Bitcoin’s bull move might not be over yet — Here are 3 reasons why

Bitcoin options market positioning and BTC’s daily chart suggest another bull move could be in the making.

The bullish momentum that propelled Bitcoin (BTC) price to a year-to-date high continues into its third week as the price presses toward the $35,000 handle.

Some notable developments that back the current bullish momentum are:

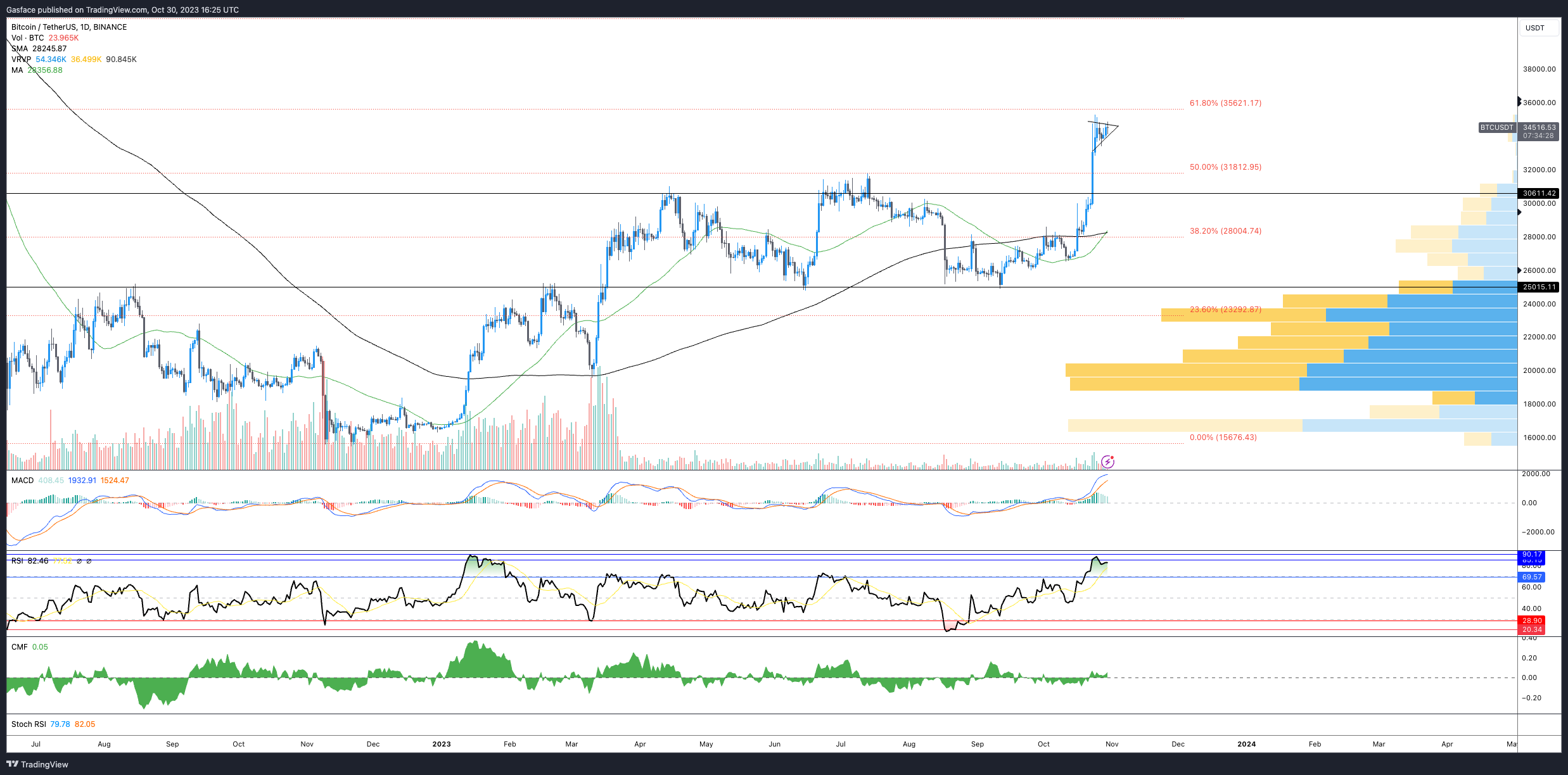

- The forming a golden cross between the 50-day moving average and 200-day moving average on the daily timeframe.

- Liquidity maps from DecenTrader and Kingfisher highlighting the potential for a short squeeze between the $36,300 and $40,000 range if Bitcoin price manages to blitz the $36,300 level.

Still a good amount of liquidity for #bitcoin between current price all the way up to $39,500.

Track it here: https://t.co/s1yivlKw5D pic.twitter.com/2i09F7Z9We

— Decentrader (@decentrader) October 26, 2023

- Options market data highlighting a shift in investors’ sentiment and positioning.

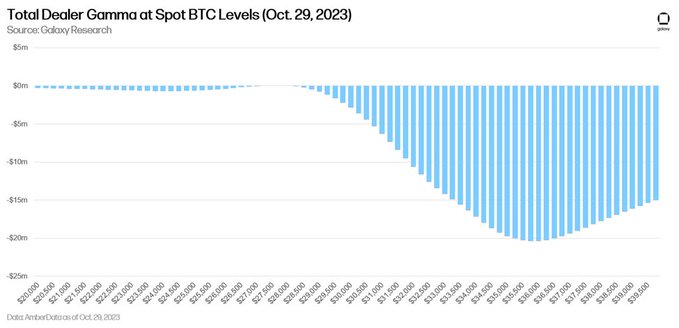

Bitcoin’s options data appears confluent with the perspective that further price upside could be in store and suggests a potential extension of last week’s gamma event culminating with BTC price rallying to $35,280. The data also shows the possibility for a gamma event in the $35,000 to $40,000 range, and investor positioning has shifted accordingly.

In the past week, daily option volumes across the derivatives market surged, leading The Big Picture podcast host Joe Kruy to say:

“Paradigm had its best day ever by 70%, in terms of volume.”

Adding to the conversation on the Bitcoin options market, Kelly Greer, Head of America Sales at Galaxy said:

“The flows that we’ve seen reflect everything that is illustrated here and what’s in the market in the listed space. An uptick month over month from Q3 to Q4, interest in the calls that we’ve been highlighting and as we started highlighting this short gamma, the noticeable difference between Bitcoin and ETH in early October, actually was the first time we started talking about this. It was incredible to see that play out once we got the catalyst for spot to break out over its range and see the chasing in spot. And see spot settle down in the mid $30; from when we started talking about it, it was mid-$25s. We’ve seen interest in upside now that vol is higher and calls skews are a little elevated. Seeing those strikes roll out so that peak gamma at the time when we discussed this in early October was around $32K and now it’s around $36K to $40K.”

From the perspective of technical analysis, traders are eyeballing the bull pennant pattern, which has formed on the daily timeframe, along with the birth of a golden cross.

In the short-term, the catalyzing move to be on the watch for is whether or not a price move through the $36,300 level leads to escalating pressure on shorts, and if this triggers a rapid uptick in spot buying volumes as options and perpetual futures traders are forced to cover their positions or face liquidation.

Essentially, one would see aggregated short liquidations surge as spot volumes peak, a process that is documented in the chart below.

According to Alex Thorn, Head of Firmwide Research at Galaxy, “the Bitcoin gamma squeeze from last week could happen again if BTC/USD moves higher to $35,750 – $36K.”

Thorn explained that:

“Options dealers will need to buy $20 million in spot BTC for every 1% upside move, which could cause explosiveness if we begin to move up towards those levels.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Go to Source

Author: Ray Salmond