A key change in Ethereum options pricing hints that ETH price could rise beyond $1,350

Ethereum whales are market makers are no longer charging excessive premiums for protective put options, a sign that ETH price could be en-route to new highs.

Ethereum price (ETH) gained 10.2% from Jan. 4 to Jan. 10, breaching the $1,300 resistance without much effort, but has the Ether price move cast a light on whether the altcoin is ready to begin a new uptrend.

Will Ethereum’s former resistance level turn to support?

After testing the $1,200 support on Jan. 1, the eight-week ascending channel has displayed strength, but Ether bulls fear that negative newsflow might break the pattern to the downside.

Despite the positive price trend, the sentiment around Ethereum and other cryptocurrencies hasn’t been very enticing. For example, on Jan. 8, Xiao Yi, the former Chinese Communist Party secretary of Fuzhou, confessed to “acting recklessly” in support of crypto mining. Xiao seemed to speak from what appeared to be a prison, apologizing for causing “grave losses” to the Fuzhou region.

On Jan. 10, South Korean tax agents reportedly raided Bithumb’s exchange offices to explore a potential tax evasion case. On Dec. 30, Park Mo — an executive at Bithumb’s parent company — was found dead, though he was under investigation for embezzlement and stock price manipulation.

This week (Jan. 10), Cameron Winklevoss, the co-founder of the Gemini exchange, issued an open letter to Barry Silbert, CEO of Digital Currency Group (DCG). In the letter Winklevoss makes some serious fraud accusations and requests that the Grayscale fund management holding company dismiss Silbert to provide a resolution for Gemini’s Earn users.

The ongoing crypto winter left another scar on Jan. 10 as the U.S. leading cryptocurrency exchange Coinbase announced a second round of layoffs, impacting 20% of the workforce.

However, the exchange’s CEO, Brian Armstrong, tried to minimize the damage by stating that Coinbase remains “well capitalized” and he attempted to tranquilize investors with business-as-usual messages.

Consequently, some investors believe Ether could revisit prices below $600 as fear remains the prevalent sentiment. For instance, trader Crypto Tony expects the current triangle formation to cause another “leg down later this year.”

Unless we take out $2,200 on the macro level I am treating this as consolidation for a B or X wave, before we get one more leg down later this year

Volume is contracting and I also expect this to dwindle down lower. Pay attention pic.twitter.com/LTik7GXEYa

— Crypto Tony (@CryptoTony__) January 10, 2023

Let’s look at Ether derivatives data to understand if the bearish newsflow has caused traders to avoid leverage longs and neutral-to-bullish option strategies.

Leveraged bulls lagged the recent rally

Retail traders usually avoid quarterly futures due to their price difference from spot markets. Meanwhile, professional traders prefer these instruments because they prevent the fluctuation of funding rates in a perpetual futures contract.

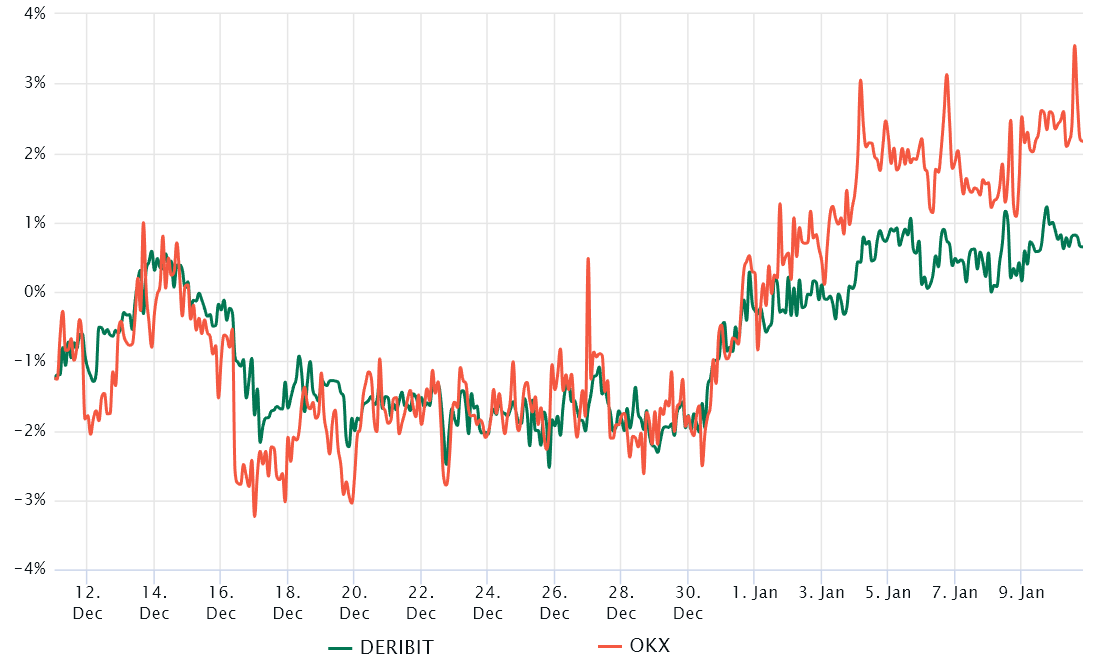

The two-month futures annualized premium should trade between +4% to +8% in healthy markets to cover costs and associated risks. When the futures trade at a discount versus regular spot markets, it shows a lack of confidence from leverage buyers, which is a bearish indicator.

The chart above shows that derivatives traders using futures contracts exited the negative premium on Jan. 1, meaning the extreme bearish sentiment is gone. However, the current 1.5% premium remains below the 4% threshold for a neutral market. Still, the absence of leverage buyers’ demand does not mean traders expect a sudden market downturn.

For this reason, traders should analyze Ether’s options markets to understand whether investors are effectively pricing in odds of a $600 retest for ETH.

Options traders have stopped overcharging for downside protection

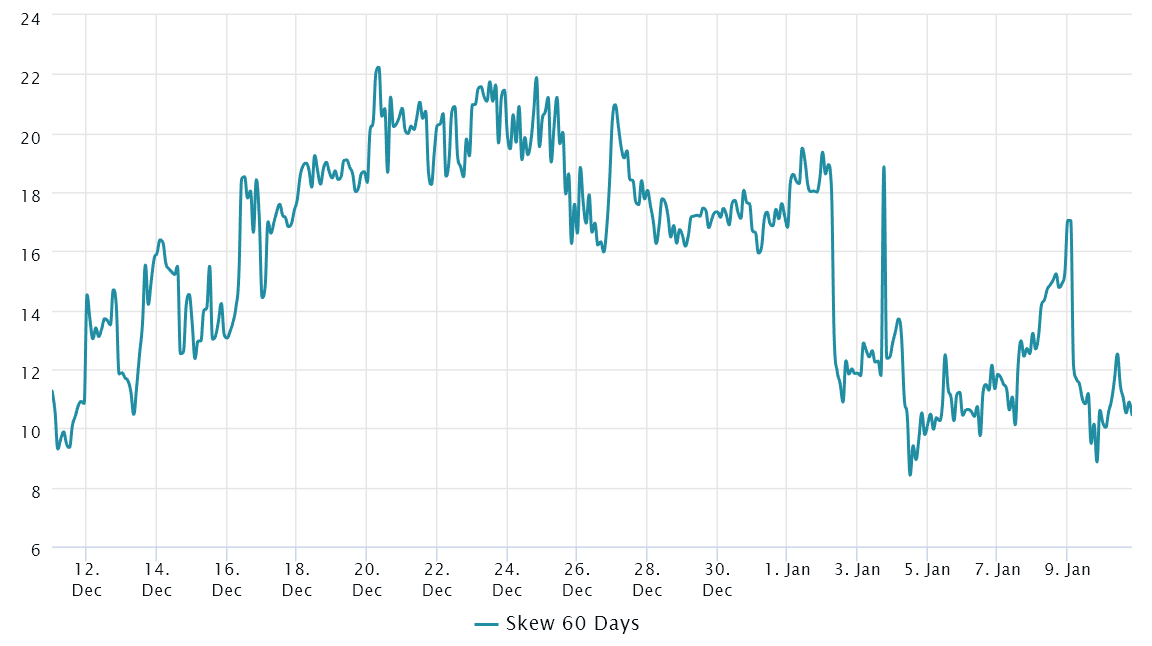

The 25% delta skew is a telling sign when market makers and arbitrage desks are overcharging for upside or downside protection.

In bear markets, options investors give higher odds for a price dump, causing the skew indicator to rise above 10%. On the other hand, bullish markets tend to drive the skew indicator below -10%, meaning the bearish put options are discounted.

The delta skew currently sits at 11% after flirting with the neutral range on Jan. 9, meaning that whales and market makers no longer charge excessive premiums for protective put options. That is a stark contrast from late 2022 when those trades were running up to 19% more costly than equivalent bullish strategies using options.

Related: Navigating the crypto crash can be challenging, but there are tools to help you in 2023

Overall, both options and futures markets point to pro traders becoming more confident and increasing the odds of $1,300 becoming a support level. So even if the newsflow doesn’t seem appealing, traders are unwilling to add bearish bets, which might fuel further positive momentum for Ether.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Go to Source

Author: Marcel Pechman