Avalanche (AVAX) price is up, but do fundamentals support the rally?

AVAX price has been in a strong rally since the start of 2023, but a sustained uptick in its DeFi components is needed in order to sustain the current bullish momentum.

Avalanche (AVAX) witnessed a meteoric start to 2023, gaining 98% in 30 days, and traders are now curious about whether the rally will extend throughout February. AVAX’s year-to-date gains for 2023 have outpaced those of Bitcoin (BTC) and Ether (ETH).

Recent reasons for AVAX’s rally can be attributed to an Amazon partnership announcement on Jan. 11. The partnership is meant to easily deploy nodes on the Avalanche blockchain with Amazon Web Services (AWS). Ava Labs, which supports the Avalanche ecosystem, hopes the partnership increases blockchain usage for enterprises and governments.

While AVAX price has benefited from the news, some analysts predict that the move could have been a bull trap.

Let’s dig into the fundamentals to see if on-chain network activity supports the recent AVAX rally.

AVAX fees from DeFi are up

After the AWS news, AVAX price was not the only metric seeing a quick rise. On Jan. 14, Avalanche network hit a year-to-date high of $31,218 AVAX fees received. The increase in fees compared to the previous 30 days is 59%, signaling that positive price appreciation helped boost the fees that the network received.

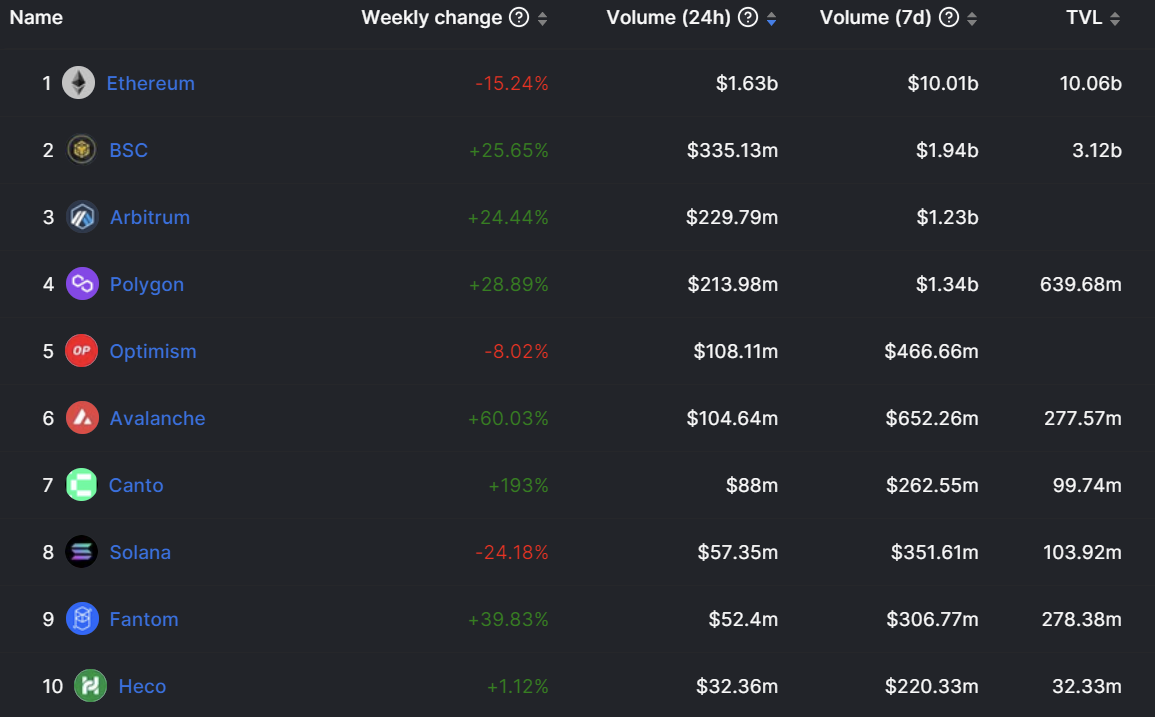

While the Avalanche fee base is increasing, it still lags behind top EVM-compatible blockchains like Ethereum, Binance Chain (BNB), Optimism (OP) and Polygon (MATIC). Over the past 30 days, the fees Avalanche has generated rank 9th out of all blockchains.

Notably, layer-2 competitor Polygon earned close to four times the amount of fees compared to Avalanche. Even with the astounding growth thaAvalanche has experienced in 2023, the network will need to substantially increase fees to overtake more blockchains.

Active addresses and users are down

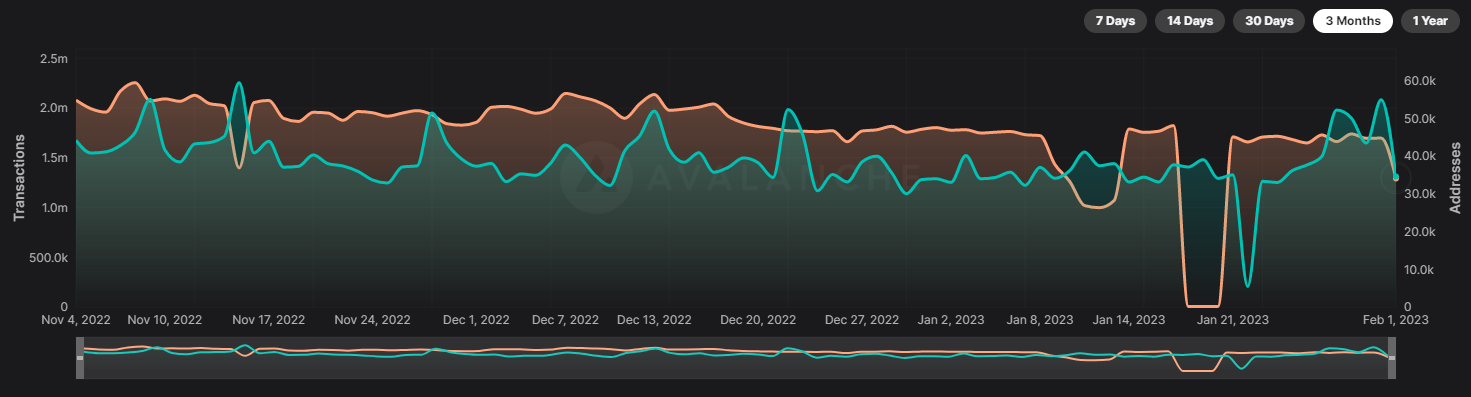

A sign of blockchain health is the number of active addresses, users and transactions. Despite reaching a year-to-date high on Jan. 18 of 1.84 million transactions, Avalanche’s transaction count is trending down.

A similar downtrend is witnessed when looking at active addresses in the Avalanche ecosystem. Active addresses denote transactions taking playing on unique wallets for a given day. After reaching a year-to-date peak of 54,978 active addresses on Jan. 31, only 34,624 active addresses were registered the following day.

The downtrend in Avalanche activity is creating further separation between other blockchains. According to TokenTerminal, Avalanche’s all-time high (ATH) number of daily active users is 131,000, which is dwarfed by Polygon’s ATH of 737,000. Avalanche is now far from its all-time high of daily users, registering only 44,000.

For blockchains to create sustainable fees, there needs to be daily active users participating on the network.

AAVE dominates Avalanche DApps

The active users on Avalanche seem to have a preference for using Aave (AAVE) on the AVAX blockchain. Over 36% of all Avalanche transactions flow through the Aave protocol. Investors have staked over $353 million on Aave’s Avalanche version, far surpassing the second-most popular protocol by verified total locked value (TVL), the Trader Joe decentralized exchange (DEX).

While Aave and Trader Joe are leading the Avalanche blockchain, when looking at DEX activity on other blockchains, they witness far less trading volume. DEX volume directly correlates to the fees that a protocol receives.

Ethereum DEX activity leads the way with over $1.6 billion in daily volume, whereas Avalance only sees around $104 million.

While Avalanche is currently witnessing immense growth from the AWS announcement, the blockchain is still small compared to competitors. The goal of the AWS partnership was to help increase network activity by reducing barriers to entry. Reaching the goal may increase Avalanche adoption but other ecosystems seem to be out to a large and early lead.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Go to Source

Author: Kyle White