitor NEAR Protocol (NEAR), according to Santiment.

“Solana (+13%), Stacks (+23%), and NEAR Protocol (+17%) are the top trending assets, according to rising social volumes. In each case, when there is mainstream talk at this level, FOMO (fear of missing out) will create price tops. If holding any, take a cautious approach.”

Solana is trading for $89.04 at time of writing, up 11.9% in the last 24 hours, and NEAR Protocol is trading for $3.42 at time of writing, up 15.6% in the last 24 hours.

Meanwhile, Stacks is trading for $1.43 at time of writing, down 5.7% in the last 24 hours.

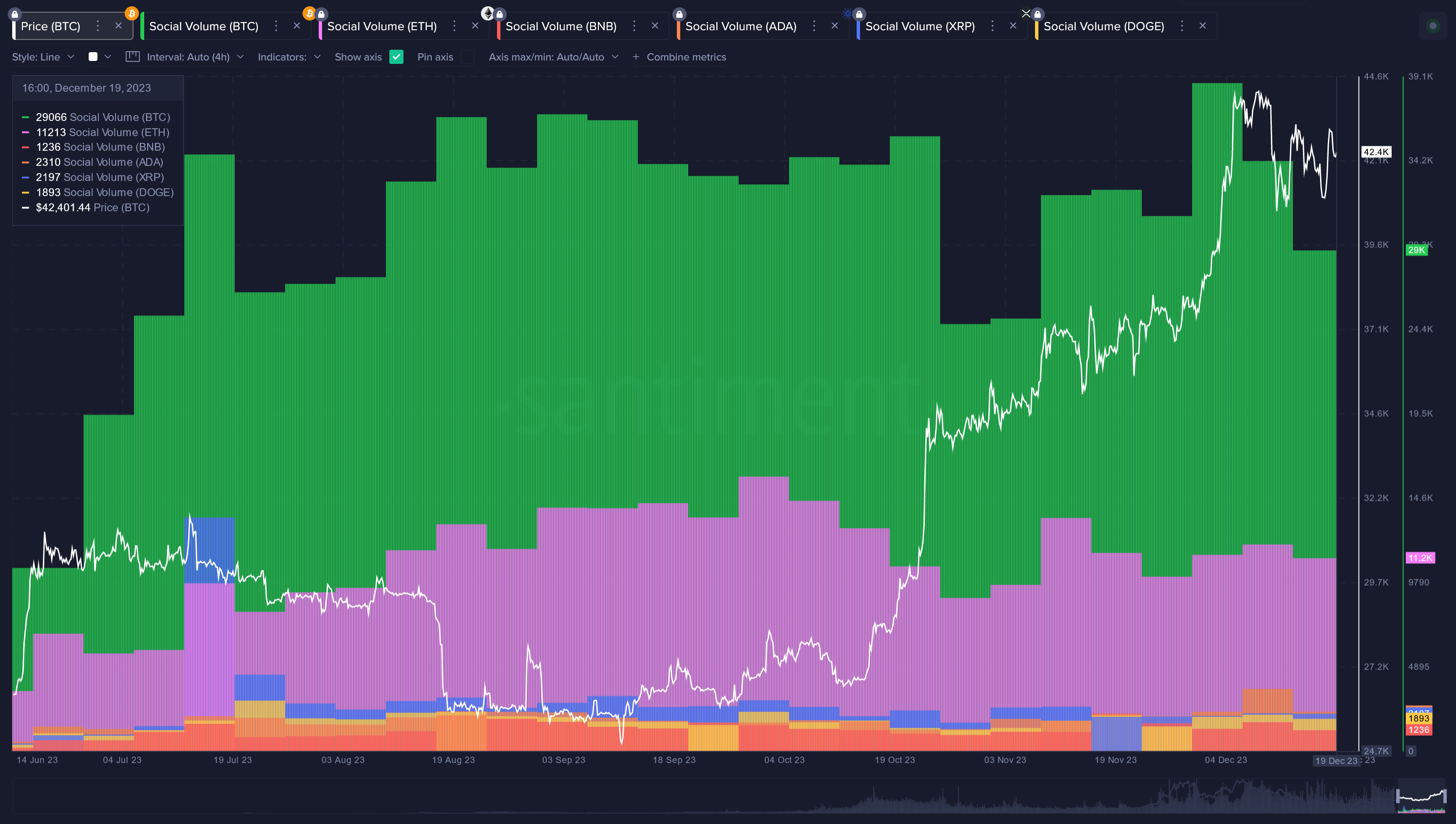

Santiment also weighs in on the broader crypto market. The firm warns that the trading volume of several altcoins is declining, indicating a cooling market.

“Bitcoin’s volume has surprisingly stayed up at the higher level it has been seeing since October, while the many altcoins represented by the smaller, declining hills in the below image, are the ones that have really fallen.”

The firm also notes that social media discussion has been declining for several alts after they surged, signaling market tops.

“There was a bump in some of the larger cap assets in the second week of December, particularly ADA and DOGE. This pattern of Bitcoin hype peaking one week, and then altcoins peaking the next, is actually quite normal. It indicates that BTC profits were being distributed to alts for one final hype cycle. And now the discussion rates have fallen.”

Santiment also warns that the exchange supply of Bitcoin is increasing, often a bearish signal.

“Ultimately, Bitcoin seeing its supply on exchanges increase by 3.5% is a bigger concern than stablecoin movement is encouraging.”

Lastly, Santiment says it is watching closely the mean dollar invested age metric for Bitcoin, which shows the average age of all tokens on the blockchain weighted by the purchase price, as it could signal a sudden surge to the $50,000 level early next year.

“If BTC’s market value continues fluctuating in this $40,000-$43,000 range, and the mean dollar invested age line is still moving down now that its price has flattened out, it would be a signal that crypto’s top asset may make a quick run at $50,000 in early 2024.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/DanieleGay/Sashkin

The post ‘Take a Cautious Approach’ – Santiment Issues Warning on Solana, NEAR Protocol and One Bitcoin Ecosystem Altcoin appeared first on The Daily Hodl.

Go to Source

Author: Daily Hodl Staff