It’s been 16 days since FTX filed for Chapter 11 bankruptcy protection in the U.S. and the former FTX CEO Sam Bankman-Fried (SBF) is allegedly still hunkering down at his seaside resort in the Bahamas. This weekend, the Youtuber known as Bitboy decided to fly down to Nassau in order to question SBF about the […]

It’s been 16 days since FTX filed for Chapter 11 bankruptcy protection in the U.S. and the former FTX CEO Sam Bankman-Fried (SBF) is allegedly still hunkering down at his seaside resort in the Bahamas. This weekend, the Youtuber known as Bitboy decided to fly down to Nassau in order to question SBF about the […]

Gala Games said the unusual activity of its pGALA token was actually part of efforts to safeguard it from potential attack.

Blockchain gaming company Gala Games urged its community for calm after misplaced fears of a multi-billion dollar rug pull or hack caused the GALA token to temporarily crash 25.6%.

The initial panic, which Gala Games later implied was unfounded, came after a single wallet address appeared to mint over $2 billion GALA tokens out of thin air — which was flagged by blockchain security firm PeckShield on Nov. 3.

Fears that the unusual activity was a sign of an exploit or rug pull caused the GALA token price to drop a dramatic 25.6% from $0.0394 to $0.0293 over a 130-minute stretch late on Nov. 3, according to data from CoinGecko.

However, Gala Games took to Twitter on Nov. 4 to dispel the “FUD” surrounding its native token, explaining that “lots of people are tossing around words like ‘hack’ and ‘rug’. Neither of these is the case.”

Update for everyone - there is a LOT of FUD out there surrounding $GALA...lots of people tossing around words like "hack" and "rug". Neither of these is the case.

— Gala Games - Spider Tanks is LIVE! (@GoGalaGames) November 4, 2022

Here is the real story - read this update from @BitBenderBrink and @pNetworkDeFi. https://t.co/ruI16v2Lkv

Gala Games president for blockchain Jason Brink explained that the unusual activity detected on decentralized exchange (DEX) PancakeSwap was performed by pNetwork, who was working to drain the liquidity pool as a means to safeguard it from a potential vulnerability.

Before you panic about $GALA, please read this thread from @pNetworkDeFi.

— Jason Brink aka BitBender (@BitBenderBrink) November 3, 2022

TLDR: Everything is fine. The activity you have been seeing on @PancakeSwap is pNetwork working to drain the liquidity pool. GALA on ETH is completely unaffected.

Do not buy $pGALA on PancakeSwap for now https://t.co/bAnHxlVcp1

In a separate tweet, pNetwork, the cross-chain interoperability bridge used by Gala Games on the Binance Smart Chain, confirmed that a “misconfiguration” event took place. It also responded to a tweet from Peckshield to note that it “coordinated the white hat attack” to prevent pGALA from being exploited:

Yes, we noticed pGALA wasn’t to be considered safe anymore and coordinated the white hat attack to prevent pGALA from being maliciously exploited. Funds are safe but users should NOT transfer or buy/sell pGALA on pancakeswap

— pNetwork (@pNetworkDeFi) November 3, 2022

The explanations appear to have quelled some panic, with the GALA token price since partially recovered from its 24-hour low of $0.0293 to now sit at $0.352.

Related: Major hack on play-to-earn crypto games a ‘matter of time:’ Report

Gala Games confirmed that all GALA tokens on Ethereum and GALA-related assets on the GALA bridge were safe, the team, along with pNetwork informed the community of its decision to “temporarily suspend” transaction activity on the bridge.

Brink also advised not to buy pGALA on PancakeSwap “for now.”

"A new pGALA token will be created to replace the old compromised one” which will be sent to those who owned pGALA before the pool was drained, pNetwork said.

Some pointed out the regulator's supposed hypocrisy, others told crypto-influencers to lawyer up, whilst a few poked fun at the reality TV star.

The crypto community reacted with a mix of disbelief and amusement after reality star Kim Kardashian was fined for promoting the cryptocurrency EthereumMax (EMAX).

The United States Securities and Exchange Commission (SEC) fined Kardashian $1.26 million on Oct. 3, for “touting on social media” about the EMAX without disclosing she was paid $250,000 to post about it.

Kardashian has neither admitted to nor denied the SEC’s allegations, but settled the charges and agreed to not promote any cryptocurrency assets until 2025.

SEC chairman Gary Gensler tweeted the fine was a reminder that celebrity endorsement of investment opportunities doesn't “mean those investment products are right for all investors.”

Today @SECGov, we charged Kim Kardashian for unlawfully touting a crypto security.

— Gary Gensler (@GaryGensler) October 3, 2022

This case is a reminder that, when celebrities / influencers endorse investment opps, including crypto asset securities, it doesn’t mean those investment products are right for all investors.

Following Gensler’s tweet, the online crypto community expressed their thoughts on the fine, with some calling out the SEC for its inconsistent enforcement decisions.

Economist Peter Schiff, known for his anti-Bitcoin (BTC) stance, pointed out what he perceived was an unfair targeting of Kardashian as the SEC hasn’t fined MicroStrategy co-founder Michael Saylor who he believes has “more to gain pumping crypto.”

The SEC is fining @KimKardashian $1.2 million for pumping #crypto. What about the real pumpers? @Saylor had much more to gain pumping crypto than Kim. Or @CNBC paid millions for ads by crypto companies, then pumping #Bitcoin non-stop while providing industry pumpers with airtime?

— Peter Schiff (@PeterSchiff) October 3, 2022

Saylor responded saying Bitcoin isn’t a security but a commodity and its promotion would be “similar to promoting steel…or granite” and the coin's open protocol offers “utilitarian beliefs similar to roads.”

Crypto-personality and author Layah Heilpern shared she believed “the SEC has bigger issues closer to home it should probably focus on…” likely inferring the widely held belief in the community that certain U.S. politicians have inside traded.

The SEC will go after Kim Kardashian for shilling a crypto but not Nancy Pelosi for insider trading her way to a hundred million dollars https://t.co/i0bZKjaxjJ

— Dr. Parik Patel, BA, CFA, ACCA Esq. (@ParikPatelCFA) October 3, 2022

Pseudonymous developer 0xBender noted a contrast between the SEC’s heavy-handed treatment of crypto promotions from celebrities, while crypto-centric influencers “have been out here shilling you garbage for 0.2 ETH (Ethereum) a tweet.”

The SEC is charging Kim Kardashian with unlawfully promoting a crypto security while influencers have been out here shilling you garbage for 0.2 ETH a tweet

— bender (@0xBender) October 3, 2022

Others such as former federal prosecutor Renato Mariotti said influencers thinking to endorse cryptocurrencies should “take note” as the regulator is showing it will “aggressively pursue enforcement actions” and those who promote crypto without considering the laws will “need to find a good lawyer.”

Kim Kardashian presented a very tempting target for the SEC.

— Renato Mariotti (@renato_mariotti) October 3, 2022

Because of this case, millions of people who didn’t know much about the SEC now know about it.

As an aspiring lawyer, she had every incentive to cooperate. Other celebrity crypto endorsers should take note. https://t.co/3mvMNQOxvg

Meanwhile, Ethereum educator and investor Anthony Sassano told his followers he believes the SEC targeted Kardashian because it creates the illusion the regulator is “doing something” about crypto scams, and suggested it should've targeted the creators of EMAX instead.

They went after Kim Kardashian because she makes a good headline and it shows the public that the SEC is "doing something" about crypto scams

— sassal.eth (@sassal0x) October 3, 2022

In reality, the fine she paid is dust to her, the creators of Ethereum Max haven't been fined (yet?), and the victims are all still rekt

Related: The SEC is bullying Kim Kardashian, and it could chill the influencer economy

Still, some saw the lighter side of investing in a tumultuous and highly speculative crypto token, with journalist Tyler Conway saying the star “got the full crypto experience” by losing more money than she’d been paid.

Self-described hacker and tech content creator Marcus Hutchins said Kardashian “would have gotten better returns” in EthereumMax as it’s down 97% since her post, compared to the -80% the promotion returned for her.

Kim Kardashian got paid $250k to promote Ethereum Max then lost $1.3m of that to an SEC fine. Would have gotten better returns just investing in Ethereum MAX, which is down 97% since her post.

— Marcus Hutchins (@MalwareTechBlog) October 3, 2022

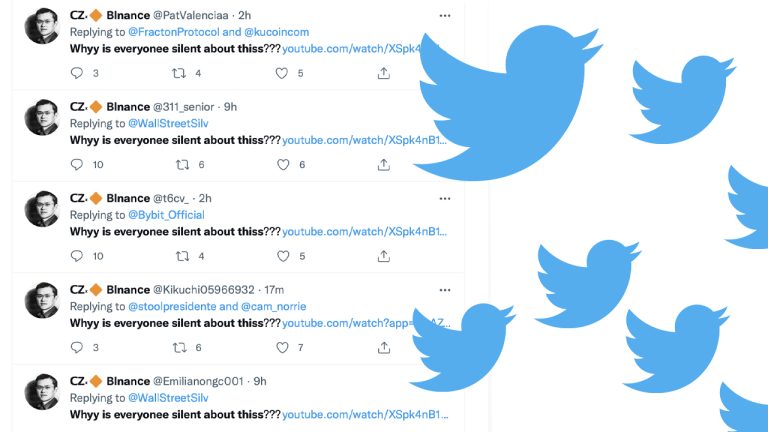

Since Tesla’s Elon Musk attempted to purchase Twitter and tried to get information on the number of bots on the social media platform, Twitter bots have infested tens of thousands of posts day after day. In the cryptocurrency industry, bots are very prevalent and any time a popular crypto account posts, the thread is teeming […]

Since Tesla’s Elon Musk attempted to purchase Twitter and tried to get information on the number of bots on the social media platform, Twitter bots have infested tens of thousands of posts day after day. In the cryptocurrency industry, bots are very prevalent and any time a popular crypto account posts, the thread is teeming […]

The addresses mainly run by active human traders have notched more than 147,000 addresses for the first time since November.

The market cap of Bitcoin (BTC) dropped another 33% in June, which is now beginning to numb the Twitter community. On the upside, many crypto traders who wanted out did so fairly aggressively from March to May. But, the less optimistic news is that the stagnancy in address activity may need to change for prices to get a running start on recovery.

Unlike April and May, the altcoin pack didn’t struggle tremendously more than Bitcoin. BTC’s 33% drop was pretty middle of the road in terms of corrections. In a vacuum, crypto bulls would prefer seeing altcoins continuing to lag, pushing more traders back toward Bitcoin as a relative “safe haven.”

Nevertheless, June was a tale of two halves. June 1-15 saw a massive 25% further downswing for Bitcoin. Comparatively, June 16-30 was looking up until the very end of the month, which now exhibits an additional 8% slide.

The $20,000 price level has shown to be both psychological support and resistance area. Therefore, a drop below (which could very well occur by the time this article is published) may quickly change traders’ outlook. Panic selling and overly eager buying should occur as soon as the $19,500 to $19,900 range is hit.

So far, 2022 has served as a reality check for altcoins whose market caps have ballooned to astronomic levels in the past two years. As mentioned, Bitcoin was nothing special compared to alts in June, but it has held up better than most projects and even a few stablecoins. As a result, the spotlight shines bright on Bitcoin, as evidenced by a healthy community focus.

This phenomenon was reflected in the whole last week of June. Bitcoin was mentioned on Santiment’s social platforms at its highest rate in about four months, while the discussion around other popular assets like Ether (ETH) and Cardano (ADA) continues to diminish.

The average 30-day trading returns on the BTC network are still very negative. And, as long they are in the yellow-green or green territory in the below chart, there is less risk in entering a Bitcoin position (or adding on to) than historical results.

Price freefalls tend to reverse if they go into the extreme low (green) territory, and that would be the ideal setup to watch for on Sanbase.

Another positive note for patient crypto hodlers, regardless of the asset, is that more and more Bitcoin shark and whale addresses are returning to the network. The addresses, mainly run by active human traders, sized 10 to 10,000 BTC, have over 147,000 addresses for the first time since November. Meanwhile, the very top-tier addresses owned primarily by exchanges (10,000 or more) showed over 100 addresses for the first time since December 2020.

And, speaking of supply moving on and off-exchange addresses, the overall trend shows BTC continuing to move away from exchanges after a brief worrisome rise in May. Now, well below 10% of coins sitting on exchanges, there is far less selloff risk (based on historical trends). And, to add to this, the amount of Tether (USDT) moving to exchanges has skyrocketed, implying more buying power at these suppressed prices.

Not to be ignored, Ethereum has had a well-documented 76% retracement since its all-time high in November. When looking at the ratio of positive vs. negative commentary being scraped by our social data algorithm, there appears to be a stunning dropoff in positive comments in early June. The 37% price drop between June 9 and 13 was the culprit and the last straw for many traders. As counterintuitive as it may seem, these “last straws” is what the community at Santiment expects to see for the market to stage a comeback.

Cardano is also seeing the equivalent of slowly rolling tumbleweeds around its network. The number of unique addresses interacting on the Cardano network is down to its lowest in about a year. The sentiment is gradually sinking for Cardano as well, which is likely due to a simple absence of discussion more than anything.

It is hard for the trading community to find any excitement in the abysmal price performances that continue to persist month after month in 2022. Yet, price surges happen when the mainstream casts the most doubts. Still, nothing is for certain in a sentiment-driven and often self-perpetuating sector like cryptocurrency. But, the more the crypto community is leaning bearish and proclaiming its crypto winter time, the higher the chance of a recovery underway.

Cointelegraph’s Market Insights Newsletter shares our knowledge on the fundamentals that move the digital asset market. This analysis was prepared by leading analytics provider Santiment, a market intelligence platform that provides on-chain, social media and development information on 2,000+ cryptocurrencies.

Santiment develops hundreds of tools, strategies and indicators to help users better understand cryptocurrency market behavior and identify data-driven investment opportunities.

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.

The crypto community's true impact shone through as a fellow crypto user battling a cancer diagnosis received broad support and financial contributions towards his treatment therapy.

When a respected member of Crypto Twitter and the Deadfellas nonfungible token (NFT) community detailed the immense financial burden of his cancer treatment, the crypto community demonstrated its kindness and generosity by donating over $73,000 in funds.

Yopi, known as @kuiyopi on Twitter, joined the crypto ecosystem in July 2021. He discovered that crypto served as a welcome distraction to his health concerns and even provided moments of joy and entertainment during his 6-month chemotherapy schedule.

Throughout this time, he enjoyed the content of crypto personalities such as Cobie, opened up on his attempts to learn Spanish, and reveled in the meme culture, while always sharing empathetic messages, condolences, and visions to support fellow cancer sufferers within the community - even in a space where the identities of users are largely anonymous.

However, he received some heartbreaking news on April 6. Doctors from the Moroccan Royal Armed Forces Military Hospital conducted an MRI scan on his right hip and uncovered “infiltrative damage to the medullary bone of the upper and middle third of the right femoral diaphysis in connection with a recurrence.”

In simpler, and more poignant words, his cancer had returned.

According to Yopi, the doctors stated that he required stem cell transplant therapy. Usually in this circumstance, the primary treatment would be chemotherapy, but having been administered a course of that previously, it was no longer a viable option.

On top of that, the estimated insurance costs totaled $50,000, a sum that a self-described "amateur Ponzi shitcoins trader" simply could not afford.

In need of assistance, Yopi reached out to the Crypto Twitter community, musing a philosophical memorandum that “Luck is the most important factor in life that is the most neglected, people [ppl] love to give all the credit to their success but never admit they were lucky.”

Hi guys, unfortunately the cancer came back after days my leg was hurtin, doctor said i only need stem cell transplant since chemo is not an option anymore. Well i dont think i can pay the 50k $ for it nor my shitty insurance would cover it. pic.twitter.com/alH4GRVdys

— Yopi (@kuiyopi) April 6, 2022

Twitter user @halo4dog1 shared an English translation of the letter to enhance the readability of the results.

Orchestrated by notorious DeFi investigator zachxbt, Yopi's tweet received enormous support from some of the industry's largest figures including renowned NFT artist Cozomo — the real identity of the legendary rapper Snoop Dogg — MoonOverlord, and President of FTX U.S. Brett Harrison, as well as TheShamdoo, among many others.

Analysis of blockchain data reveals that Yopi’s wallet, titled beastmo.eth, received a total of 107 transactions — 94 in ETH, 5 in USDT, 3 in USDC, 2 in DAI, 1 in WETH, 1 in LINK, and 1 in APE — in the fourteen hours following his tweet.

These selfless acts soared his total wallet balance to $74,268.60, a number which surpasses his insurance bill by over 48.5%, and is still rising at the time of writing.

In a series of emotional responses, Yopi declared his love and adulation for the crypto community, thanking them for their warmth and kindness. “Man this was unbelievable for me. I don't know even what to say, I'm living in a dream and hope I will be born again, love you guys.”

Man im literally cryring right now i cant thank you enough ser ❤

— Yopi (@kuiyopi) April 6, 2022

The popular Golden State Warriors point guard, Stephen Curry, asked his 15.5 million followers for some “advice” about crypto. Curry said he was “just getting started” and a great number of people shared advice with the professional basketball player. Stephen Curry Gets ‘Advice’ From Crypto Twitter Well known athletes, celebrities, and musicians worldwide have been […]

The popular Golden State Warriors point guard, Stephen Curry, asked his 15.5 million followers for some “advice” about crypto. Curry said he was “just getting started” and a great number of people shared advice with the professional basketball player. Stephen Curry Gets ‘Advice’ From Crypto Twitter Well known athletes, celebrities, and musicians worldwide have been […] Bitcoin and a slew of digital currency markets are seeing significant losses on Sunday as a majority of coins are down between 2-15% during the last 24 hours. The entire crypto-economy has dropped more than 6% and bitcoin dominance is down to 40% the lowest the metric has been in two years. Crypto Markets Face […]

Bitcoin and a slew of digital currency markets are seeing significant losses on Sunday as a majority of coins are down between 2-15% during the last 24 hours. The entire crypto-economy has dropped more than 6% and bitcoin dominance is down to 40% the lowest the metric has been in two years. Crypto Markets Face […]