Bitcoin sees new 4-month high as US PPI, retail data posts ‘big misses’

A further boost to crypto markets precedes the Wall Street open, but order books are warning of “fading” upside.

Bitcoin (BTC) set yet another multi-month high before the Jan. 18 Wall Street open as United States macroeconomic data fell far wide of expectations.

U.S. PPI numbers fall wide of the mark

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD spiking to $21,646 on Bitstamp.

A subsequent correction saw the pair moving around $21,400 at the time of writing, with U.S. stocks reacting to surprise data surrounding economic activity in December.

Specifically, the Producer Price Index (PPI) showed cost rises cooling faster than consensus predicted, with retail sales also declining beyond estimates.

“PPI comes in at 6.2%, while expectation was 6.8%. Core PPI comes in at 5.5%, while expectation was 5.7%,” Cointelegraph contributor Michaël van de Poppe wrote in part of ongoing Twitter updates.

“Retail sales at -1.1%, while -0.8% was expected. Core retail sales at -1.1%, while -0.4% was expected. Big misses.”

Bitcoin showed bullishness around the numbers, these potentially signaling less of a need for further aggressive interest rate hikes from the Federal Reserve going forward.

Earlier, Cointelegraph reported on the Bank of Japan itself not to make already very loose policy more restrictive, in contrast to the Fed and other major central banks.

An already flagging U.S. dollar index (DXY) thus extended a retracement which began with the Japan news as PPI hit, falling to 101.52, its lowest since late May last year.

Analysis sees “momentum fadin” on BTC chart

BTC/USD last traded at the day’s high in mid-September.

Related: BTC price cancels FTX losses — 5 things to know in Bitcoin this week

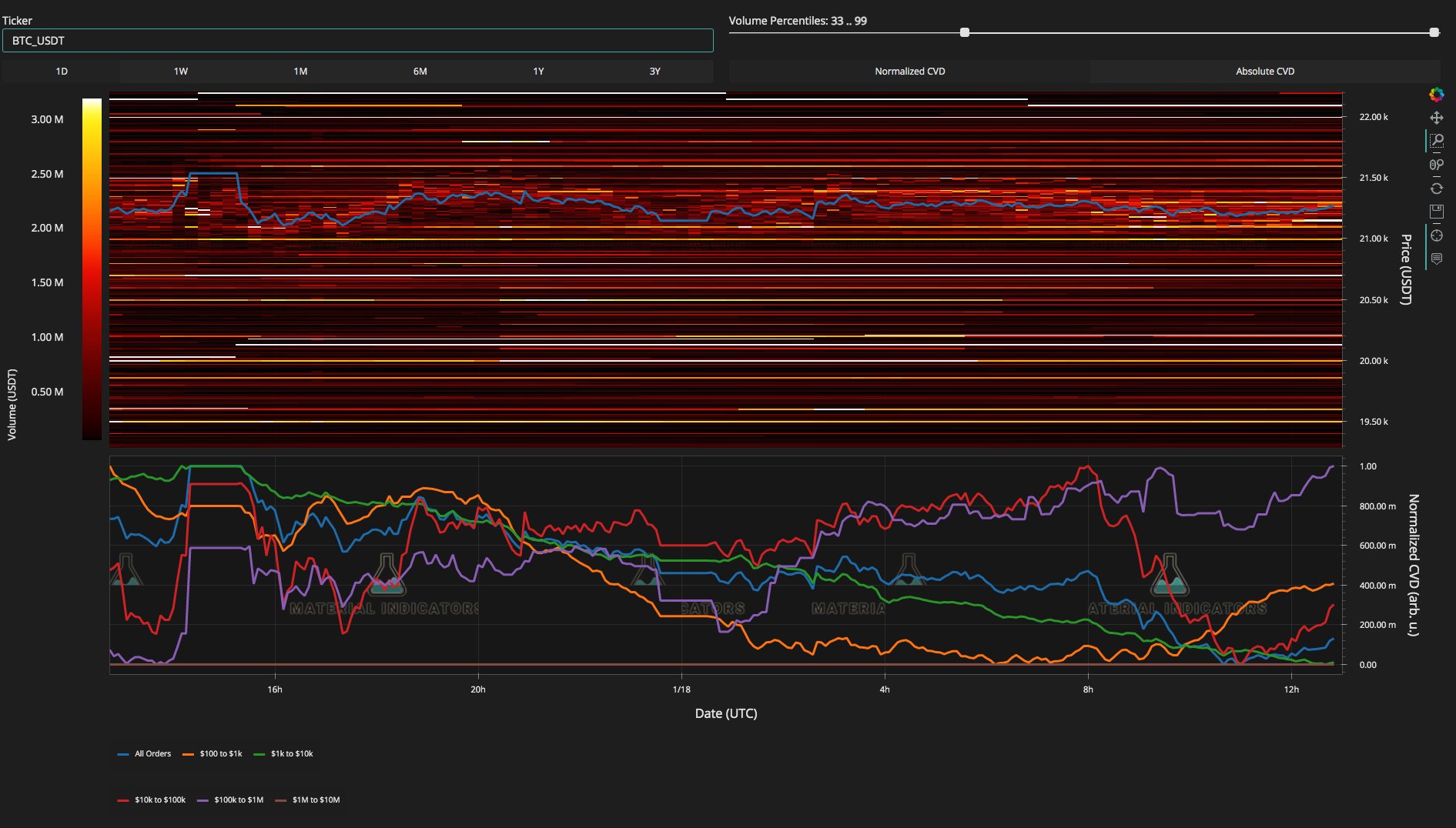

As ever, there were plenty of nerves visible among traders despite the strong performance, with analytics resource Material Indicators repeating warnings over uptrend weakness.

“Waking up to the same game in the BTC chart,” it wrote on the day, referencing the status quo on the Binance order book.

“Declining volume makes me think momentum is fading, and the fact that some bids were removed is concerning. Watching to see if bid liquidity continues to replenish and move up. If not, the 21-Week Moving Average must hold.”

More optimistic was popular commentator Bloodgood, who disputed others’ bearish predictions of a drop to $12,000 for BTC/USD in 2023.

Analyzing the longer-timeframe picture, he argued that the two-year lows seen in Q4 constituted a “failed breakdown.”

“Failed breakdowns usually lead to strong reversals,” he added on an accompanying chart with a key support zone at around $19,000.

“$12k is not in play as long as we stay above the blue line. Get another weekly candle to close above and we go higher.”

A snapshot of long and short positions by Filbfilb, co-founder of trading firm Decentrader, was similarly heartening.

“The liquidity picture looks a lot different now for BTCUSD. More bears sweating than bulls at this point,” he tweeted.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Go to Source

Author: William Suberg